India's exporters face challenges amidst global trade concerns and a new tax regime, with hopes pinned on the revised foreign trade policy (FTP). The article highlights the impact of technology on trade dynamics and the potential for countries like the EU and USA to become new low-cost manufacturing centers, increasing competition for Indian exporters. While adjustments are anticipated in the FTP to support exporters, the overarching trade landscape remains fraught with uncertainties.

![AUGUST 2017 II THE DOLLAR BUSINESS 17

TDB INTELLIGENCE UNIT

India's exporters got little from this year's

Union Budget. The recently implemented

Goods and Services Tax (GST) further left

them confused. They now can't wait to learn

what 'happy surprises' the mid-term review

of the Foreign Trade Policy has in store for

them. And not to say, their expectations

from the mid-term review have changed

in the past weeks. [It's just getting bigger!]

The Dollar Business reaches out to India's

EXIM community to learn what it desires

from the FTP revision and how GST has

impacted its wishlist.

T

he good news is that over

the last few months, ex-

ports from India are on

the rise. The not so good

news is that while exports

moved up y-o-y by 5.33% to $276.28 bil-

lion in FY2017, it is still way below the

$314 billion mark touched in FY2014

and a far cry from the $900 billion target

that FTP 2015-2020 had set for FY2020.

While there is no doubt that the For-

eign Trade Policy (FTP) 2015-2020 went

a long way in simplifying procedures

and improving ease of doing business, its

impact on the growth of India's exports

has been at best limited. And the govern-

ment, not blind to this fact, is presently

undertaking a midterm review of FTP,

which, following deliberations with all

stakeholders, is expected to be unveiled

in September this year. And high time

too! Between the beginning of the delib-

erations on the review and now, the 'big-

gest tax reform' in India – the Goods and

Services Tax (GST) – was implemented

on July 1, 2017. And it brought forth

many new challenges for the exporters.

So much so that when The Dollar Busi-

ness questioned exporters on issues

even unrelated to the new tax regime,

they replied saying most of their pres-

ent challenges emanate from the GST

and more than anything else, that is

what they want addressed in the review.

Sure there are other long pending de-

mands related to Advanced Authorisa-

tion Scheme, changes to SION and the

usual suspects like increasing the rates of

incentives and remissions, but challenges

that have arisen due to the GST seem to

be bothering exporters the most.

THE GST CONUNDRUM

Back in May 2015, after FTP 2015-2020

was released with much fanfare, the-then

Director General of Foreign Trade, Pra-

vir Kumar, had told The Dollar Business,

“We have removed all the confusion and

overlapping that existed in FTP 2009-

2014. We have clubbed together various

schemes; and most importantly, the new

policy has liberalised the utilisation of

duty credit scrips.” Well, implementation

of the GST seems to have brought back

the confusion and managed to deliber-

alise the utilisation of duty scrips at one

fell swoop.

Let us first talk about the limitations

that the implementation of GST has im-

posed on the usage of duty scrips, be-

cause that seems to be a pain point that

all Export Promotion Council (EPC)

heads that The Dollar Business spoke to

share. For the uninitiated, duty scrips

are incentives offered to exporters by

The Directorate General of Foreign

Trade (DGFT) under export promotion

schemes – Merchandise Exports from In-

dia Scheme (MEIS) and Services Exports

from India Scheme (SEIS) – which can be

used to offset various taxes that exporters](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-17-320.jpg)

![20 THE DOLLAR BUSINESS II AUGUST 2017

COVER STORY FTP 2015-2020 MID-TERM REVIEW

utilisation of duty credit scrips in the up-

coming Midterm Review.”

Giving an example of how the lim-

itation on the utilisation of scrips will

impact exporters, Ajay Sahai, CEO &

Director General of Federation of In-

dian Export Organisations (FIEO) tells

The Dollar Business, "With a BCD of 5%

and other duties like CVD and ACD of

18%, the exporters could utilise the scrip

within a period of one year. Now, the

same exporters would require four years

time to utilise the scrips." In a situation

like this, exporters will be compelled to

sell or transfer their scrips in the open

market, and herein lies another major

obstacle since the GST on sale of scrips

will now attract a duty of 18%, as they fall

under the residual category [the DGFT

in a tweet though has said that scrips un-

der Chapter 3 of the FTP will attract 12%

duty under HSN classification 4907, sub-

ject to clarification by the Tax Research

Unit (TRU). The question is who will get

the clarification issued – the DGFT or

individual exporters?] against the earlier

VAT incidence of 4%.

Scrips are typically traded at a dis-

count. So if we take the discounted mar-

ket value of a Rs.100 scrip to be Rs.92,

in the VAT regime the buyer would

have paid a total of Rs.95.68 (Rs 92 plus

Rs.3.68 as VAT), while in the GST re-

gime, the buyer of the scrip will end up

paying Rs.108.56 (Rs.92 plus Rs.16.56 as

GST). The second situation is clearly less

attractive. Also, purchase of duty scrips

will become a viable option for the buy-

ers only if they can claim the Input Tax

Credit (equivalent to GST paid while

procuring the scrip). All such complica-

tions with tradability of scrips could fur-

ther pull down the premium (read price)

of the scrips.

FIEO's Sahai estimates that under this

situation a Rs.100 scrip is likely to sell for

Rs.80 in open market. O. P. Prahladka,

Chairman, Export Promotion Council

for Handicrafts (EPCH), agreeing with

the estimates says, “GST will compro-

mise at least 20% of the premium on

MEIS scrips." Clearly, this will put ex-

porters at a disadvantage as without more

avenues for offsetting the scrips, export-

ers will have to sell their scrips at a deep

discount. This in turn, will significantly

eat into the charm of MEIS and SEIS, the

flagship schemes promulgated in the FTP

2015-2020. Exporters in such a situation

will also be forced to pass on the costs

to buyers, which is then likely to hurt

the competitiveness of their products in

global markets, and ultimately result in a

decline in exports from India.

Several EPCs have requested the gov-

ernment to increase the avenues for util-

isation of the scrips and increase their

validity period. In fact, FIEO has also

requested that trading of scrips be ex-

empt from GST or at the most attract 5%

GST. The other suggestion that has been

offered to the government is that trading

of scrips be treated in the same way that

trading of securities are treated. Export-

ers hope that the review will consider

these suggestions and give exporters a

solution that will not suck the lives out

of flagship schemes of the current FTP.

The other major issue that has ema-

nated from the implementation of GST is

the withdrawal of exemptions under Ad-

vance Authorisation (AA) and Duty Free

Import Authorisation (DFIA) schemes.

Under the GST regime, while exemption

from payment of import duties, includ-

ing BCD, anti-dumping duty, safeguard

duties and customs cesses continue, there

is no exemption from payment of IGST

and GST Compensation Cess for im-

ports under AA and DFIA. Previously,

an exporter need not have funded the tax

portion of imports for production of the

goods. That will be necessary under GST.

While the government has said that 90%

of refund/ credit on these taxes paid will

be issued within seven days of filing all

necessary documents, exporters fear that

this is impractical. "Under GST regime,

only BCD will be exempted and IGST

will have to be paid. This would make

Advance Authorisation completely unvi-

able as duties will be paid upfront at the

time of import. We have suggested the

new norm be waived off. Otherwise ex-

ports will drop," says T. S. Bhasin, Chair-

man, Engineering Exports Promotion

Council (EEPC).

What's more? The Advance Release

Order (ARO) facility available for do-

mestic procurement of inputs under AA

has been restricted only to certain inputs

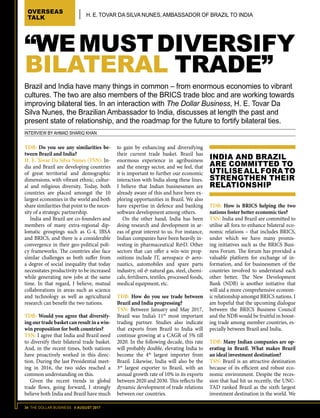

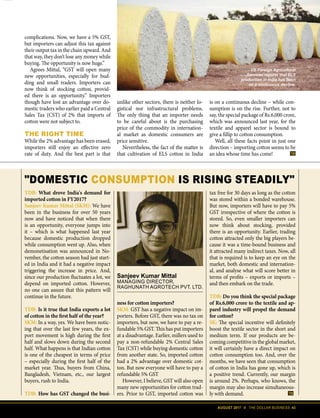

[listed in the Fourth Schedule of CentralSource: TDB Intelligence Unit and Ministry of Commerce,GoI; figures in $ billion

India’s merchandise exports since April 2014

Between FY2015 and FY2017 India's exports has gone down by about 11%

30

25

20

15

10

05

00

Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar

FY2015 FY2016 FY2017

LIMITATIONS ON

SCRIP UTILISATION

WILL RESULT IN A

DECLINE IN SCRIP

PREMIUMS

Most exporters are not happy with the Ad-

vance Authorisation Scheme as they believe

that the Standard Input Output Norms are

completely flawed.](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-20-320.jpg)

![AUGUST 2017 II THE DOLLAR BUSINESS 21

Excise Act, 1944 (CE Act)] such as tobac-

co and petroleum products. Therefore,

AA cannot be used for domestic procure-

ment of other inputs. What will therefore

happen is that a significant portion of an

exporter's working capital will remain

blocked with the government, thus rais-

ing his cost of capital. With cost of capital

already high in India, when compared to

other exporting nations, this could have a

negative effect on the competitiveness of

Indian goods and services in the interna-

tional marketplace.

The treatment for EPCG is simi-

lar. EPCG scheme was formulated to

encourage manufacturer exporters to

import capital goods including spares

for pre-production, production and

post-production activities at zero duty

subject to an export obligation (EO) of

six times of duty saved on capital goods

imported under the EPCG scheme, to

be fulfilled in six years from the authori-

sation issue date. This was expected to

give a boost to exports of high-value

and value-added products from India,

something that the government has

been trying to promote. Under GST, the

exemption from import duties under

Manish Karajia

Chairman, Jute Products Development & Export Promotion

Council (JPDEPC)

As scrip utilisation will go down, we believe most exporters will have to

invest 15-20% extra working capital in the business. And, there is a lot of

uncertainty in the refund process as of now. I think the reverse charge mech-

anism under GST is unnecessary. Add to that the fact that an exporter is now

liable to pay taxes on the supply of goods and services from unregistered suppliers. Since job

work is quite extensive in our sector, a 5% GST on job work that has been imposed on items

from yarn to fabric has put us at a disadvantage. One must keep in mind that almost 60%

of the job work in our sector is done by the unorganised cottage industry players and hence

exporters would now end up paying the taxes for the job work. We believe, 4% of the capital

will have to be spent on paying taxes on job work. Another issue we are currently facing is

that the jute shopping bag has been clubbed in the 18% GST slab with luxury handbag. We

want the FTP to revisit these issues.

Puran Dawar

President, Agra Footwear Manufacturers & Exporters

Chamber (AFMEC)

Exports from the footwear sector is already under pressure, and as such

it has huge expectations from the FTP review. We hope the review re-

lieves the sector from some of the GST related compliance and teething

issues. As for drawbacks, I believe, we were already under incentivised. Be-

fore GST, utilising AIR norms, we used to get 9.5% duty drawback – of which about 50% could

be said to be our actual costs and 50% would be incentives. But now, we are paid only for the

actual. To cover GST-related compliance costs, we need at least 2% increment in benefits

under MEIS. Also under the FTP review, deemed duties should be generously taken care of

because in many of our products the share of deemed duties is quite significant.

TDB: What are the key issues that the FTP 2015-2020 mid-

term review must revisit?

Mukesh Bhatnagar (MB): The dictum of exports is ‘export

goods and not taxes’. So, any tax incurred during the produc-

tion of goods or during exports must be rebated through a sim-

ple, transparent and acceptable procedure. Speaking of GST,

the pay-first-and-get-a-refund-later mechanism under GST is

creating a hassle because exporters don’t know if the refund

will happen as promised. I believe FEIO has been raising the

issue with the government for some time and there has been an

emphasis on developing a mechanism to give exporters some

form of a rebate. If we look at other countries and their expe-

riences, we will find that they have a system of refund of taxes

which go into the production of goods and there is a system

whereby, if they are under a VAT regime, the goods that are

taxed at the input stage are refunded. This is what we should do

in India too. But the bigger problem is the availability of export

credit at a competitive rate. Indian exporters have a disadvan-

tage in the international market because the cost of borrowing

is high. And, when the high borrowing cost is coupled with the

lack of infrastructure and the high turnaround time, exporters

lose competitiveness. The FTP needs to consider introducing

more competitive and more liberal borrowing schemes.

TDB: The export incentives will eventually be phased out.

What would you suggest?

MB: This is an obligation which is eventually going to come

to India. The government has been gradually sensitising the

exporters that export subsidies are not going to be there forev-

er. But, there can be other incentives, say production subsidy

with which the government can continue to subsidise

the exporters.

MUKESH BHATNAGAR, PROFESSOR, INDIAN INSTITUTE OF FOREIGN TRADE (IIFT)

“FTP MUST CONSIDER INTRODUCING

MORE LIBERAL BORROWING SCHEMES”](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-21-320.jpg)

![60 THE DOLLAR BUSINESS II AUGUST 2017

TDBFORUM

My client has received advance pay-

ment (forex) from a foreign buyer

but has not remitted equivalent

goods/ services within one year

from the receipt of funds. I wanted

to check if he has made a non-com-

pliance. If yes, is there a way out,

either pre- or post-approval or any

other provision, under law where-

in he can be a compliant entity?

(Akash, adarsha.aakash@gmail.com)

Dear Aakash: Since your client (ex-

porter) has been unable to make the

shipment within one year from the

date of receipt of advance payment,

In the world of export-import,

each shipment counts.

And you cannot afford to

make any “uninformed

investment”. So, if you have

any doubt or a question,

ask us. Our team of experts

at The Dollar Business

Intelligence Unit will be

happy to answer your

queries. Your question(s),

if approved, will also

be published on www.

thedollarbusiness.com, and/

or in the forthcoming issue

of The Dollar Business

AskaQuestion

Response by:

Steven Philip Warner

President (VMPL)

Editor-in-Chief,

The Dollar Business

I am interested in importing es-

sential oils and agricultural prod-

ucts from United States to India.

Do I require to obtain any license

or permits from the Government

of India? (Kirat Patel, President, Goji

Snacks Inc., +91-8306252XXX, kirtapa-

tel2020@gmail.com)

Dear Kirat: We are glad to know

that you want to import essential oils

and agricultural products. The im-

port of essential oils is free under the

Foreign Trade Policy. However, the

provisions relating to Drugs Cos-

metics Act and Food Safety Standard

Authority of India (FSSAI) Regu-

lations needs to be complied while

importing, depending on the usage

of the essential oil.

When it comes to agriculture

products, you need to specify what

products you plan to import as tech-

nically all products falling under

Chapter 1 to 24 of ITC (HS) Code

are broadly described as agricultural

products. Most agricultural prod-

ucts are freely importable but some

of them are restricted and would

require an authorisation before the

imports. Such imports are also sub-

ject to Plant Quarantine regulations.

Response by:

Ajay Sahai

Director General CEO,

Federation of Indian Export

Organisations (FIEO)

any remittance towards refund of

the advance payment or payment of

interest to the foreign buyer should

be made only after the prior approv-

al of RBI. Please refer to Notification

No.FEMA 23(R)/2015-RB dated

January 12, 2016 [Foreign Exchange

Management (Export of Goods

Services) Regulations, 2015]. We

hope we’ve been able to respond ap-

propriately to your query. In case you

have any further question, please feel

free to write to us. We look forward

to hearing from you.](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-60-320.jpg)

![62 THE DOLLAR BUSINESS II AUGUST 2017

Have a product to showcase? Want to learn what

your rivals are up to? Here is a list of trade fairs you

shouldn’t miss in August and September 2017.

FLORA TECH INDIA

August 28-29

Bangalore

www.floratechipmindia.com

The Flora Tech India is an international

exhibition on floriculture, plants and land-

scaping technologies. This is one of In-

dia’s largest trade shows that displays a

comprehensive collection of plants, trees,

palms, greenhouse and landscape equip-

ment. It is often considered to be the gate-

way to enter the South Asian market and

offers a platform to prospective buyers and

sellers to network and do business. Visitors

can also visit Agri Tech India (a trade fair

that displays seeds, chemicals, machinery,

etc. for agricultural use), which will be held

alongside Flora Tech at the same venue.

INDIA FOODEX

August 28-30

Bangalore

www.indiafoodex.com

India Food Exhibition is an annual trade

fair celebrated amongst the food retailing,

processing, packaging, machinery and al-

lied industries. The event will be held con-

currently with Grain Tech India 2017, Dairy

Tech India 2017, Meat Tech Asia 2017, In-

dia Food Park Expo 2017 and SnackBev

India 2017 at the Bangalore International

Exhibition Centre. The expected footfall is

around 35,000 visitors. Around 400 exhib-

itors are likely to participate in the event.

The 2017 edition will also host confer-

ences, conduct buyer-seller meets, work-

shops and other programmes.

AGRI ASIA

September 01-03

Gandhinagar

www.agriasia.in

Agri Asia is one of India's biggest exhibi-

tions on agriculture technology. Held every

year in Gandhinagar, Gujarat, it connects

domestic companies and traders with

buyers from countries like Germany, Ja-

pan, Israel, Netherlands and many more.

It attracts policymakers, corporate deci-

sion-makers, experts and practitioners

from the agri sector, making this fair a

must-visit affair for every stakeholder.

IMEX

September 08-10

Mumbai

www.imexonline.com

IMEX is an international trade exhibition

for machine tools and allied products. This

platform offers an opportunity to both na-

tional and international manufacturers and

suppliers to showcase their latest products

and developments. The 2017 edition will

focus on facilitating effective interaction

amongst the makers of machine tools, au-

tomation, cutting tools and user industries

and enable visitors to explore the best re-

sources available in the country under one

roof. IMEX will be held parallel to five other

major trade events including TECHINDIA

(engineering and manufacturing industry)

and UMEX (used machinery industry).

ANUTEC

August 21-23

New Delhi

www.foodtecindia.com

ANUTEC – International FoodTec India is

one of the country's most important trade

platforms for the food and drink industry.

The fair is held concurrently with PackEx

India, Sweet SnackTec India and Dairy

Universe India trade fairs that cater to the

sweet snack processing and dairy pack-

aging industries. This year, in its 12th

edition,

the show is expected to attract around 400

exhibitors and about 10,000 visitors from 33

countries including Sri Lanka, Nepal, Ban-

gladesh and Myanmar.

A file photo of Automation Expo 2016

AUTOMATION EXPO 2017

August 09-12, Mumbai, www.automationindiaexpo.com

Automation Expo is a unique business platform and is considered as South-East

Asia's largest automation trade fair. This annual event garners over 50,000 visitors,

900 exhibitors and 20,000 products. It helps visitors and participants interact face-

to-face through workshops, seminars, conferences and other interactive sessions –

besides showcasing India’s latest developments in technologies. Events such as the

MSME summit and India International Flow Expo will be held concurrently.

[India]](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-62-320.jpg)

![SUBSCRIBE

NOW!The Dollar Business magazine

Read this exclusive platform on foreign trade and get an unbeatable edge

in the business of exports-imports. Welcome to globalisation!

1. This is a limited period offer.

2. The Dollar Business and Vimbri Media Pvt. Ltd. will not be held responsible in case of any

postal / courier delay in delivery of any issue of the magazine.

3. The Dollar Business and Vimbri Media Pvt. Ltd. will not be held responsible in case of any

production delay that leads to late delivery of any issue to its subscriber(s).

4. If for any reason, a certain issue of The Dollar Business is not published, the subscription

will automatically be extended by a month.

5. The Dollar Business and Vimbri Media Pvt. Ltd. reserve the right to terminate any

subscription or accept or reject any request for subscription.

6. Disputes, if any, are subject to the exclusive jurisdiction of courts in Hyderabad only.

7. Any change in periodicity of The Dollar Business magazine may apply to existing

subscribers. They will continue receiving the same number of issues they had originally

subscribed to. They duration between issues may however stand duly altered.

8. Any change in the cover price of The Dollar Business magazine will not apply to existing

subscribers. They will continue receiving the same number of issues they had originally

subscribed to.

9. It is the sole responsibility of the subscriber(s) to report delay in delivery of any issue of

the magazine to the subscription department of The Dollar Business within 14 days of the

issue release date.

10. It is the sole responsibility of the subscriber(s) to report non-receipt of any issue of the

magazine to the subscription department of The Dollar Business within 30 days of the issue

release date.

11. Terms and conditions may be altered without notice to the subscribers.

12. For Delivery, Return and Refund Policies, and for more information on Subscriptions,

please log on to www.thedollarbusiness.com

No additional delivery charges apply to India-based subscribers. **Rates exclusive of airmail charges for all international subscribers.

[Applicable annual additional charges: $50 for all international subscribers.] Issues wil be despatched using regular India Post international

mail service. Vimbri Media Pvt. Ltd. is not liable for postal delays. NOTE: All approved subscriptions include both Print e-Magazine offers.

For subscription-related queries, please write to us at subscription@thedollarbusiness.com or call us on +91 40 67609999. We’d love to hear from you!

You can also write to us at: The Dollar Business, Vimbri Media Pvt. Ltd., Level III IV, 8-2-542/A, Road No. 7, Banjara Hills, Hyderabad 500 034, Telangana, IN

TERMS CONDITIONS

SIMPLY ENCLOSE YOUR BUSINESS CARD

OR FILL THE BELOW-MENTIONED FIELDS TO SUBSCRIBE

Mr. Ms. Dr.

Name:

Address:

City:

State: Pin code:

Telephone no.(s):

Email:

Date of Birth (DD/MM/YYYY):

Company: Industry:

Subscription for 1 Year (12 issues) 2 Year (24 issues) 3 Year (36 issues)

INR 1,080 / USD 24** INR 1,920 / USD 43** INR 2,520 / USD 58**

SUBSCRIBE BY LOGGING ON TO

WWW.THEDOLLARBUSINESS.COM AND PAYING ONLINE

(MANDATORY FOR ALL INTERNATIONAL SUBSCRIBERS)

OR FILL THE BELOW-MENTIONED PARTICULARS OF

PAYMENT THROUGH CHEQUE / DD MODE

I am enclosing a Cheque / DD No:..................................

dated drawn on.........................................

.........................................................................................

for INR1,080 / INR1,920 / INR2,520

favouring Vimbri Media Pvt. Ltd. payable at Hyderabad

Add Rs.50 for non-Hyderabad cheques (not required for At Par cheques).

Please write your name and address on the reverse of the cheque/DD.

Do not send cash. Please send the filled form to:

The Dollar Business, Vimbri Media Pvt. Ltd., Level III IV, 8-2-542/A,

Road No. 7, Banjara Hills, Hyderabad 500 034, Telangana, IN

SUBSCRIPTION REQUESTS CAN BE PLACED BY LOGGING ON TO WWW.THEDOLLARBUSINESS.COM, FILLING-IN NECESSARY DETAILS IN THE APPLICATION FORM GIVEN AND

MAKING PAYMENTS USING CREDIT CARDS/ DEBIT CARDS OR VIA NET BANKING

Print version INR USD

No. of Issues 12 24 36 12 24 36

Cover Price 1,200 2,400 3,600 24 48 72

e-Magazine INR USD

No. of Issues 12 24 36 12 24 36

Cover Price 1,200 2,400 3,600 24 48 72

Total Price 2,400 4,800 7,200 48 96 144

Discount 55% 60% 65% 50% 55% 60%

You pay 1,080 1,920 2,520 24** 43** 58**

SPECIALOFFER!GET UP TO 65%

DISCOUNT ON

SUBSCRIPTIONS

CUTTHEDOTTED

LINE

CUTTHEDOTTED

LINE

To advertise / subscribe, please call us on +91 40 67609999

or write to us directly on reachus@thedollarbusiness.com or log on to www.thedollarbusiness.com

**Rates exclusive of airmail charges for all international subscribers. All international subscribers are requested to add applicable annual additional charges of $50

I WANT TO RECEIVE MY MAGAZINE COPY THROUGH COURIER AND AGREE TO PAY AN ADDITIONAL CHARGE OF INR 360 A YEAR TO COVER FOR THE SERVICEOVER AND

ABOVE THE ABOVEMENTIONED SUBSCRIPTION PRICE (EG. FOR A 1 YR. SUBSCRIPTION, TOTAL CHARGES INCLUSIVE OF COURIER IS INR 1,440)](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-63-320.jpg)

![AUGUST 2017 II THE DOLLAR BUSINESS 65

Log on to www.thedollarbusiness.com

for more events and details.

[Global]

MIMS AUTOMECHANIKA

August 21-24

Moscow, Russia

http://www.mims.ru/en-GB/

MIMS Automechanika Moscow is one of

the most comprehensive trade fairs in

Russia. It caters to people from the auto

components industry. The expo offers a

platform to both Russian and foreign man-

ufacturers and suppliers of auto parts,

automotive components, equipment and

products for the maintenance of cars to

showcasing their products. The floor ex-

hibition is divided theme-wise: Auto Parts,

Repair Maintenance, Sink Equipment

for Service Stations, Electrical Electron-

ics, Accessories Tuning, and Manage-

ment IT.

CHINA ADHESIVE

August 23-25

Shanghai, China

en.chinaadhesive2000.com

The China International Adhesives and

Sealants Exhibition (China Adhesive) is a

professional event guided by ‘Made in Chi-

na 2025’. It brings together manufacturers

of adhesives, sealants, ink, PSA tape and

label products from around the world un-

der one roof. About 36 countries would be

participating in this year's edition including

India, Germany, US and Turkey. The exhi-

bition this year will also host 30 technical

seminars and expects about 500 exhibitors

and 25,000 visitors, including over 3,000

international buyers.

CTG

August 25-28

Phnom Penh, Cambodia,

www.camboexpo.com/CTG/

The Cambodia Textile and Garment Indus-

try Exhibition (CTG) is Cambodia’s largest

annual trade show that caters to sectors

like textiles, apparels, accessories, fibres,

fabrics, textile machinery and more. Each

year, over 200 exhibitors showcase thou-

sands of new products and more than 80%

of the visitors are decision makers from

over 15 countries – and this makes CTG a

popular platform to meet potential business

partners. The Cambodia International Ma-

chinery Industry Fair (CIMIF) will be held

alongside CTG. It is a platform that attracts

companies from industries like automotive

parts, plastics, food technology and oil

gas products.

INTERAUTO

August 23-26

Moscow, Russia,

http://eng.interauto-expo.ru

INTERAUTO is a trade fair popular

amongst leading global players of the

transportation and logistics industry. Over

700 companies, from nearly 20 countries

will display a wide range of car accesso-

ries, components, maintenance equip-

ment, paints, coolants, oil, batteries and

much more. Participating countries include

Belgium, Germany, Spain, Italy, China,

Taiwan, US, Turkey, Japan, etc., making

INTERAUTO an ideal platform for profes-

sionals to strike transnational deals.

TUNNEL EXPO

September 01-04

Istanbul, Turkey

www.tunnelexpoturkey.com

Tunnel Expo is Turkey's largest special-

ised trade fair dedicated to drilling and

underground construction. It's an exhi-

bition that attracts construction compa-

nies, design firms, engineers, dealers of

machinery and technicians from across

the globe, and as such is an ideal plat-

form to find prospective business part-

ners and network with industry peers.

Currently in its third edition, the event

is considered as the perfect bridge be-

tween Eurasia and the rest of the world

for professionals from the sector.

THE GREEN EXPO

September 05-07

Mexico City, Mexico

www.thegreenexpo.com.mx

The Green Expo showcases solutions and

technologies focused on strengthening

the biological and industrial cycles of our

environment and ecosystem. Currently in

its 25th

edition, it has a growing roster of

companies and industry representatives

attending the event every year. Visitors will

get to see a wide display of energy saving

devices, biogas, recycling and solar equip-

ment, air compressors and many more

such eco-friendly technologies.

IFSEC

September 06-08

Kuala Lumpur, Malaysia

www.ifsec.events/sea/

IFSEC Southeast Asia is a prestigious

trade show that is much-celebrated

amongst members of the security, fire, and

safety industry. This is an annual event that

caters to over 10,000 professionals from

51 countries and showcases state-of-the-

art technologies such as access control

and biometrics, physical security, control

rooms, fire alarms, intruders alarms, cyber

security and much more. The trade show

is considered as a gateway to the growing

Southeast Asian safety equipment market.

A file photo of The Green Expo 2015.](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-65-320.jpg)

![66 THE DOLLAR BUSINESS II AUGUST 2017

BORDERLINE EDITOR’S COLUMN

HIGH HOPES

AND EXPECTATIONS

Manish K. Pandey

Editor,

The Dollar Business

T

he one thing that India’s foreign trade community

has been eagerly waiting for since the start of this fis-

cal [more than anything else, even the rollout of the

Goods and Services Tax (GST) – perhaps the most

radical and progressive tax reform the country has ever seen]

is the outcome of the mid-term review of the Foreign Trade

Policy 2015-2020. After all, it’s ‘the document’ that decides the

direction of India’s foreign trade and also, of course, the fate

of millions of exporters and importers! But thanks to the GST

rollout, they will have to wait a little longer.

Nevertheless, the hopes are high! So what does India’s ex-

porter-importer community expect from the review? One of

the biggest expectations that exporters, at least the ones whom

I have been interacting with on a regular basis, have from the

mid-term review of FTP 2015-2020 is nothing but to offset the

losses arising because of the implementation of GST. They have

their reasons.

While exports are zero-rated under GST and exporters will

indeed get input tax credit, they will have to pay taxes first and

apply for refunds later. And this ‘pay-first-and-get-a-refund-

later’ mechanism is what is going to hurt exporters who are al-

ready burdened with high cost of credit. Although policymak-

ers have assured 90% of the refund will be processed within

seven days, exporters are worried that this may not be feasible.

What’s more? Industry experts estimate that the competitive-

ness of Indian products will be eroded by about 2% as most

exporters, particularly MSMEs, will have to rely on loans and

borrowings to meet their working capital requirements or pay

advance taxes. The industry hence expects the government to

offset the loss arising out of this transition [from an exemption

model during pre-GST period to refund system under GST re-

gime] through some policy instrument, preferably incentives.

GST has also narrowed the ambit of duty credit scrip only to

payment of basic customs duty, whilst earlier the utilisation of

the scrip was allowed for the payment of customs duty, excise

duty and service tax. This is bound to have wide ramifications

on exporters. Also, MEIS and SEIS scrips, which used to attract

5% VAT now attract 18% GST because the scrips fall under the

residual category. This issue must be addressed, otherwise GST

will sharply reduce the incentive aspect of these scrips. If utili-

sation does not gets integrated with GST, the premium on these

scrips is also bound to go down drastically.

Then there has been a long-pending demand of the EXIM

community to rescind DGFT Public Notice No.31, dated

01.08.2013. This notification directly contradicts para 4.2.6 of

FTP, which deals with transferability. On one hand, para 4.2.6

allows transferability of the inputs imported against the authori-

sation, whereas notification 31 disallows and restricts an export-

er to import and use the products only in the export product.

So, the whole purpose of allowing transferability of Duty Free

Import Authorisation (DFIA) is defeated. The industry expects

the authorities to consider this matter during the ongoing FTP

mid-term review. And if the revocation is not at all possible, the

policymakers should at least do away with DGFT Public Notice

No.35, dated 30.10.2013, that enforces the conditions of DGFT

Notification No.31 even on DFIA licences issued prior to the

issuance of Notification No. 31/(RE-2013).

The industry feels that the Advance Authorisation Scheme

needs to be streamlined by faster fixation of Standard Input

Output Norms (SION) by the Norms Committee. Exporters

allege that currently, due to delays, they are not able to obtain

Export Obligation Discharge Certificate (EODC) and as such

are placed in the Denied Entities List (DEL). This impacts them

adversely. And not to say, this is one expectation that ranks high

on their wishlist.

The exporting community also wants the FTP 2015-2020

mid-term review to address the inverted duty structure prev-

alent across industries. Several cases exist in various sectors

where import duty on an intermediate product is higher than

that on the finished product, which make ‘Made in India’ cost-

lier than imported products. A case in point could be the tyre

industry – imports of natural rubber that is used for manufac-

turing of tyres attracts 25% duty, whereas imports of finished

auto tyres is taxed at 7%.

This kind of a situation not only discourages an entrepreneur

from setting up a manufacturing business, but also questions

the intention of the government with regards to initiatives like

‘Make in India’.

There are many such concerns that India’s exporters com-

munity expects the policymakers to address through a revised

and better FTP. And that’s not too much to ask for considering

that it’s them who are earning precious foreign exchange for the

country. But will their hopes meet reality this time?

Time will tell.

www.thedollarbusiness/blogs/manish @MK_Pandey](https://image.slidesharecdn.com/tdbvol4issue08fullissuesinlge-170804111959/85/The-Dollar-Business-August-2017-Issue-66-320.jpg)