CPG Exhibit 1 of 1

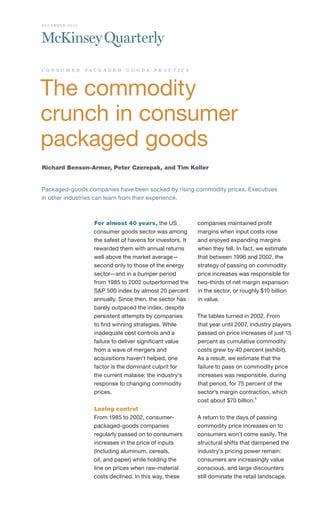

- 1. D EC EM B ER 2010 c o n s u m e r pa c k a g e d g o o d s p r a c t i c e The commodity crunch in consumer packaged goods Richard Benson-Armer, Peter Czerepak, and Tim Koller Packaged-goods companies have been socked by rising commodity prices. Executives in other industries can learn from their experience. For almost 40 years, the US companies maintained profit consumer goods sector was among margins when input costs rose the safest of havens for investors. It and enjoyed expanding margins rewarded them with annual returns when they fell. In fact, we estimate well above the market average— that between 1996 and 2002, the second only to those of the energy strategy of passing on commodity sector—and in a bumper period price increases was responsible for from 1985 to 2002 outperformed the two-thirds of net margin expansion S&P 500 index by almost 20 percent in the sector, or roughly $10 billion annually. Since then, the sector has in value. barely outpaced the index, despite persistent attempts by companies The tables turned in 2002. From to find winning strategies. While that year until 2007, industry players inadequate cost controls and a passed on price increases of just 15 failure to deliver significant value percent as cumulative commodity from a wave of mergers and costs grew by 40 percent (exhibit). acquisitions haven’t helped, one As a result, we estimate that the factor is the dominant culprit for failure to pass on commodity price the current malaise: the industry’s increases was responsible, during response to changing commodity that period, for 75 percent of the prices. sector’s margin contraction, which cost about $70 billion.1 Losing control From 1985 to 2002, consumer- A return to the days of passing packaged-goods companies commodity price increases on to regularly passed on to consumers consumers won’t come easily. The increases in the price of inputs structural shifts that dampened the (including aluminum, cereals, industry’s pricing power remain: oil, and paper) while holding the consumers are increasingly value line on prices when raw-material conscious, and large discounters costs declined. In this way, these still dominate the retail landscape.

- 2. 2 The commodity crunch in consumer packaged goods These retailers, using detailed sectors ranging from consumer analysis of data available from electronics to industrial chemicals their point-of-sales systems and to medical devices—currently shopper research, today have a facing an unfavorable and volatile sophisticated understanding of the environment for raw-material costs prices they want and of their ability and pricing. to demand those prices. Regaining the initiative The net result is that the industry Many economists and financial- continues to face downward market forecasters believe that pressure on prices. Some of the continued price volatility amid a solutions aren’t complicated, but general rise in commodity prices they are extremely difficult to is likely as the world economy Q1 2011 implement and probably hold recovers, so companies across CPG lessons for companies—in many sectors may easily destroy Exhibit 1 of 1 Since 2002, industry players in packaged goods have been less able toindustry players price increases tohave been Since 2002, pass on input in packaged goods consumers. less able to pass on input price increases to consumers. Consumer-packaged-goods industry, index: product price index and raw-material price in 1985 = 100 Raw-materials price1 Producer price index 1985–96: companies 1996–99: companies After 1999: companies 2002–07: companies passed on raw-material maintained prices, although increased prices were unable to pass on price increases raw-material prices as raw-material prices raw-material price decreased by ~10% increased increases to consumers 180 170 160 150 140 130 120 110 100 90 0 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 1 Average weighted by sector-specific indexes for raw-material inputs—eg, aluminum, plastics, and raw sugarcane as inputs for soft drinks—and by weight of sector in overall consumer-packaged-goods market. Source: Standard & Poor’s Compustat; US Bureau of Labor Statistics; McKinsey analysis

- 3. The commodity crunch in consumer packaged goods 3 value in the years ahead. Suppose a financially sustainable innovation that in consumer packaged goods, pipeline, for consumers who seek commodity prices increase by about a steady stream of new products 20 percent during the next five years, that satisfy new needs, and for and companies hold prices constant retailers that hope to benefit from in a quest to maintain market share. greater demand for new and existing In that case, up to 4.5 percentage products. points of margin could be lost—or about 33 percent of current earnings 1 Our analysis excludes 2008 and 2009, when before interest, taxes, depreciation, the global recession and dramatic market fluctuations skewed the data. and amortization (EBITDA). Avoiding 2 See Walter L. Baker, Michael V. Marn, and this fate will require iron-willed Craig C. Zawada, “Do you have a long-term pricing resolve, which may be pricing strategy?” mckinseyquarterly.com, October 2010. richly rewarded if the environment turns slightly more favorable. If commodity prices fall by 5 percent Richard Benson-Armer is in the next five years but companies a director in McKinsey’s New hold product prices steady, for Jersey office, Peter Czerepak example, we estimate that industry is an associate principal in the margins will increase by around Boston office, and Tim Koller is a 1 percentage point, and EBITDA will principal in the New York office. jump by 8 percent, reversing the current trend. Copyright © 2011 McKinsey & Company. All rights reserved. We welcome your Conceiving, developing, and comments on this article. Please send them to quarterly_comments@mckinsey.com. marketing category-changing products that consumers crave has long been the lifeblood of leading consumer-packaged-goods companies—and, for that matter, a priority for companies in a great many industries. An important question for all is how to capitalize on the opportunity that such innovations present to reset prices upward across relevant product categories, as P&G managed to do when the company introduced its Swiffer cleaning product.2 Capitalizing on innovations isn’t easy. But in an industry like packaged goods, it’s probably critical for companies that aim for