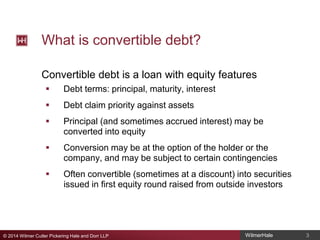

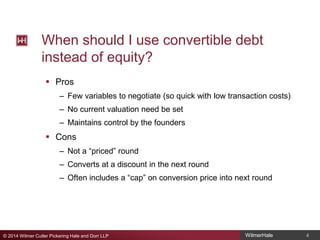

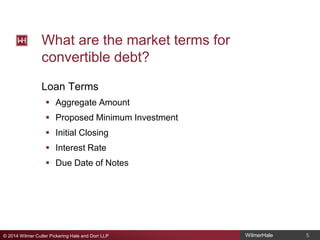

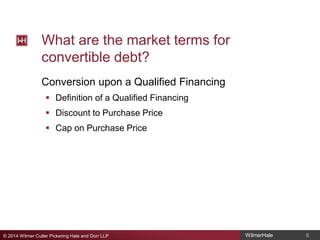

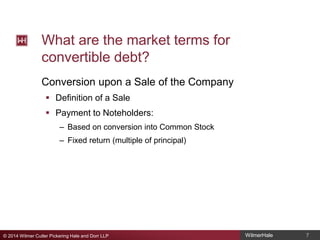

The document discusses convertible debt as a financing option, characterized as a loan with equity features that allows conversion into equity under certain conditions. It outlines when to use convertible debt instead of equity, highlighting its advantages such as lower transaction costs and maintaining founder control, as well as drawbacks like conversion discounts. Additionally, it details market terms for convertible debt, including loan terms, conversion triggers, and repayment structures in various scenarios.