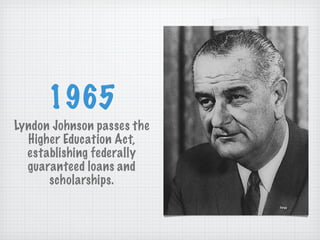

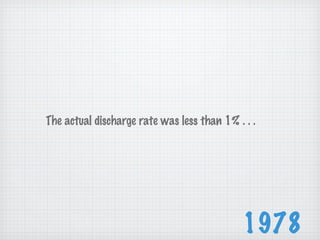

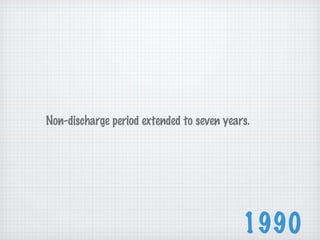

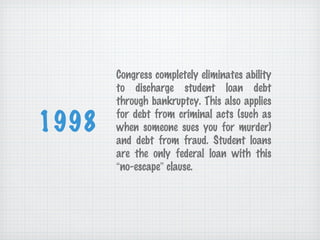

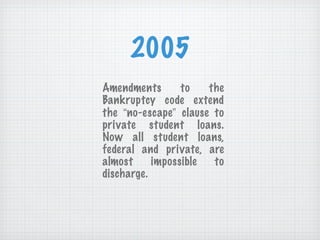

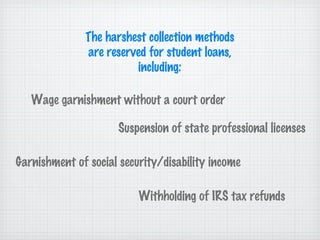

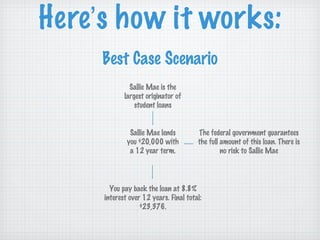

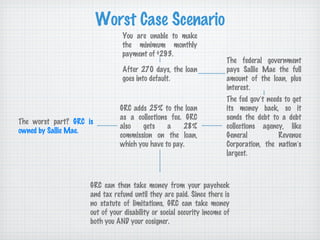

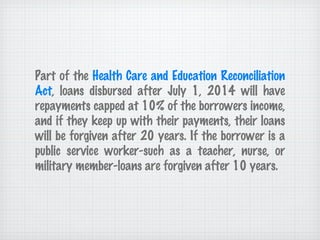

The document discusses the history and evolution of student loan debt in the U.S., highlighting the permanent inability to discharge such debt through bankruptcy and how the system benefits lenders like Sallie Mae and the government. It makes analogies to the subprime mortgage crisis, showing the alarming default rates among student loans and the rising costs of education relative to inflation. However, it notes potential reforms established in 2014 that could cap repayments and offer loan forgiveness after certain conditions are met.