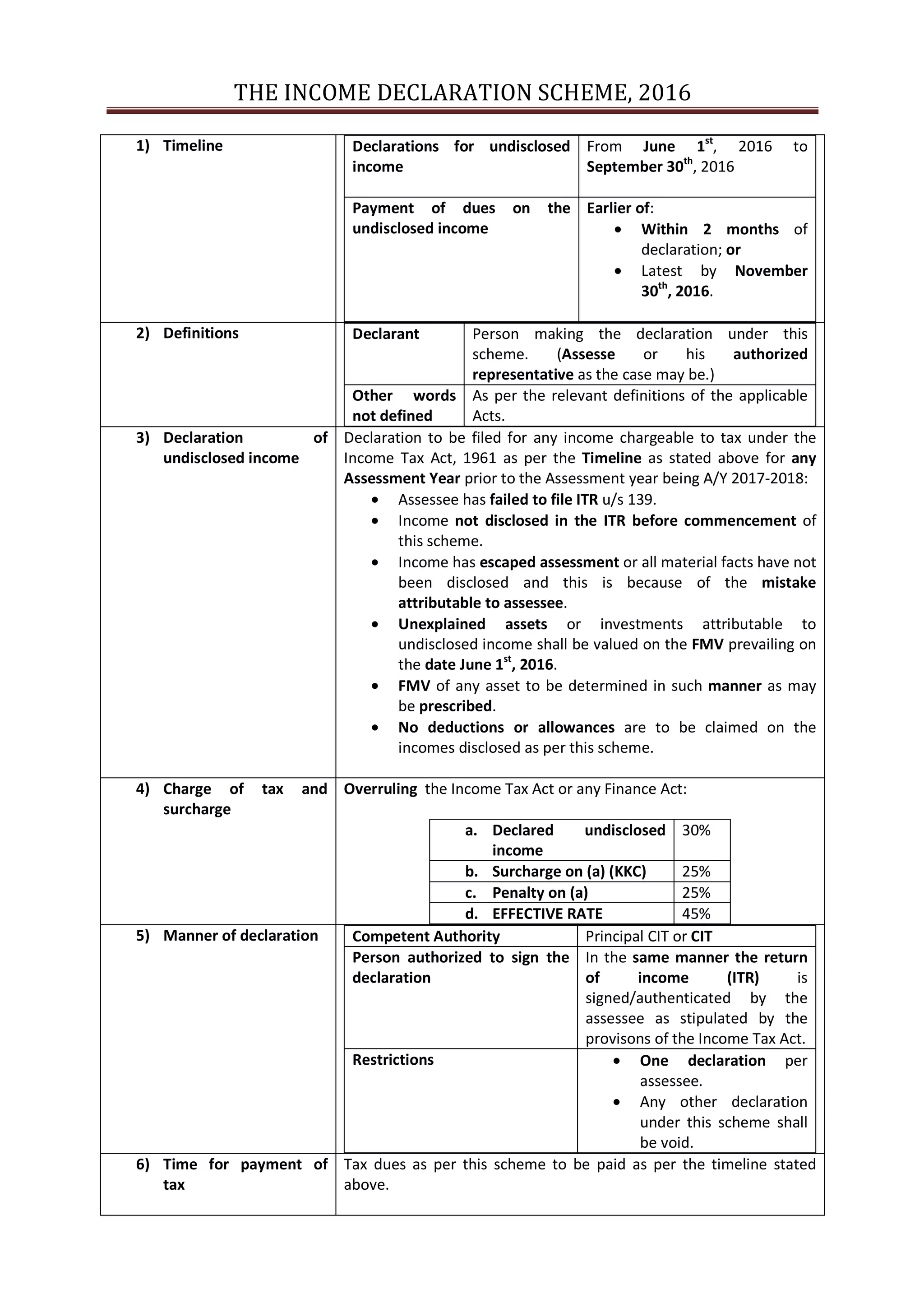

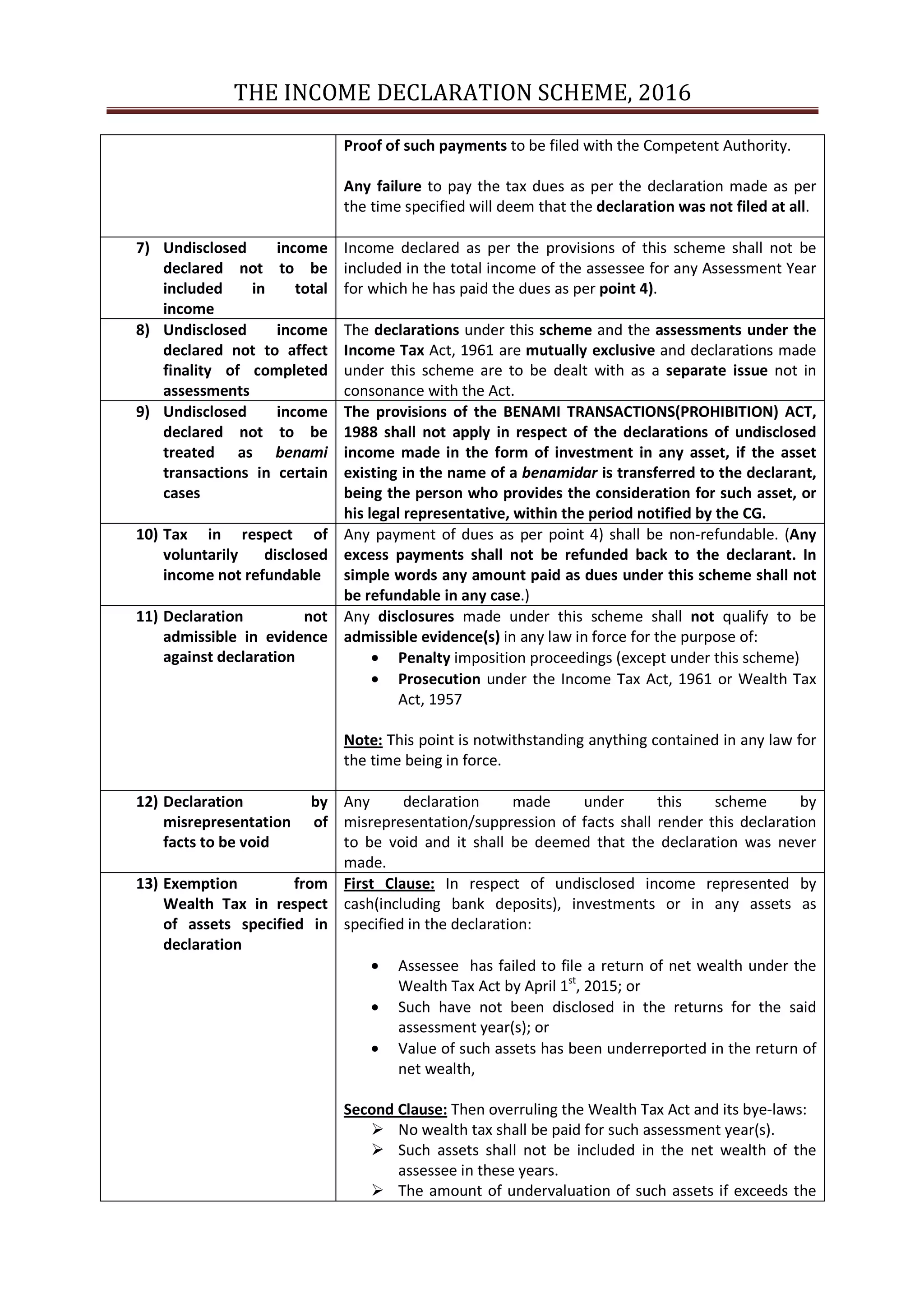

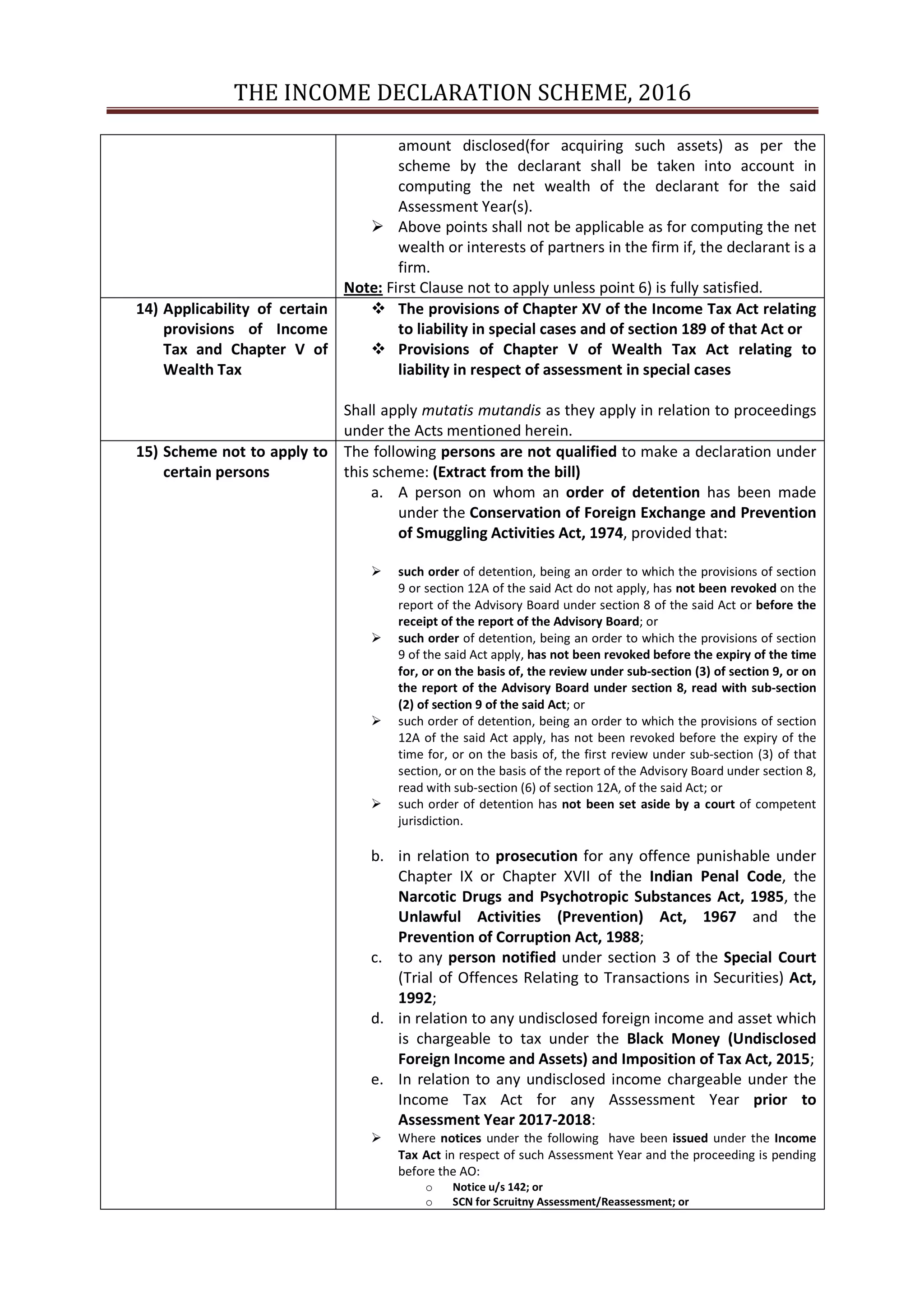

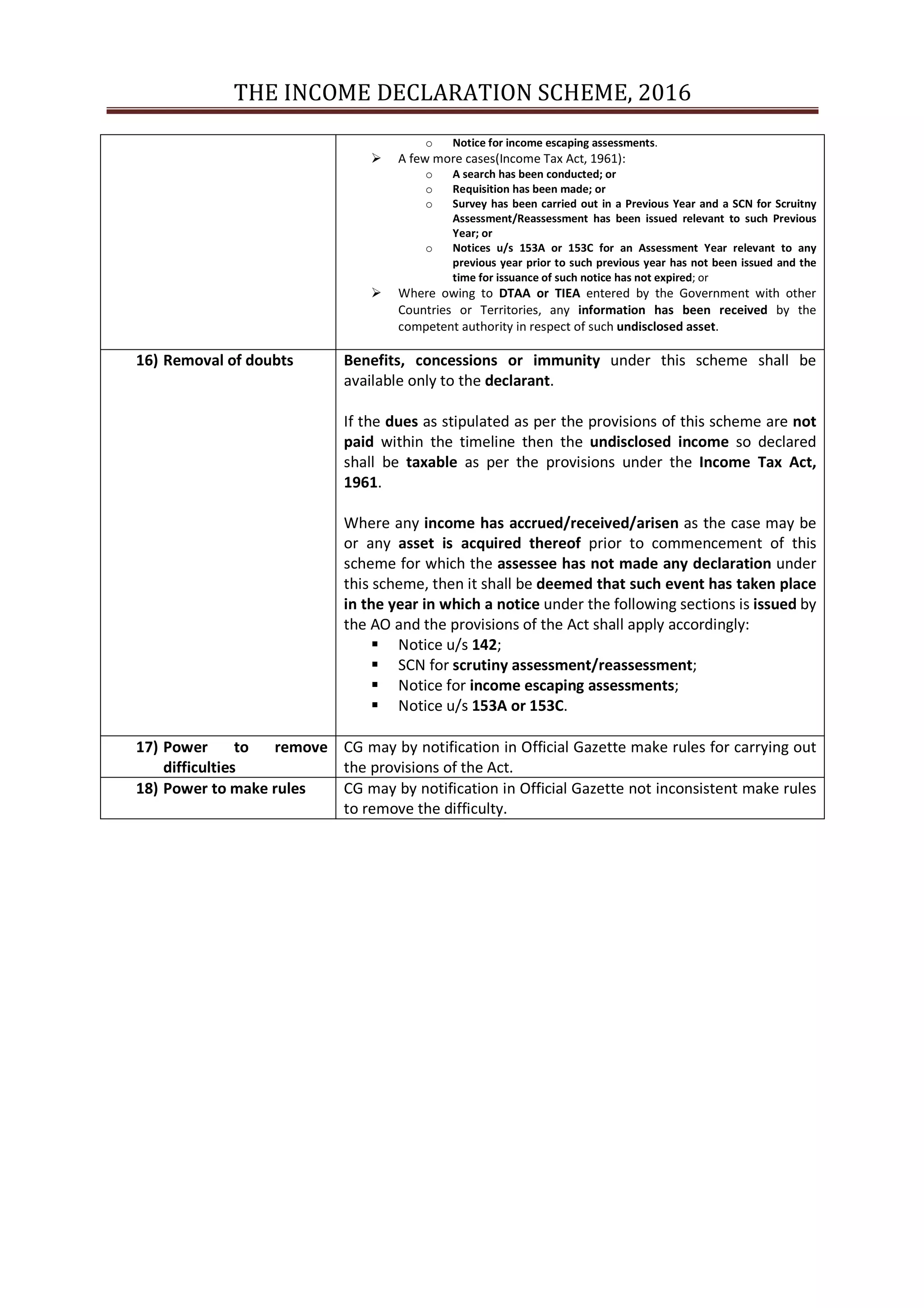

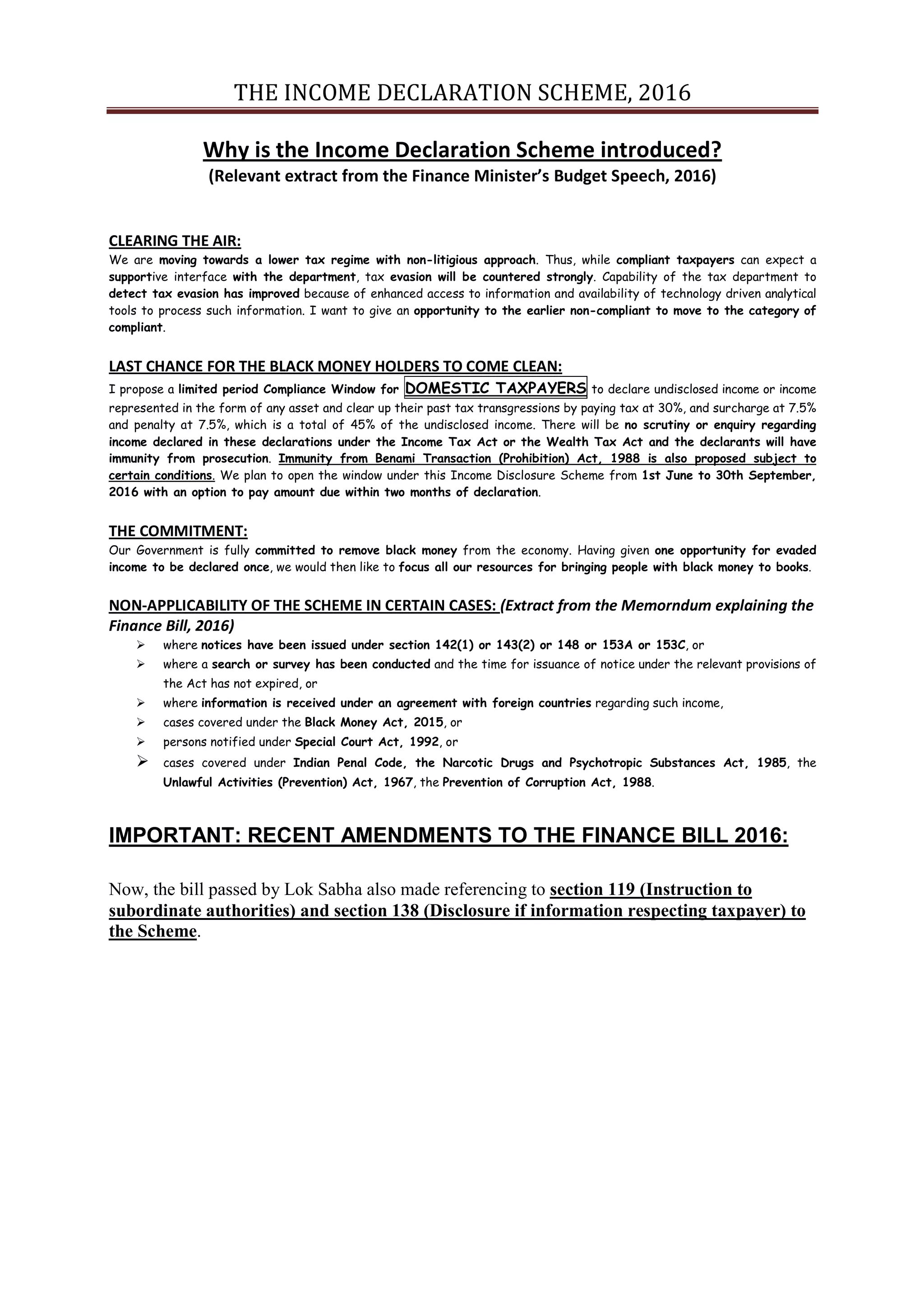

The Income Declaration Scheme, 2016 provides an opportunity for taxpayers to declare undisclosed income and pay tax, surcharge, and penalty at 45% to obtain immunity from prosecution. The key aspects of the scheme are:

1) Declarations can be made from June 1, 2016 to September 30, 2016 and tax dues must be paid within 2 months of declaration or by November 30, 2016.

2) The tax rate on undisclosed income is 30% plus surcharge of 25% and penalty of 25%, amounting to an effective tax rate of 45%.

3) Immunity from prosecution under the Income Tax Act and Wealth Tax Act is provided if tax is fully paid under the scheme.