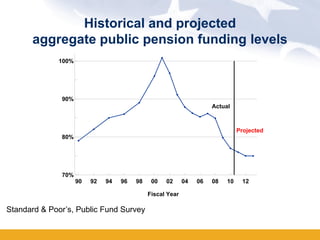

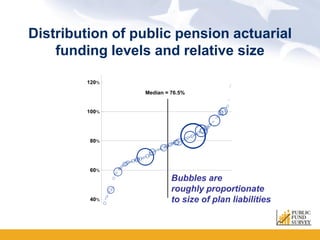

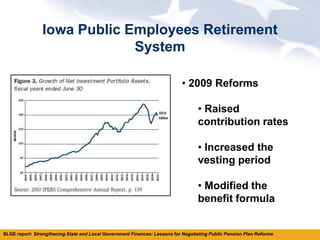

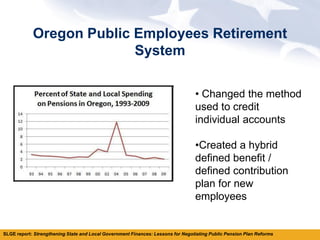

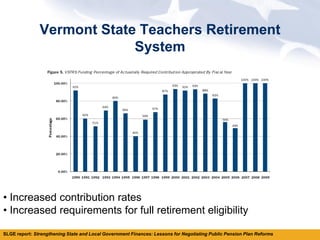

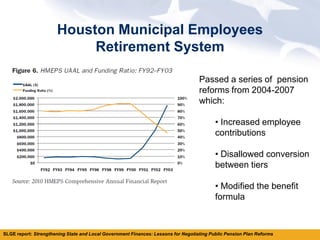

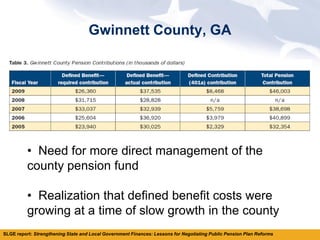

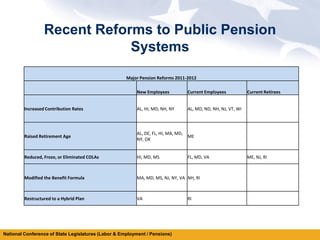

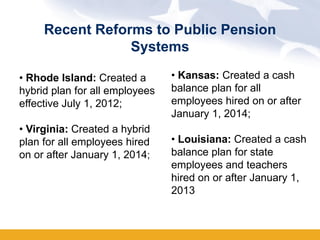

This webinar discusses recent reforms to state and local government pension systems. It provides an overview of public pensions in the US, noting $3 trillion in assets, 15 million active participants, and 8 million retirees receiving $200 billion annually. Recent reforms across many states have increased employee contributions and retirement ages for both new and current employees in an effort to address underfunding and rising costs. The webinar examines case studies of negotiated reforms in five pension systems and updates on reforms enacted in 2012.