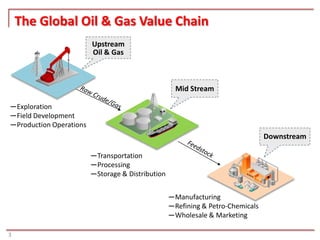

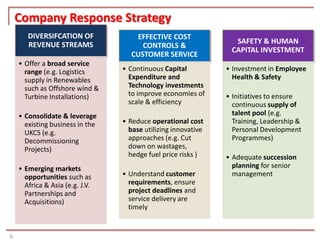

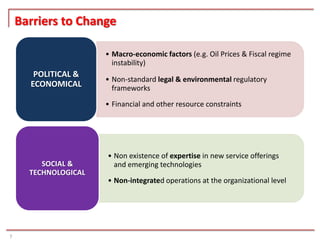

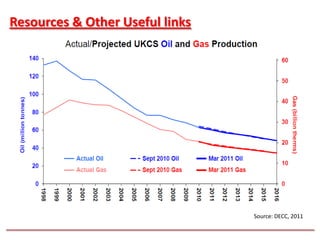

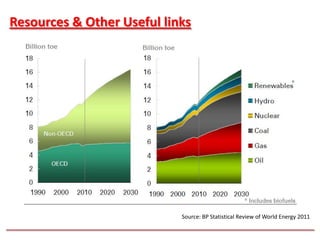

The document discusses the prospects and challenges facing the global oil and gas industry in the next decade. It outlines the industry value chain and major changes, including volatile markets, tougher operating environments, and skills shortages. The presentation framework discusses diversifying revenue, effective cost controls, and investing in safety and human capital as a company strategy. Barriers to change include political/economic instability, lack of expertise in new technologies, and non-integrated operations. Overcoming barriers involves integrated logistics, risk management, industry advocacy, communication, and training. Price risks, capital investments, and sustainability will drive the industry, which will see future growth from new assets, technology, and people.