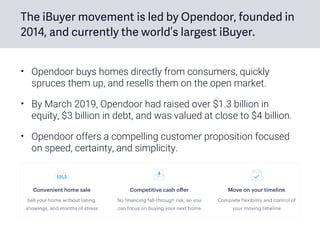

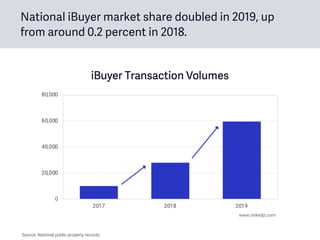

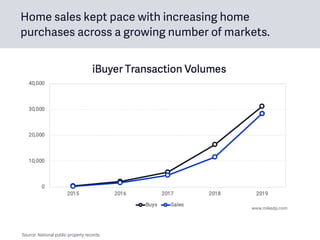

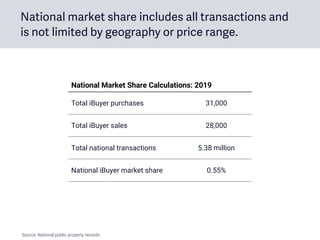

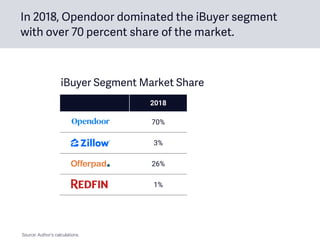

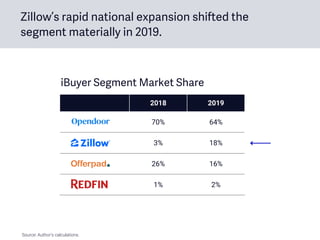

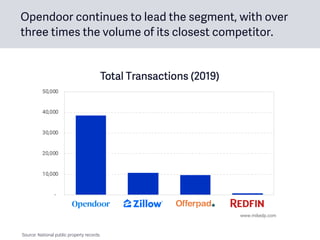

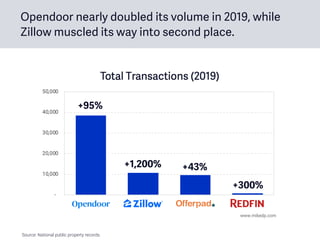

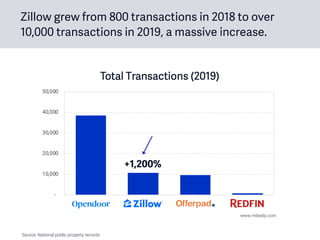

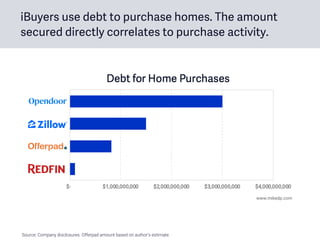

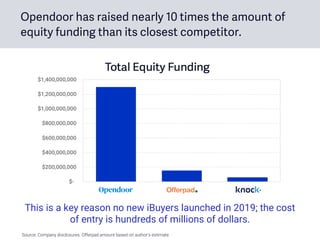

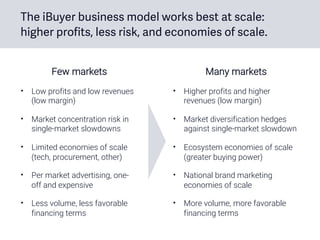

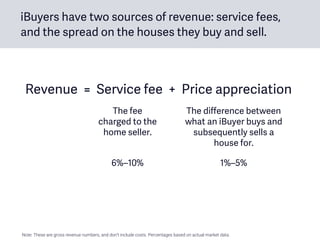

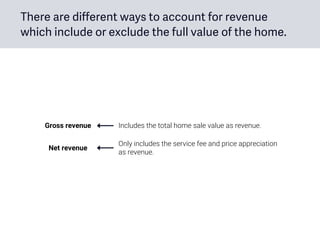

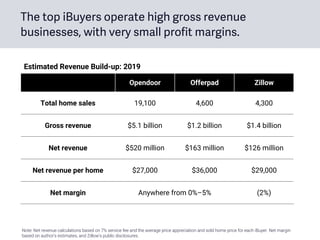

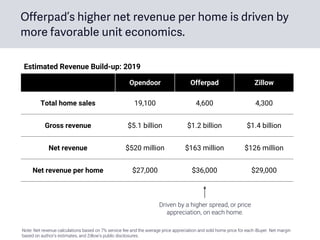

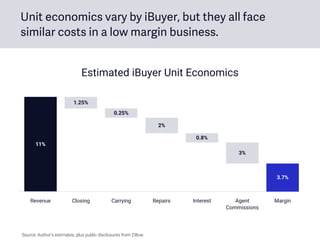

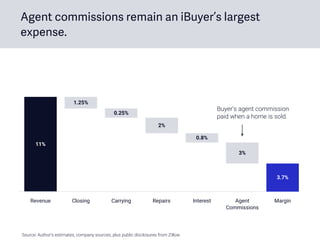

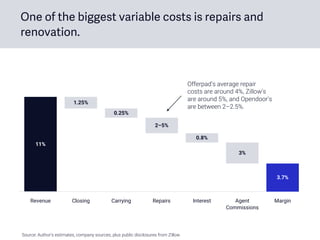

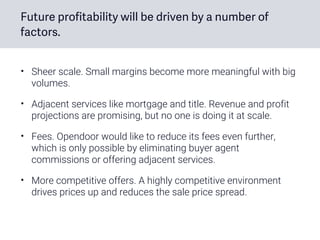

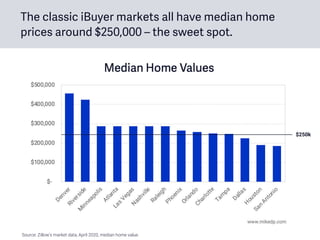

The 2020 iBuyer report highlights the rapid growth and increasing market share of iBuyers, particularly focusing on Opendoor, which dominates the sector. In 2019, iBuyers accounted for nearly 60,000 transactions, with a notable increase in national market share from 0.2% in 2018 to 0.5%. The report discusses the financial dynamics, competitive landscape, and future profitability factors for iBuyers in the evolving real estate market.