The document discusses the sluggish economic recovery in the US despite massive monetary expansion by the Federal Reserve. It provides the following key points:

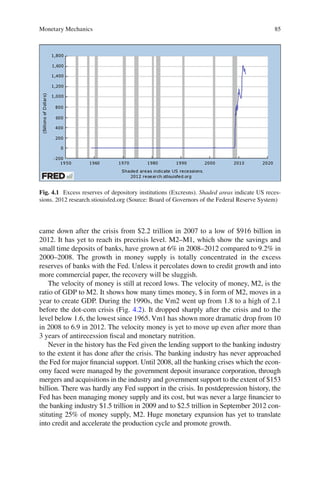

1) Most of the money from quantitative easing programs has remained as excess reserves held by banks at the Federal Reserve rather than flowing into the real economy or increasing bank lending.

2) Money supply has grown but credit growth and velocity of money remain low, restraining economic growth.

3) Investment remains subdued due increased uncertainty from issues like the ongoing Eurozone crisis.

4) Infrastructure investment is proposed as an alternative driver of growth and employment given the lagging housing sector recovery.