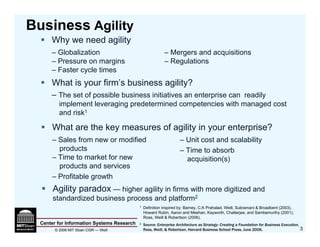

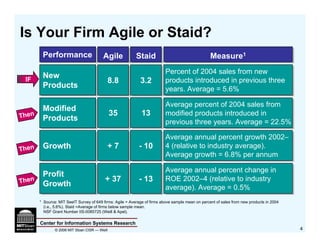

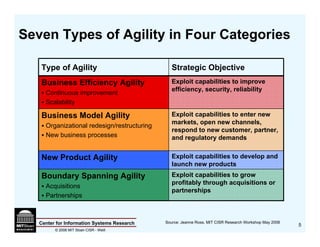

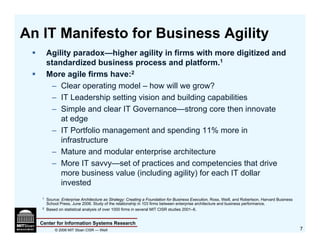

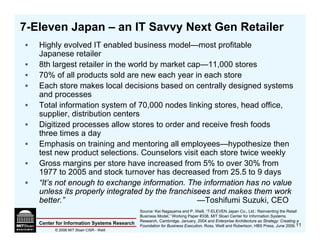

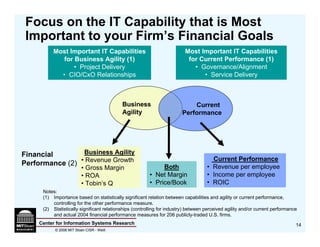

The MIT CIO Summit discusses the concept of business agility and its importance in the modern corporate environment, emphasizing globalization, mergers, and regulatory pressures that require firms to innovate rapidly. Research highlights an 'agility paradox' where firms with more digitized and standardized processes achieve higher agility, supported by effective IT governance and investment strategies. The document also outlines different types of agility and their strategic implications, alongside case studies demonstrating successful implementations.

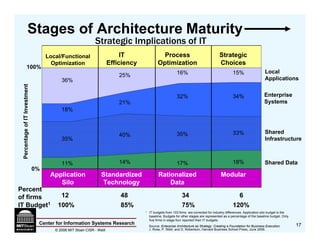

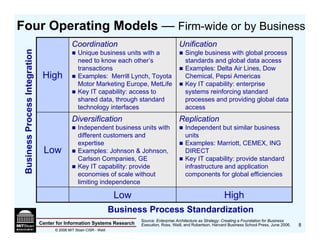

![Different Standardization Requirements

of the Four Operating Models

Coordination Unification

Business Process Integration

Technology Technology

Customer and Product Data Customer and Product Data

[Shared Services] Shared Services

High Core Processes such as

Operations, Customer

Service, Logistics [R&D,

Marketing/Sales]

Diversification Replication

Technology Technology

(Shared Services) Shared Services

Low Core Processes such as

Operations, Customer

Services, Logistics [R&D,

Marketing/Sales]

Low High

Business Process Standardization

Source: Enterprise Architecture as Strategy: Creating a Foundation for Business

Center for Information Systems Research Execution, Ross, Weill, and Robertson, Harvard Business School Press, June 2006.

10

© 2006 MIT Sloan CISR - Weill](https://image.slidesharecdn.com/weillslides-110527094132-phpapp01/85/The-Agility-Paradox-10-320.jpg)

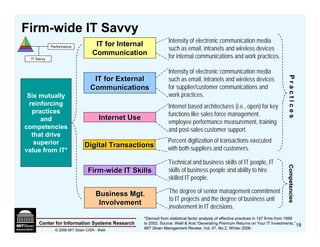

![IT Portfolios of Top Performers

with Different Strategies

Information

Strategic

Business Strategy and Top Performance

Transactional

Average Firm11

Average Firm Cost 22

Cost Balance Cost &

Balance Cost & Agile44

Agile

Infrastructure [n=337]

[n=337] [n=22]

[n=22] Agility33 [n=50]

Agility [n=50] [n=22]

[n=22]

18% 11%

IT Portfolio 17% 11% 17% 11%

15% 10%

Mix of 27%

24%

26% 24%

Investments 44%

46% 48% 51%

$IT compared to Average percent

Average percent 15% more than

15% more than 3% less than

3% less than

industry avg. as % of expenses industry average

Industry average

Industry average industry average

of expenses of expenses industry average industry average

1 All 337 US stock exchange listed firms in the sample of 640 3 Balanced: middle 50% on % of sales from modified products and top 50% on ROIC

2 Cost Focus: top 50% on ROIC and bottom 25% on % of 4 Agile: top 50% on revenue growth and top 25% on % sales from modified products.

sales from modified product.

Source: Analysis by MIT CISR (Weill and Johnson) using IT Investment (2003-5 average) and firm

performance (2003-4 average). IT Data: Collected from 640 firms using MIT CISR framework.

Center for Information Systems Research Performance data from Compustat. NSF Grant Number IIS-0085725 15

© 2006 MIT Sloan CISR - Weill](https://image.slidesharecdn.com/weillslides-110527094132-phpapp01/85/The-Agility-Paradox-15-320.jpg)