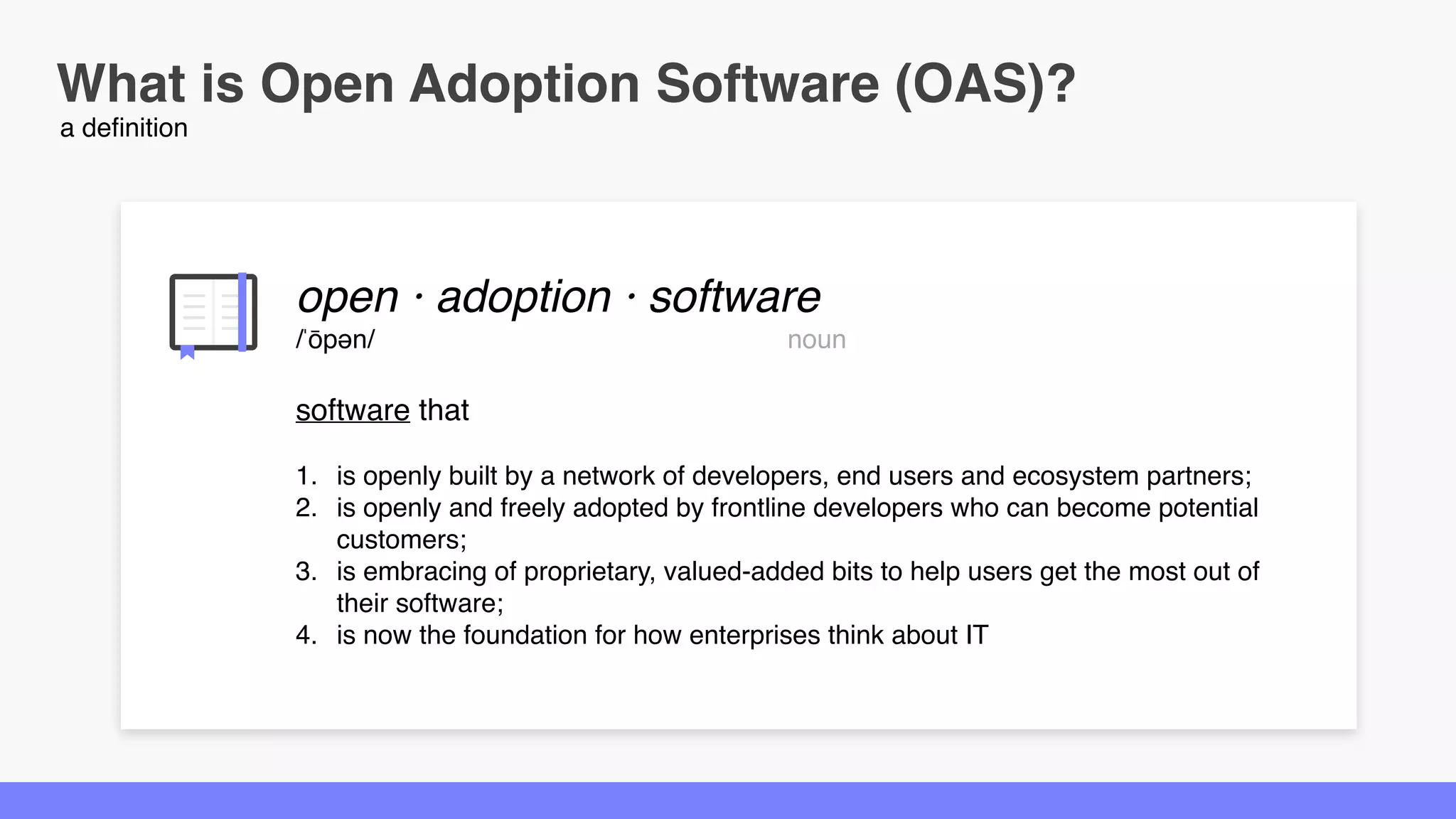

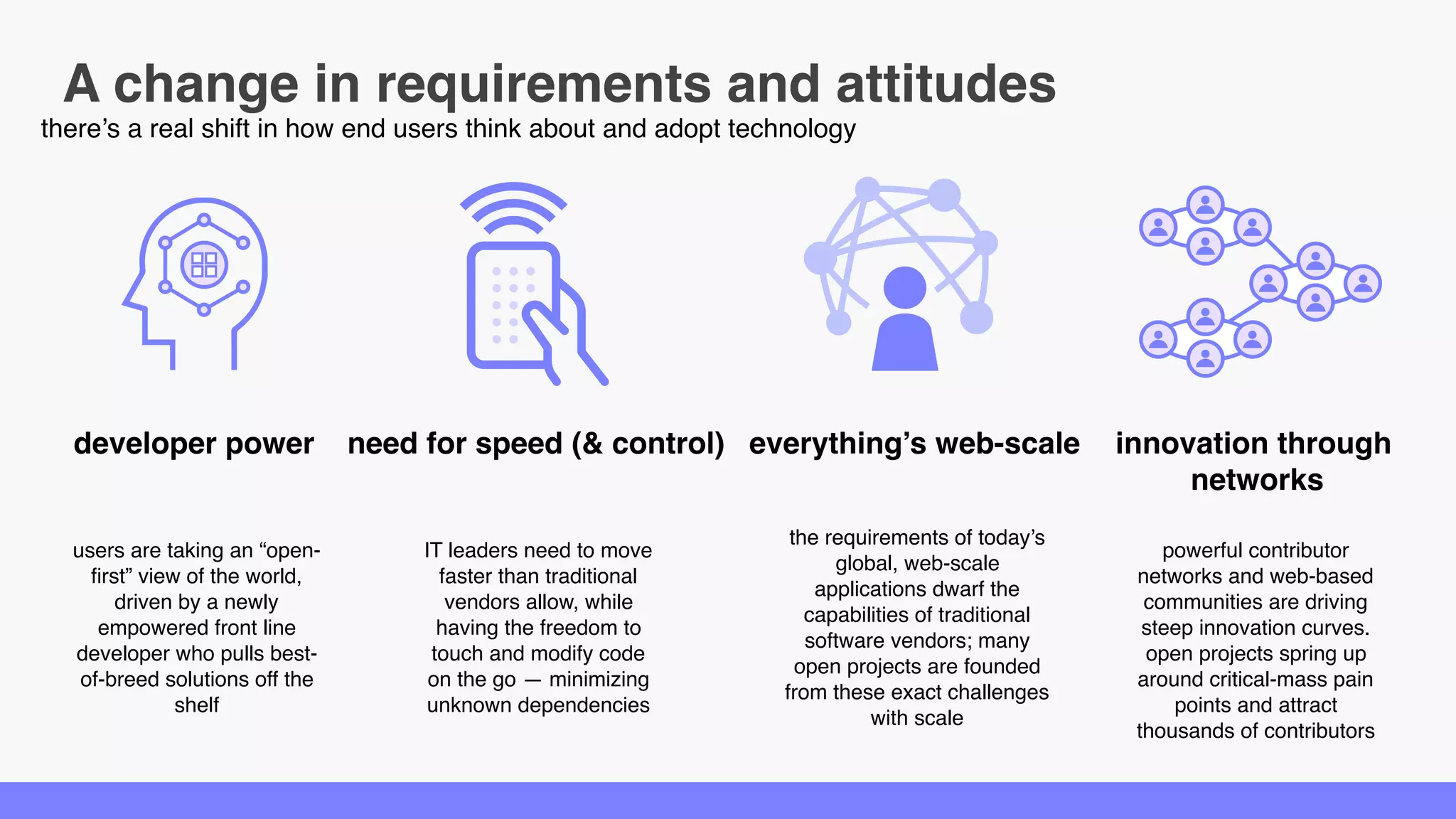

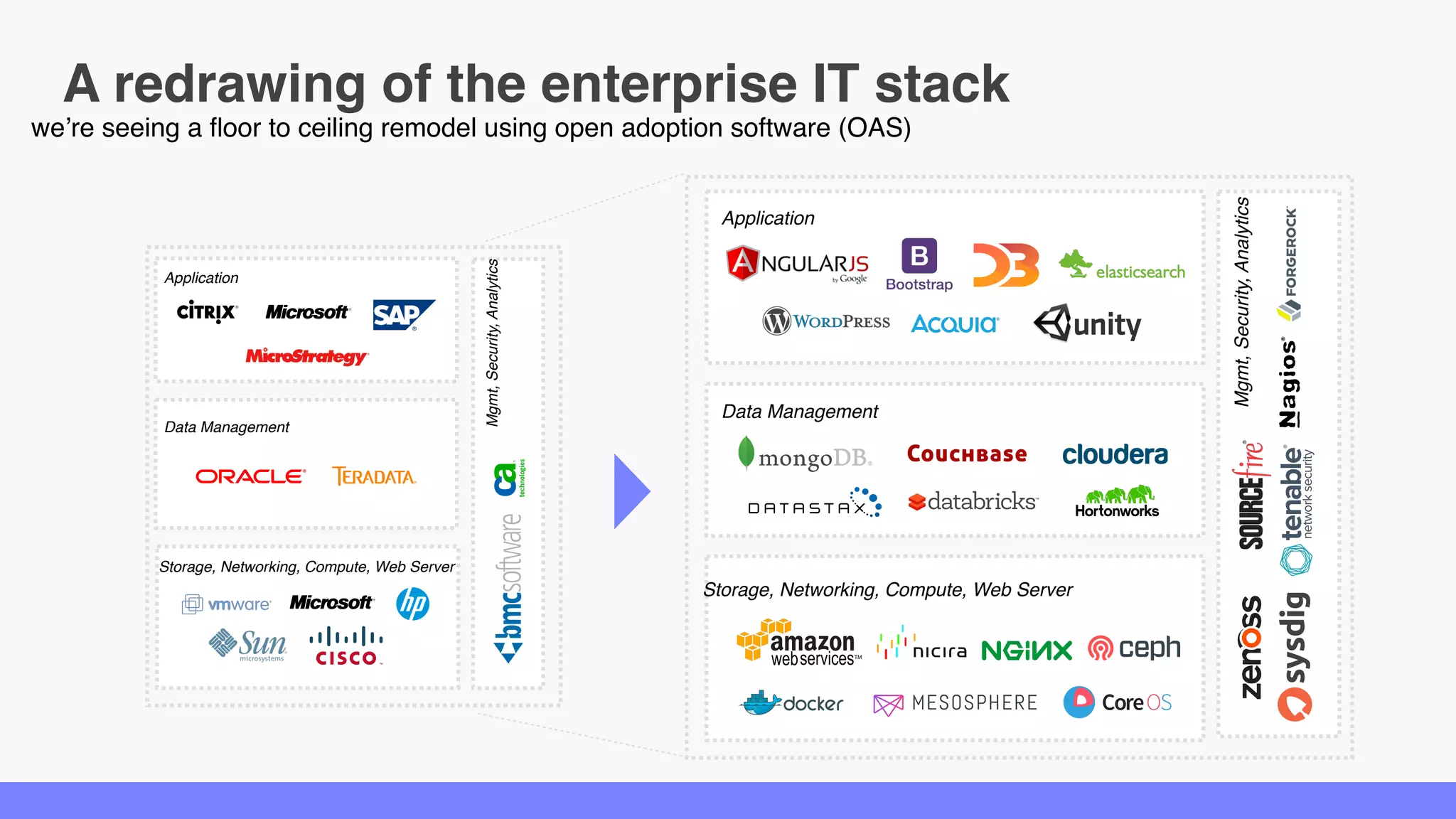

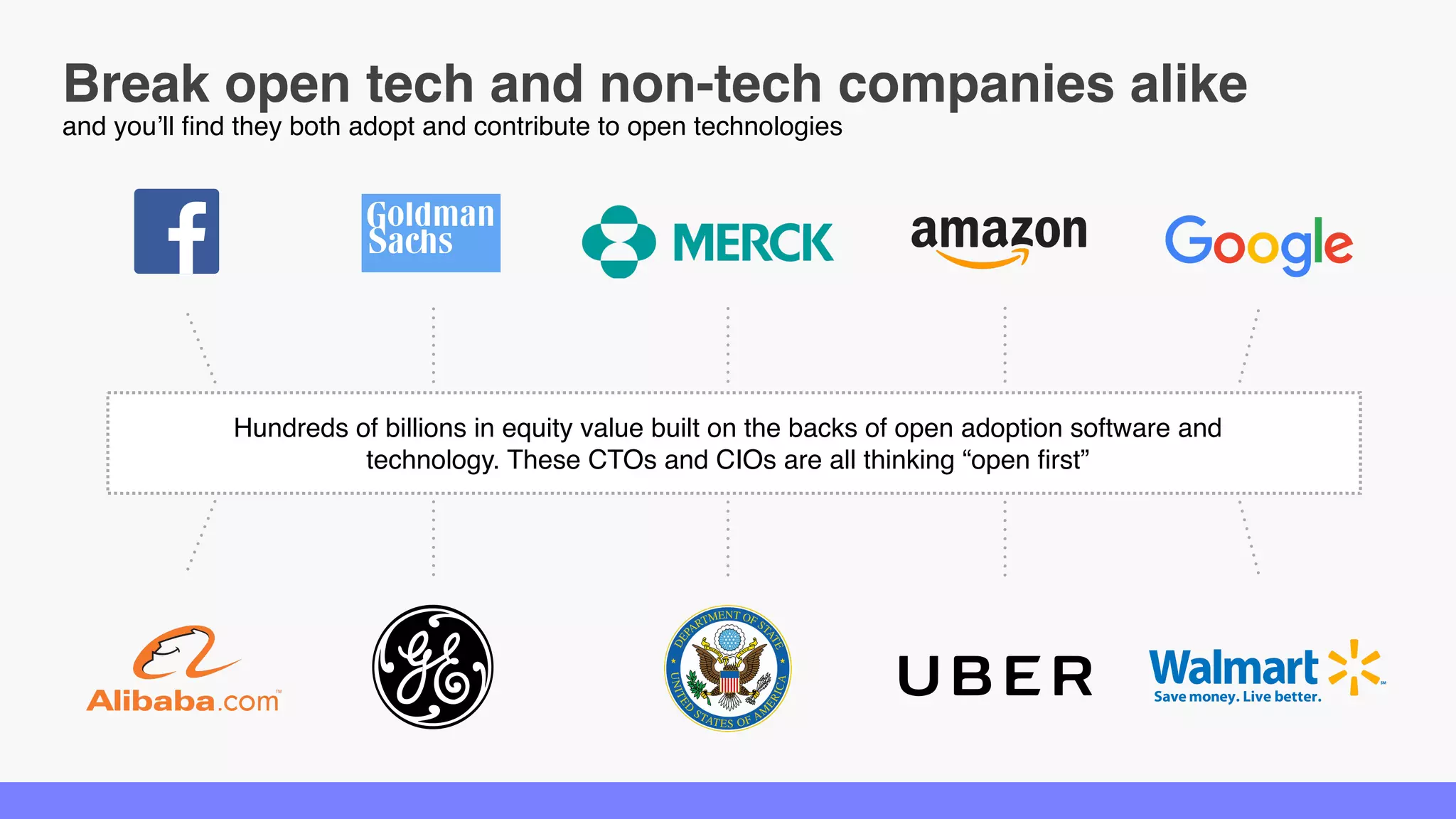

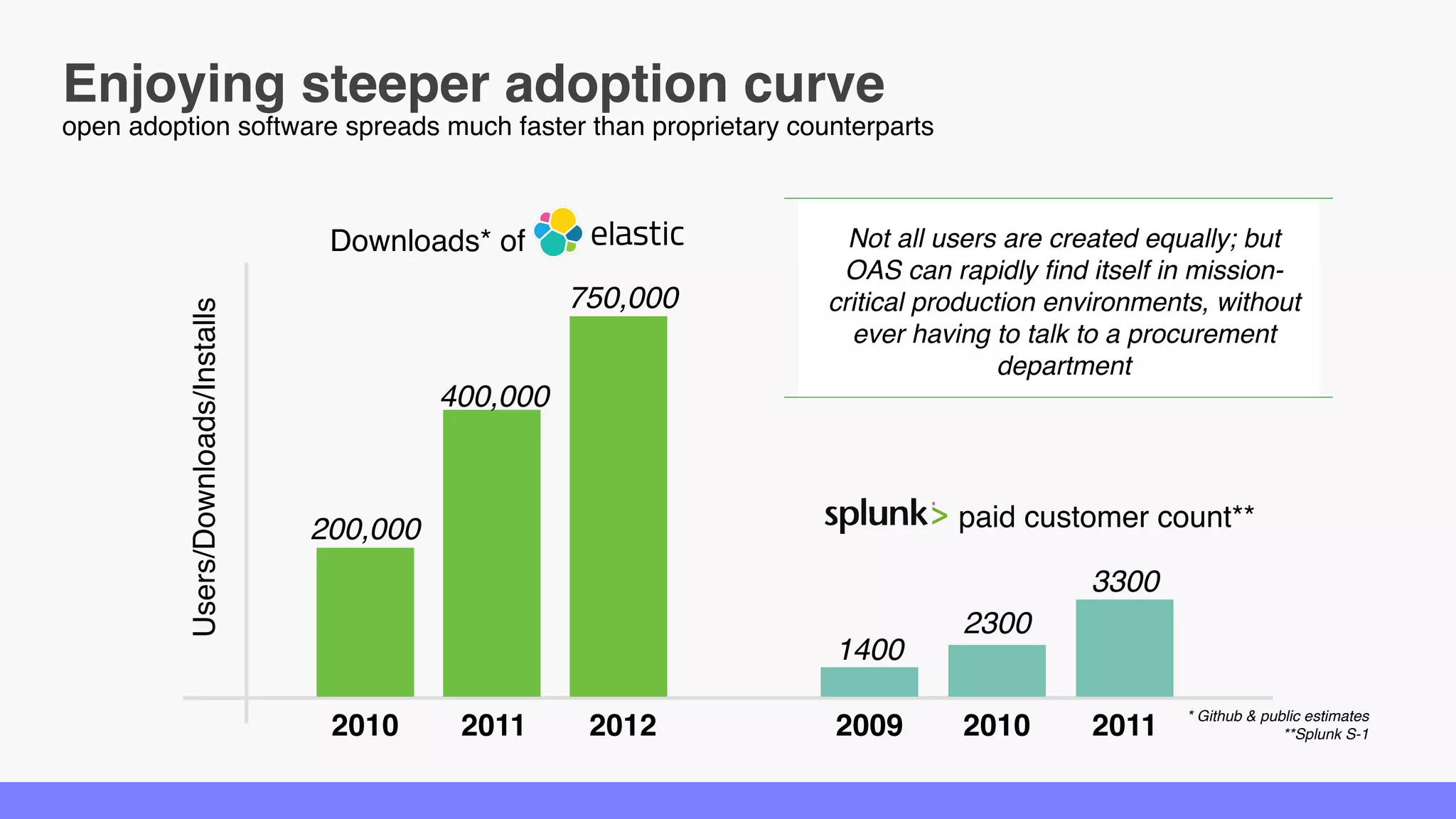

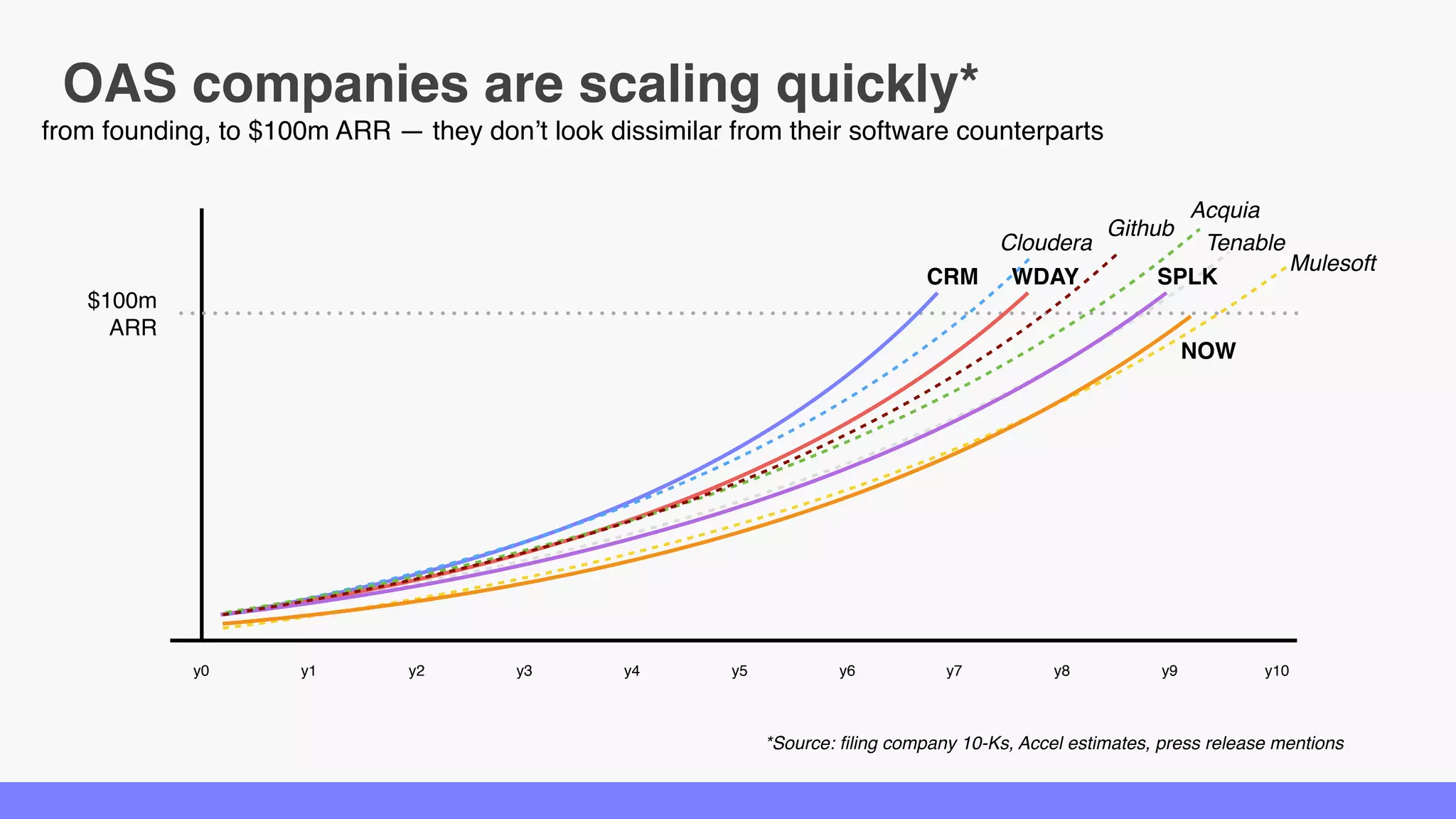

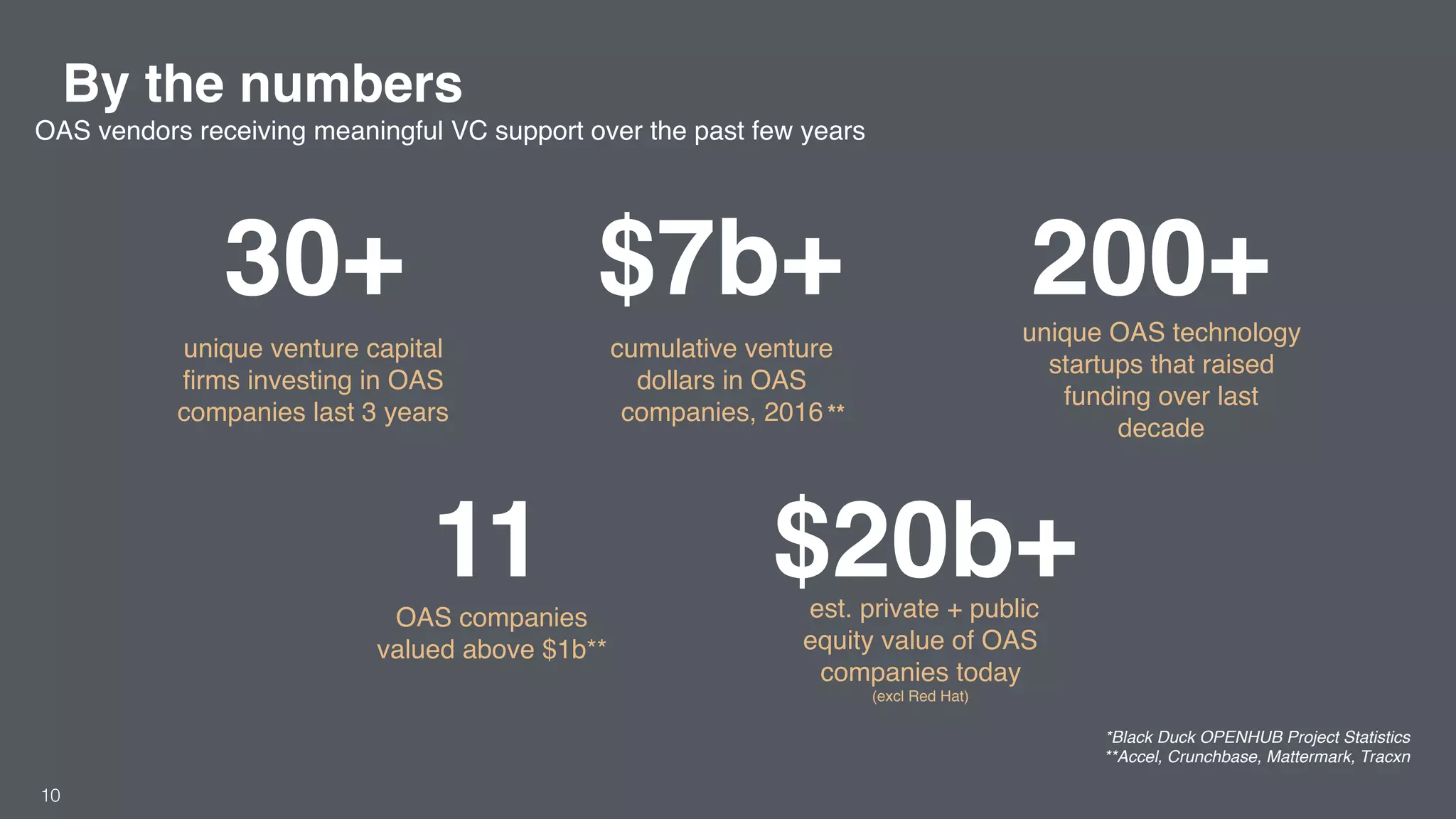

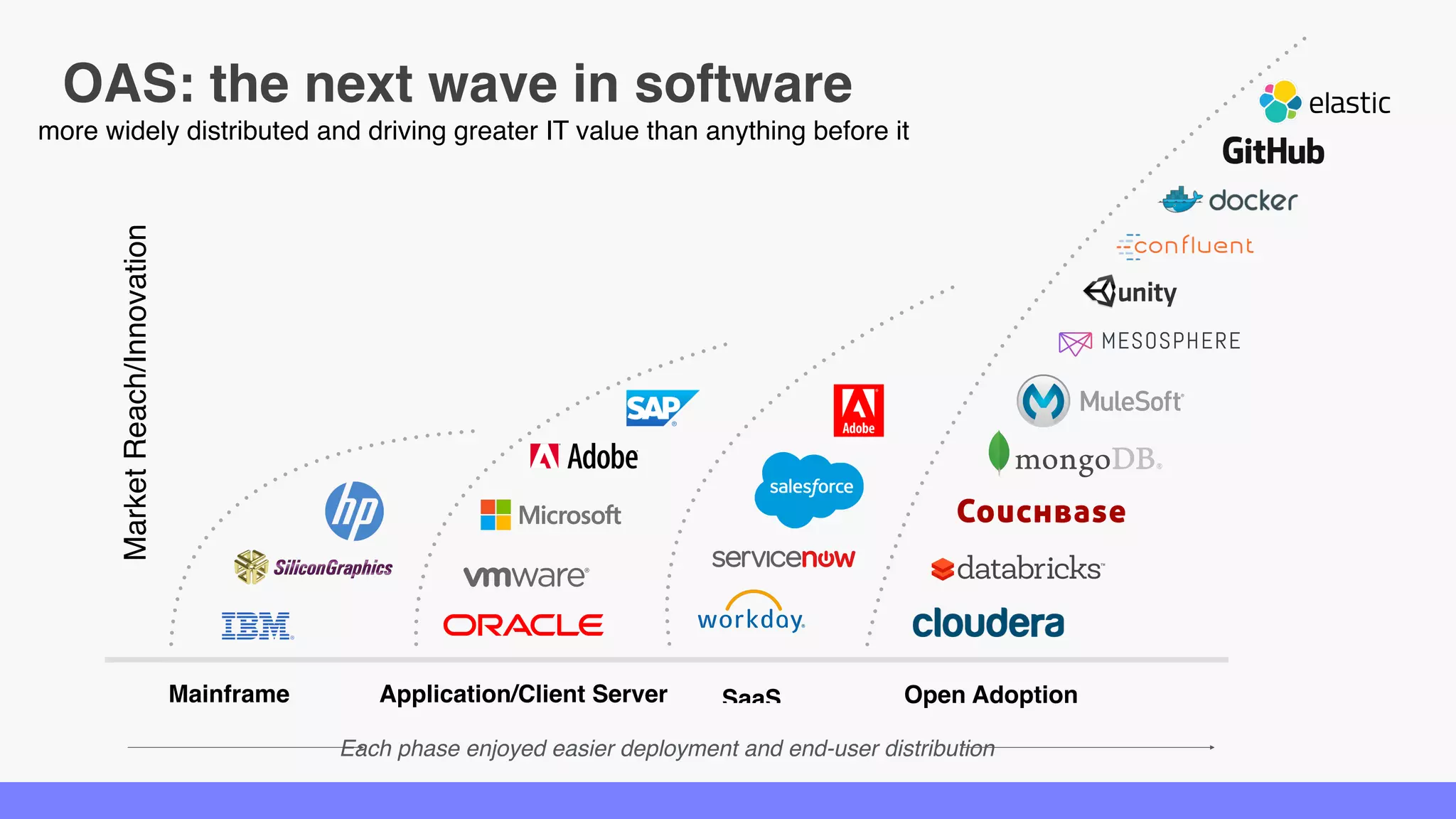

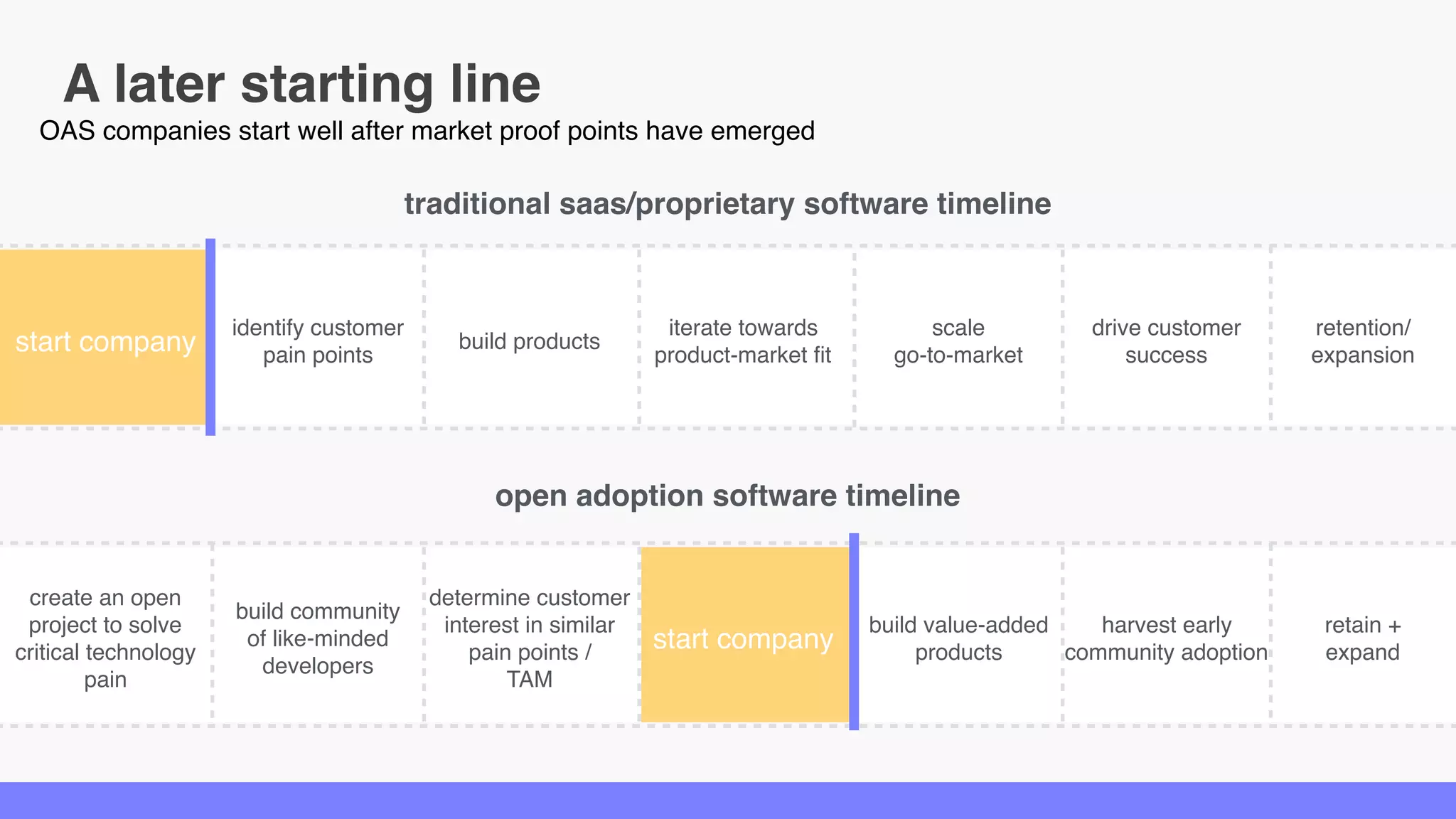

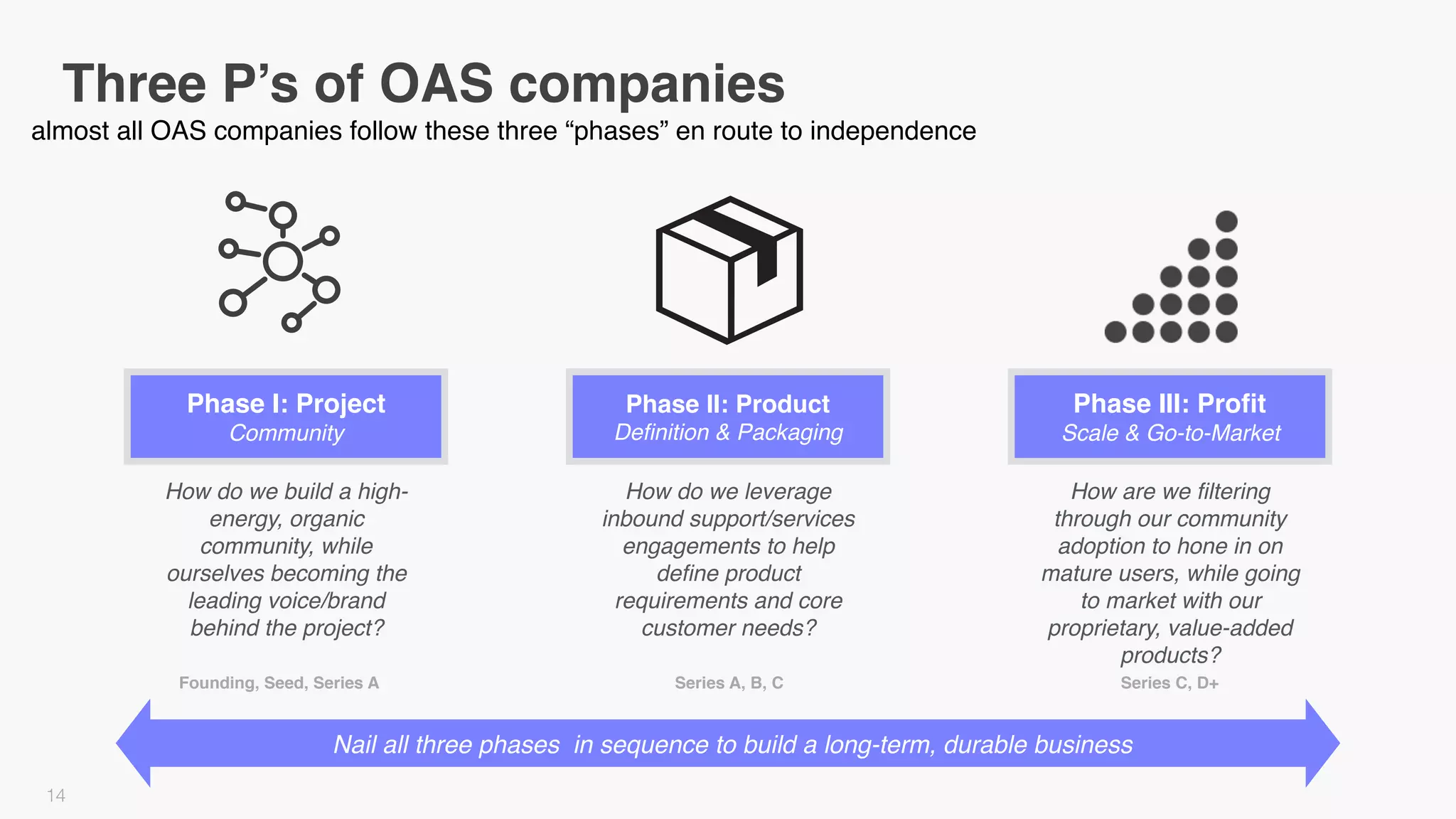

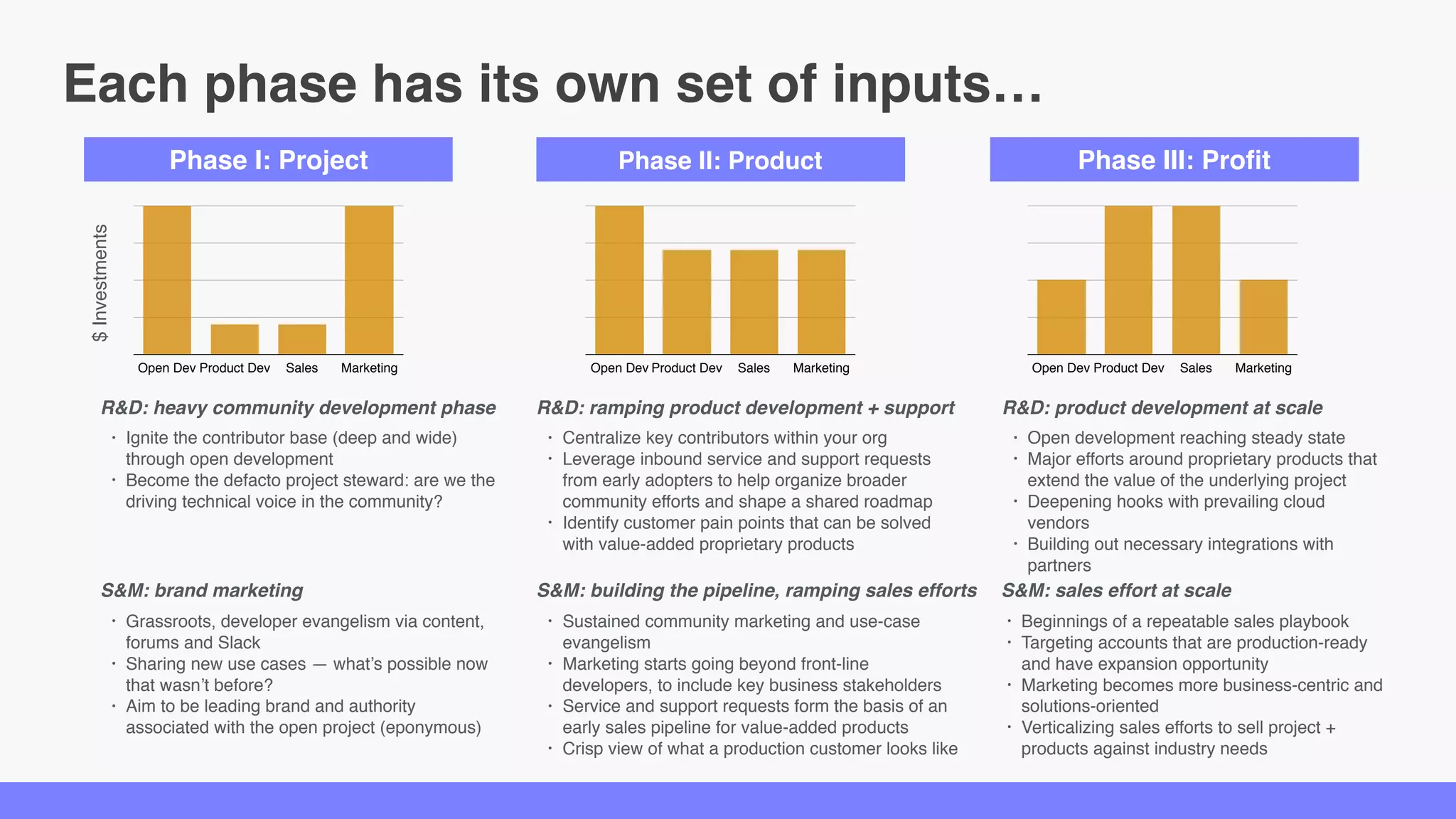

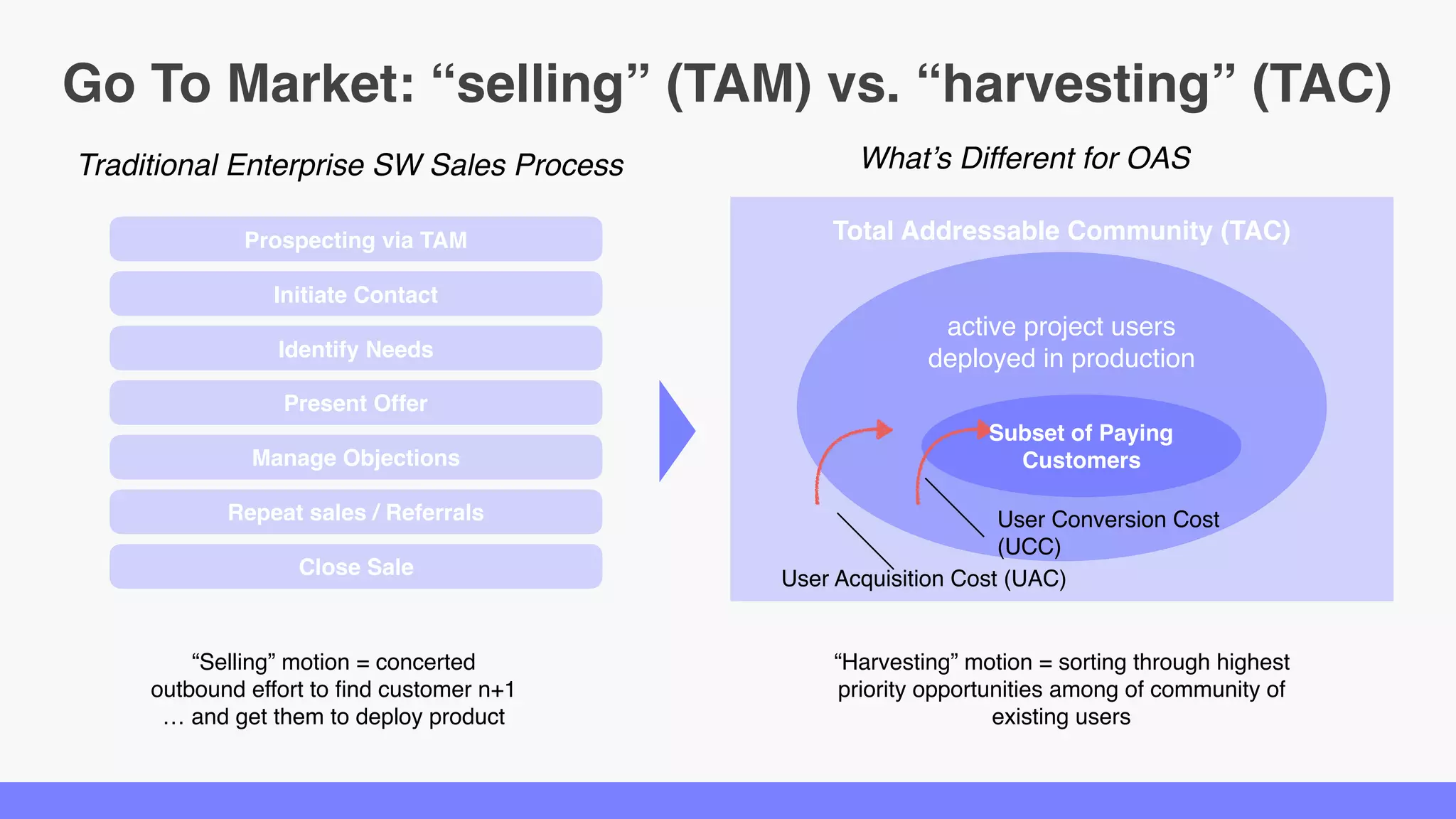

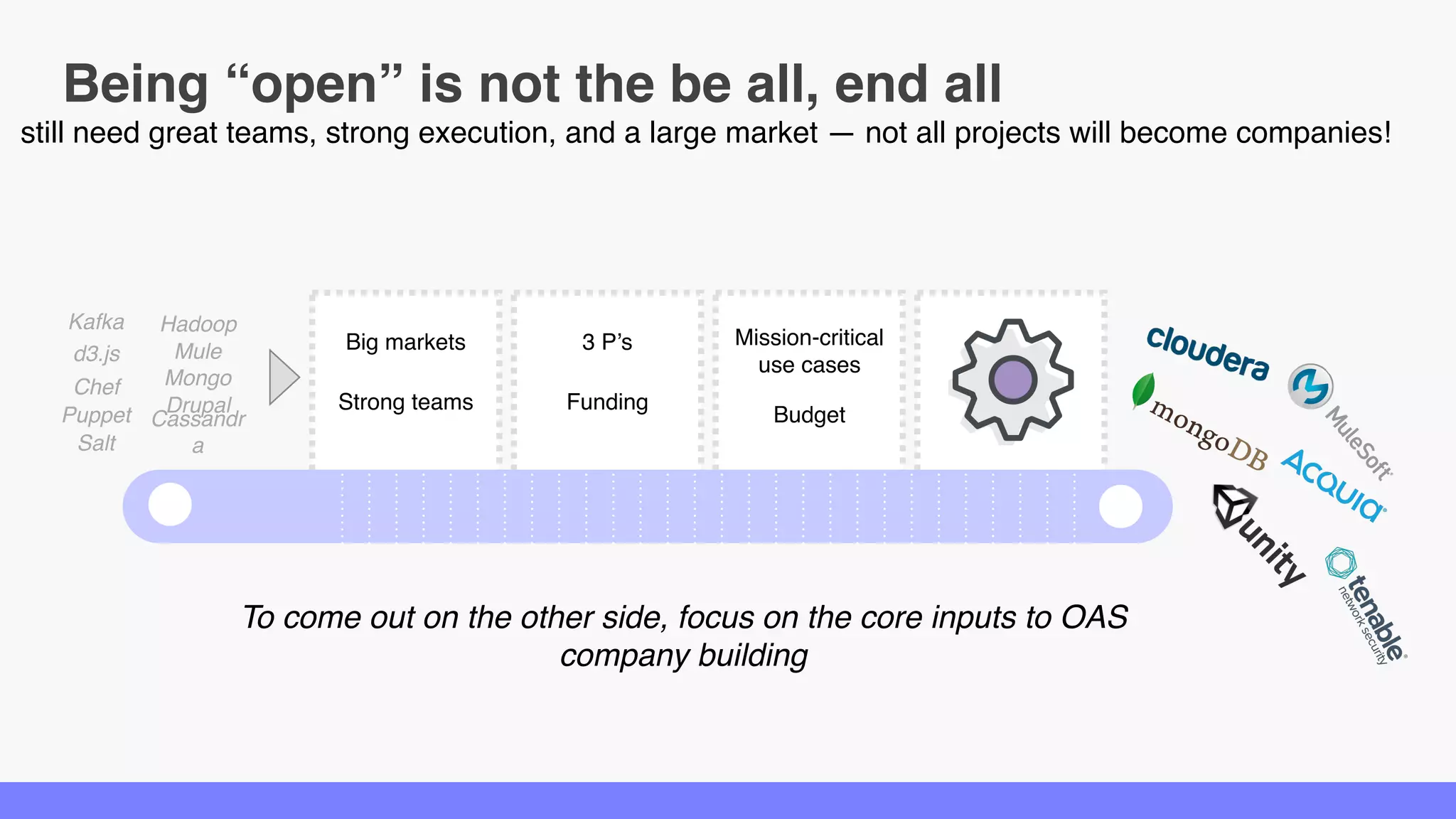

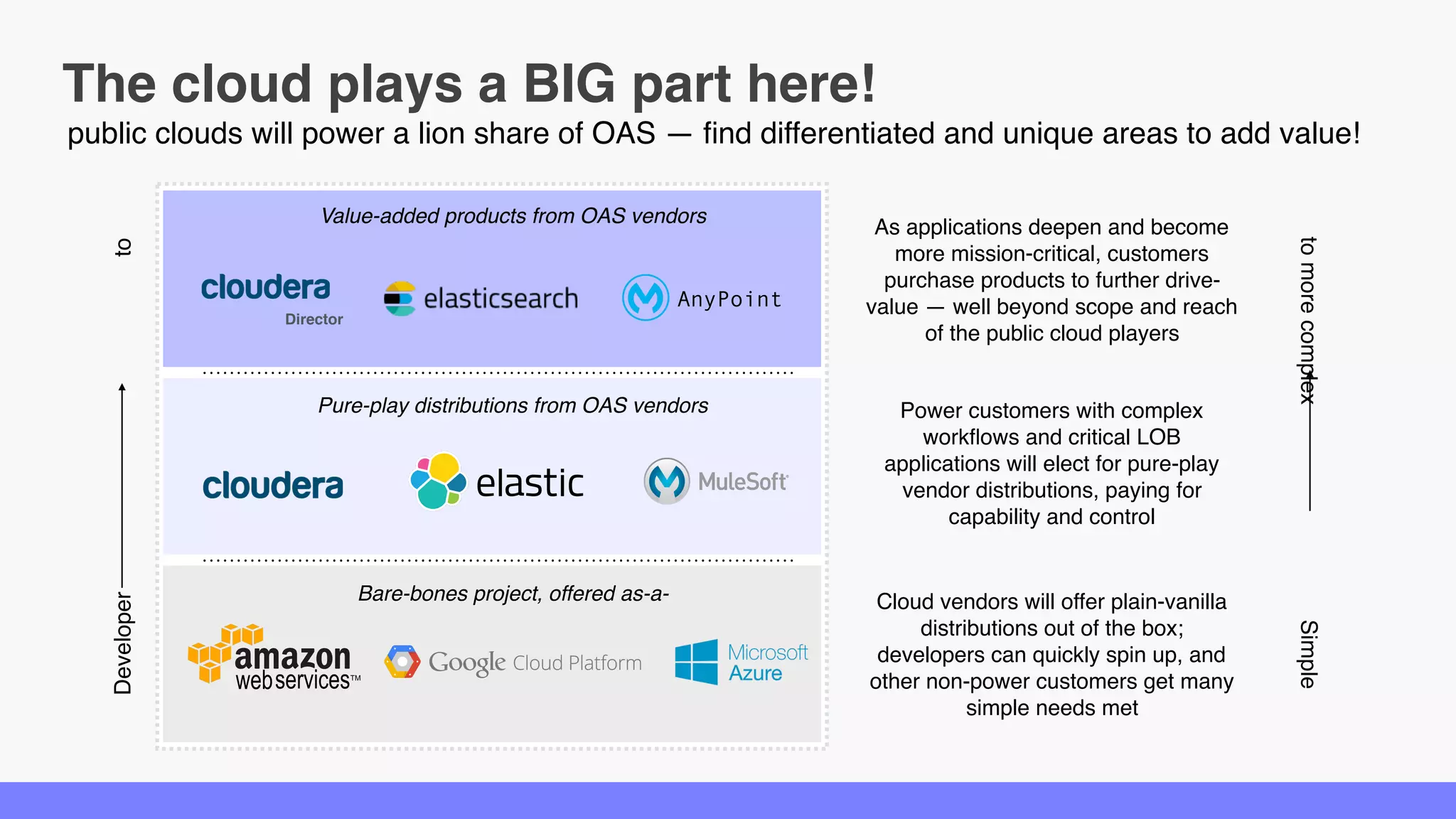

The document discusses the rise of Open Adoption Software (OAS). It defines OAS as software that is openly built by developers and partners, freely adopted by frontline developers, and embraces proprietary additions. The key drivers of OAS include powerful contributor networks, the need for speed and control, and users taking an "open-first" view. Many companies are now using OAS to remodel their IT stacks from the floor to the ceiling. OAS companies can enjoy rapid adoption through communities and become valued at billions, serving both tech and non-tech companies. The document outlines the typical phases and funding stages of OAS companies.