The document provides 10 predictions for the world in 2030 from an investment perspective. Some of the key predictions include:

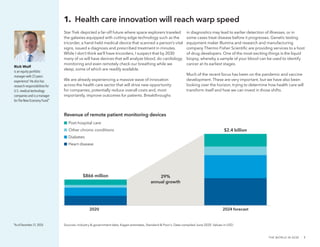

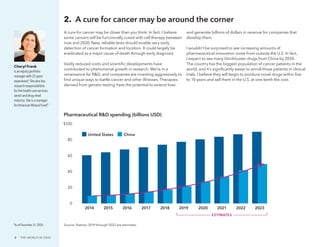

1) Health care innovation will accelerate dramatically, with early cancer detection, functional cures for some cancers, and widespread use of devices that can remotely monitor health.

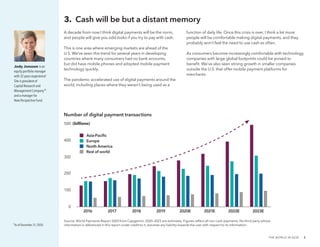

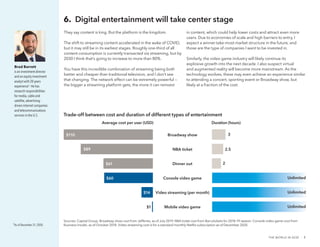

2) Digital payments will be the norm globally, with cash becoming obsolete in most places. Streaming services and digital entertainment will dominate content consumption.

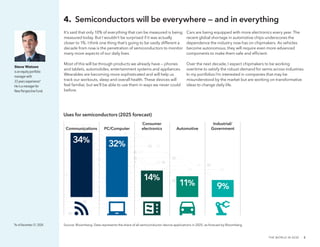

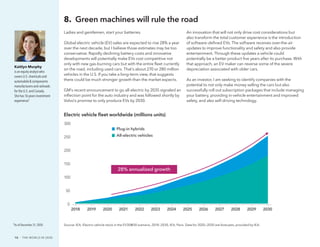

3) Autonomous vehicles will be widely deployed in major city fleets, reducing personal vehicle ownership. Remote work will also reshape industries and lead to de-urbanization in some cities.