The mid-term review of India's foreign trade policy has been welcomed amid concerns about its effectiveness in boosting exports during challenging times. Although recent data shows a rebound in export performance, issues like delayed GST refunds and the need for tailored incentives for states remain critical. As the government looks to the upcoming budget, there are rising hopes and expectations for enhanced support to the export sector in 2018.

![40 THE DOLLAR BUSINESS II JANUARY 2018

THE SECRET INGREDIENT MENTHOL

HOW ABOUT

‘MINT’ING

SOME MONEY?

People want their toothpastes, their chocolates, their

detergents and even their medicines to be minty

fresh – menthol has certainly found usage across

product categories and industries, globally. And with

India consolidating its leadership position in menthol

exports, as well as several menthol-based products,

many exporters are now making a shift towards this

minty material.

BY ANISHAA KUMAR

T

he ancient Greeks believed

that the nymph Minthe was

Hades’ lover. They used

leaves of the mint plant to

perform the last rites of their dead. An

aroma that can even overpower death

is quite something. In fact, people have

never quite gotten over the novelty of

menthol. Today, it is ubiquitous – it is in

our pastes, creams, powders, cupcakes...

well, the list goes on. Derived from the

plant Mentha Arvenis, menthol, is find-

ing ‘f(l)avour’ the world over. Currently,

India contributes to about 33% of the

world’s menthol exports, followed by

China. With its usage across sectors, it is

not surprising to find that going forward

the demand for mint and mint products

is expected to increase 3-5% year-on-

year [International Trade Centre report].

A study by Allied Market Research too

states that the global essential oil market,

of which mint oil forms a large part, is

expected to grow at a CAGR of 8.7% and

become a $11.5-billion market by 2022.

P.GuptaofNewDelhi-basedJDChem

India, a producer of menthol, states that

exporters are attracted towards menthol

because of its many uses – from cosmet-

ics to confectionery to pharmaceuticals.

Its varied uses makes it an attractive

proposition despite menthol exports be-

ing a low-margin business.

Mentha is currently cultivated across

northern India – from Himachal

Pradesh to Haryana, from Uttar Pradesh

to Bihar. According to an Internation-

al Trade Centre report, in CY2015, the

total production of the Mentha Arvensis

crop in India was around 31,000 metric

tonne (MT), which increased to around

35,500 MT in CY2016.

Exports of menthol from India are

currently placed under two different HS

Indian farmers are in desperate need of training and support to increase the yield of the plant

from which natural menthol is extracted.](https://image.slidesharecdn.com/vol5issue1-jan2018-full-issue-singlepages-180212051143/85/January-2018-40-320.jpg)

![SUBSCRIBE

NOW!The Dollar Business magazine

Read this exclusive platform on foreign trade and get an unbeatable edge

in the business of exports-imports. Welcome to globalisation!

1. This is a limited period offer.

2. The Dollar Business and Vimbri Media Pvt. Ltd. will not be held responsible in case of any

postal / courier delay in delivery of any issue of the magazine.

3. The Dollar Business and Vimbri Media Pvt. Ltd. will not be held responsible in case of any

production delay that leads to late delivery of any issue to its subscriber(s).

4. If for any reason, a certain issue of The Dollar Business is not published, the subscription

will automatically be extended by a month.

5. The Dollar Business and Vimbri Media Pvt. Ltd. reserve the right to terminate any

subscription or accept or reject any request for subscription.

6. Disputes, if any, are subject to the exclusive jurisdiction of courts in Hyderabad only.

7. Any change in periodicity of The Dollar Business magazine may apply to existing

subscribers. They will continue receiving the same number of issues they had originally

subscribed to. They duration between issues may however stand duly altered.

8. Any change in the cover price of The Dollar Business magazine will not apply to existing

subscribers. They will continue receiving the same number of issues they had originally

subscribed to.

9. It is the sole responsibility of the subscriber(s) to report delay in delivery of any issue of

the magazine to the subscription department of The Dollar Business within 14 days of the

issue release date.

10. It is the sole responsibility of the subscriber(s) to report non-receipt of any issue of the

magazine to the subscription department of The Dollar Business within 30 days of the issue

release date.

11. Terms and conditions may be altered without notice to the subscribers.

12. For Delivery, Return and Refund Policies, and for more information on Subscriptions,

please log on to www.thedollarbusiness.com

No additional delivery charges apply to India-based subscribers. **Rates exclusive of airmail charges for all international subscribers.

[Applicable annual additional charges: $50 for all international subscribers.] Issues wil be despatched using regular India Post international

mail service. Vimbri Media Pvt. Ltd. is not liable for postal delays. NOTE: All approved subscriptions include both Print & e-Magazine offers.

For subscription-related queries, please write to us at subscription@thedollarbusiness.com or call us on +91 40 67609999. We’d love to hear from you!

You can also write to us at: The Dollar Business, Vimbri Media Pvt. Ltd., Level III & IV, 8-2-542/A, Road No. 7, Banjara Hills, Hyderabad 500 034, Telangana, IN

TERMS & CONDITIONS

SIMPLY ENCLOSE YOUR BUSINESS CARD

OR FILL THE BELOW-MENTIONED FIELDS TO SUBSCRIBE

Mr. Ms. Dr.

Name:

Address:

City:

State: Pin code:

Telephone no.(s):

Email:

Date of Birth (DD/MM/YYYY):

Company: Industry:

Subscription for 1 Year (12 issues) 2 Year (24 issues) 3 Year (36 issues)

INR 1,080 / USD 24** INR 1,920 / USD 43** INR 2,520 / USD 58**

SUBSCRIBE BY LOGGING ON TO

WWW.THEDOLLARBUSINESS.COM AND PAYING ONLINE

(MANDATORY FOR ALL INTERNATIONAL SUBSCRIBERS)

OR FILL THE BELOW-MENTIONED PARTICULARS OF

PAYMENT THROUGH CHEQUE / DD MODE

I am enclosing a Cheque / DD No:..................................

dated drawn on.........................................

.........................................................................................

for INR1,080 / INR1,920 / INR2,520

favouring Vimbri Media Pvt. Ltd. payable at Hyderabad

Add Rs.50 for non-Hyderabad cheques (not required for At Par cheques).

Please write your name and address on the reverse of the cheque/DD.

Do not send cash. Please send the filled form to:

The Dollar Business, Vimbri Media Pvt. Ltd., Level III & IV, 8-2-542/A,

Road No. 7, Banjara Hills, Hyderabad 500 034, Telangana, IN

SUBSCRIPTION REQUESTS CAN BE PLACED BY LOGGING ON TO WWW.THEDOLLARBUSINESS.COM, FILLING-IN NECESSARY DETAILS IN THE APPLICATION FORM GIVEN AND

MAKING PAYMENTS USING CREDIT CARDS/ DEBIT CARDS OR VIA NET BANKING

Print version INR USD

No. of Issues 12 24 36 12 24 36

Cover Price 1,200 2,400 3,600 24 48 72

e-Magazine INR USD

No. of Issues 12 24 36 12 24 36

Cover Price 1,200 2,400 3,600 24 48 72

Total Price 2,400 4,800 7,200 48 96 144

Discount 55% 60% 65% 50% 55% 60%

You pay 1,080 1,920 2,520 24** 43** 58**

SPECIALOFFER!GET UP TO 65%

DISCOUNT ON

SUBSCRIPTIONS

<<CUTTHEDOTTED

LINE>>

<<CUTTHEDOTTED

LINE>>

To advertise / subscribe, please call us on +91 40 67609999

or write to us directly on reachus@thedollarbusiness.com or log on to www.thedollarbusiness.com

**Rates exclusive of airmail charges for all international subscribers. All international subscribers are requested to add applicable annual additional charges of $50

I WANT TO RECEIVE MY MAGAZINE COPY THROUGH COURIER AND AGREE TO PAY AN ADDITIONAL CHARGE OF INR 360 A YEAR TO COVER FOR THE SERVICEOVER AND

ABOVE THE ABOVEMENTIONED SUBSCRIPTION PRICE (EG. FOR A 1 YR. SUBSCRIPTION, TOTAL CHARGES INCLUSIVE OF COURIER IS INR 1,440)](https://image.slidesharecdn.com/vol5issue1-jan2018-full-issue-singlepages-180212051143/85/January-2018-47-320.jpg)

![JANUARY 2018 II THE DOLLAR BUSINESS 49

TDBFORUM

I want to export live goat / sheep to

Dubai from India. Can you please

advise me on how to go about it?

Is it necessary to have an office set-

up and a trade license in Dubai to

export? [Khurram, Co-owner, Prakash

Agrotech, +91-8130716XXX, khurrami-

mam@gmail.com]

Dear Khurram: While exports of

live goat and sheep to Dubai is al-

lowed from India, there are certain

procedures that need to be followed

for the same. The first step of course

will be to obtain an Importer Export-

er Code (IEC). This can be obtained

from the Directorate General of For-

You can log on to www.thedollarbusiness.com/tdb-forum and submit your foreign trade-related queries, or write across to our experts at

editorial@thedollarbusiness.com. Every question matters – to your business, to The Dollar Business.

I want to export charcoal. What are

the countries that buy acacia wood

charcoal? (Rajesh, Rajesh Enterprise,

rajeshlakhani675@gmail.com)

Dear Rajesh: We assume you are in-

terested in exporting wood charcoal

falling under HS Code: 44029090.

Industry data reveals that India is

not a big exporter of wood charcoal

falling under the said HS Code. In

fact, India ranks 26th in the world

when it comes to exports of wood

charcoal and accounts for just 0.81%

share in global exports of the prod-

uct. India’s only significant export

destination for the product falling

under the said HS Code is Bhutan

(the country accounts for about 96%

of India’s total exports of the prod-

uct), though the country is also ex-

porting the product to Netherlands,

Czech Republic and Sri Lanka in

small quantities. Further, sadly, In-

dia’s exports under the HS Code:

44029090 has only been falling over

the last few years. More of such pure,

researched data is available to TDB

license holders. (You can read more

on https://www.thedollarbusiness.

com/memberships).

eign Trade. The Dollar Business will

be happy to help you in acquiring

the IEC. Further, for exporting live-

stock to Dubai, one needs to fulfill

the livestock health requirements of

the Emirate of Dubai and furnish

self-certified copies of health record,

including vaccination record, of

the animal. An Export Quarantine

Certificate will be issued by the An-

imal Quarantine and Certification

System of the Government of India

after physical examination/quaran-

tine observation of the animal 2-3

days prior to the shipment date. If

required, the animal may be referred

for detailed clinical examination in-

cluding testing. If the animal is not

healthy/fit, certificate is not issued.

The animal may be subject to testing

at the entry point in Dubai.

Coming to the second part of

your question, you don’t need an

office or license in Dubai to export

from India, however the buyer will

need a license to import into Dubai.

Response by:

Steven Philip Warner

President (VMPL)

& Editor-in-Chief,

The Dollar Business

I want to export surgical products

and sports goods from India. I al-

ready have an Importer Exporter

Code (IEC). How do I find overseas

buyers of these products? (Ankit Pra-

japati, Proprietor, Oso Contractor & Sup-

pliers, +91-9634113XXX, ankitk536@

gmail.com)

Dear Ankit: We are happy to hear of

your decision to head into the world

of foreign trade. You can approach

your concerned associations – Phar-

maceuticals Export Promotion

Council (PHARMEXCIL) for phar-

ma products and Sports Goods Ex-

port Promotion Council (SGEPC)

for sports goods – for assistance or

directly reach out to potential buyers

by posting your product informa-

tion on https://www.thedollarbusi-

ness.com/marketplace. From dis-

covering the best markets to source

from or supply to, to overcoming

statutory and procedural challeng-

es with respect to exports-imports

documentation, to identifying the

right logistics partners, Internation-

al Marketplace understands all your

requirements and accordingly con-

nects you with the right market and

partners so that you can make a for-

tune out of foreign trade.

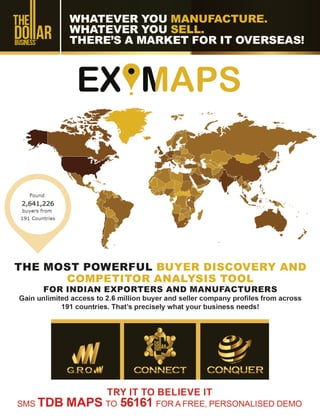

Additionally, you can also explore

The Dollar Business CONQUER

Programme (You can read more on

TDB CONQUER Programme on

https://www.thedollarbusiness.com)

that gives an in-the-making super

successful exporter like you the ac-

cess to TDB EXIMAPS (https://

www.thedollarbusiness.com/ex-

im-maps), the most powerful buyer

discovery and competition analysis

tool for Indian exporters, which en-

sures you touch newer highs in glob-

al trade. In case you have further

queries, do write back to us.

Response by:

Manish K. Pandey

Editor,

The Dollar Business

Is there any export incentive

available under Merchandise Ex-

ports from India Scheme (MEIS)

for Indian Kabuli Chickpeas (HS

Code: 07132000)? (Bharat Parekh,

Director, Tricos Exports Pvt. Ltd., +91-

9820034XXX, tricosexports@gmail.com)

Dear Bharat: Indian Kabuli Chick-

peas (HS Code: 07132000) does not

qualify for MEIS benefit or any other

such benefit under the new Foreign

Trade Policy FY2015-2020.

Response by:

Dr. A. K. Sengupta

Chief Consulting Editor,

The Dollar Business

Response by:

Indranil Das

Executive Editor,

The Dollar Business](https://image.slidesharecdn.com/vol5issue1-jan2018-full-issue-singlepages-180212051143/85/January-2018-49-320.jpg)