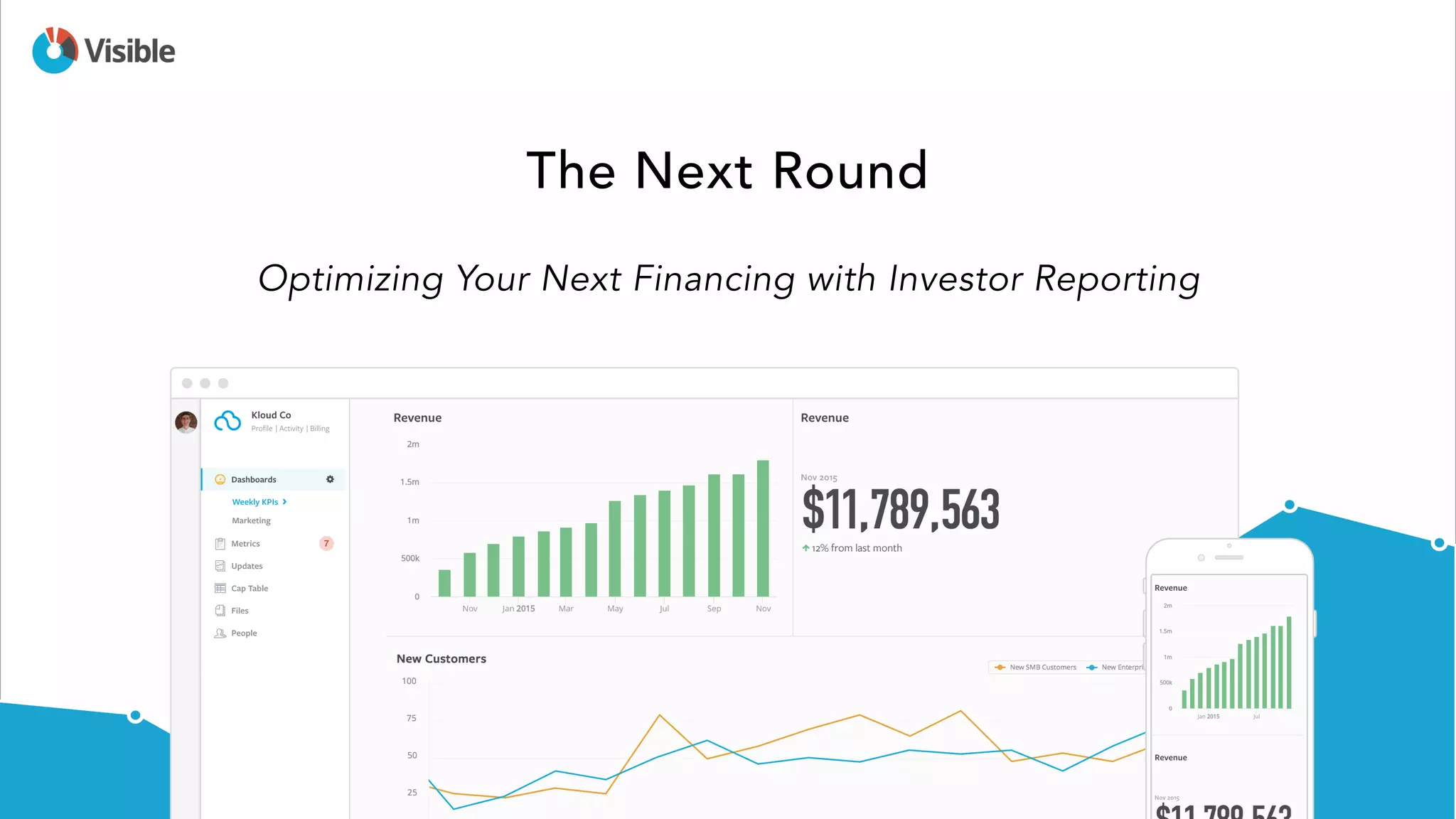

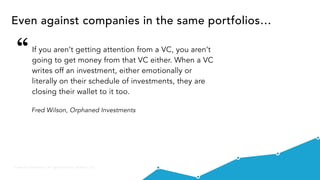

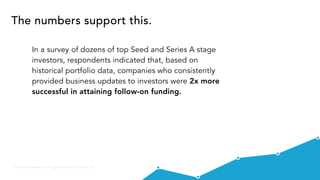

The document discusses the importance of effective investor relations and consistent communication in attracting capital and talent for startups. It highlights that companies providing regular updates are twice as likely to secure follow-on funding and emphasizes transparency and accountability in reporting key metrics. Additionally, it offers strategies for optimizing investor updates to maintain engagement and strengthen relationships with stakeholders.