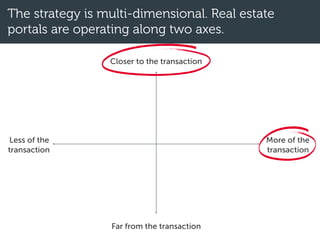

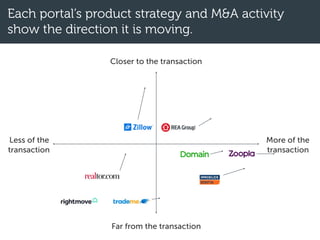

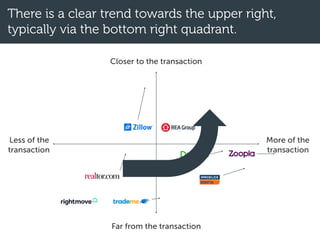

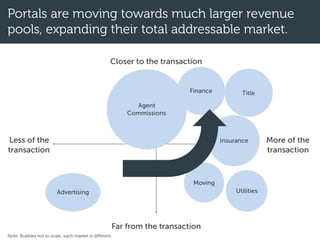

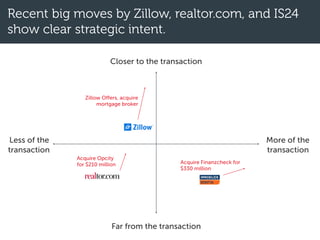

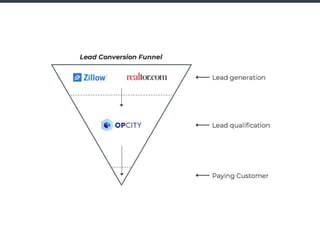

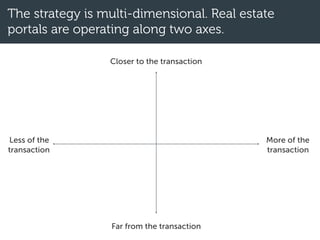

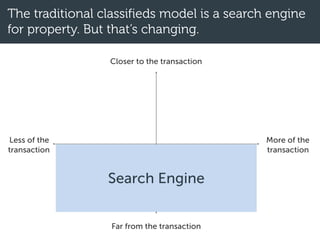

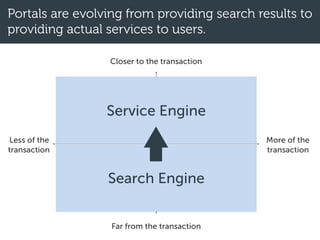

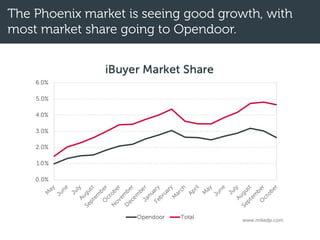

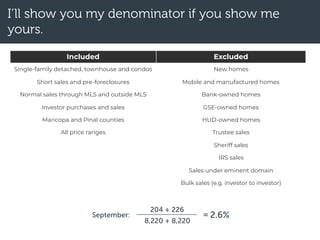

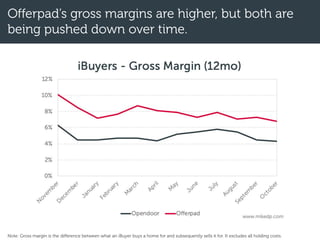

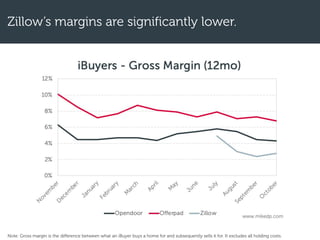

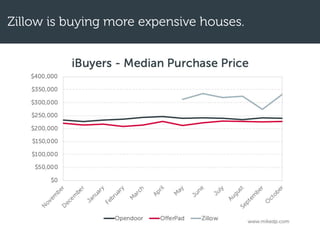

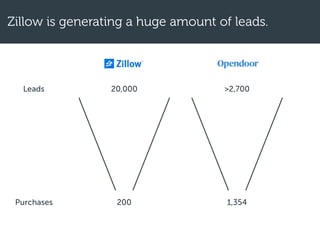

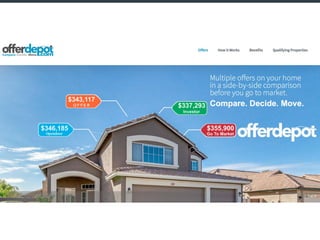

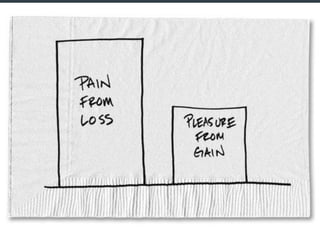

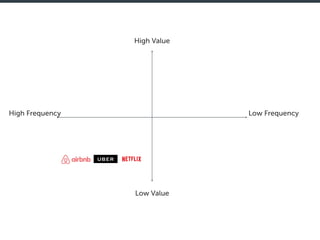

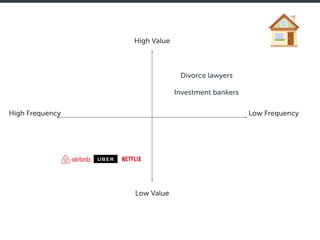

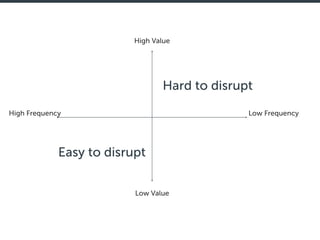

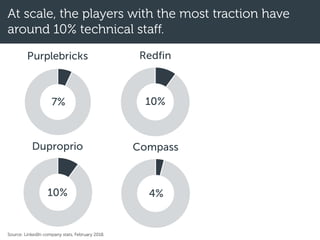

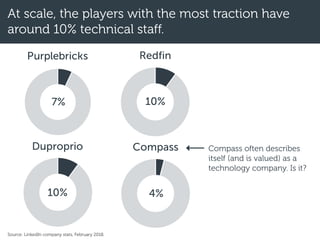

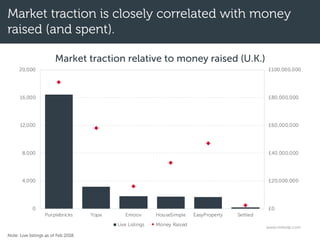

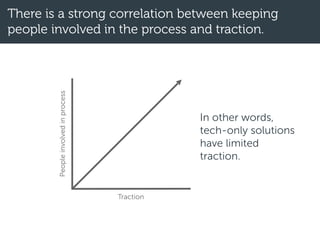

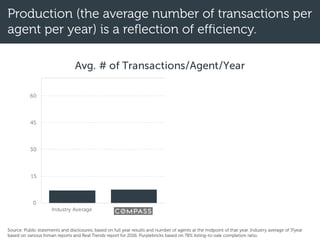

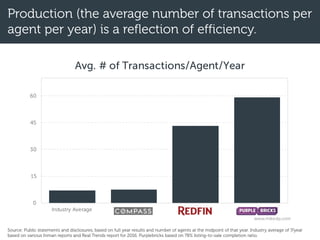

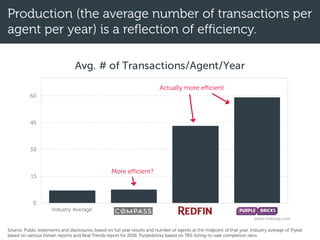

This document summarizes trends in real estate technology. It discusses how real estate portals are evolving from search engines to service engines by moving closer to transactions and taking on more of the transaction process. It provides insights into iBuyers (instant home buyers) and their business models and margins. It also discusses how human psychology is an important factor in real estate that technology must address. The document outlines risks for real estate technology companies, including hubris from raising a lot of funding, not properly addressing human psychology, and claiming to be more efficient without proven results.