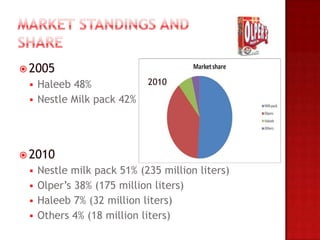

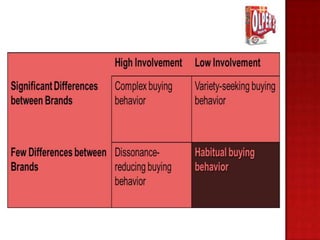

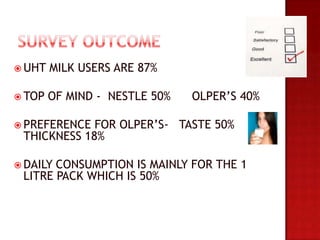

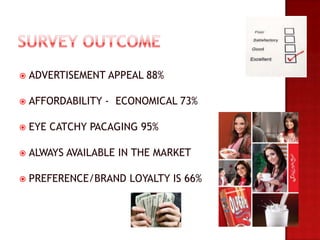

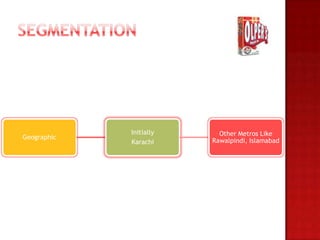

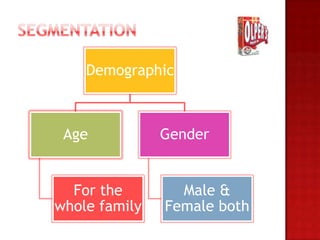

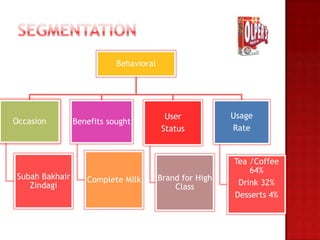

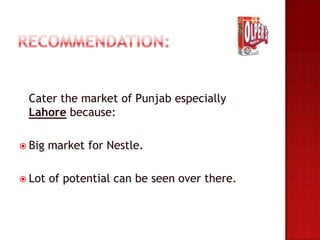

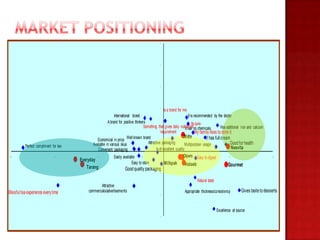

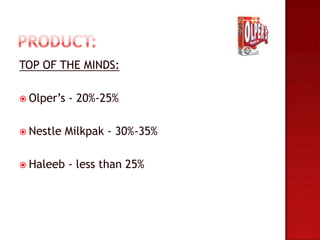

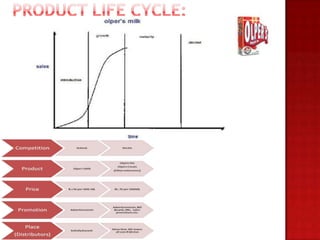

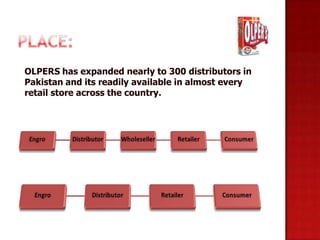

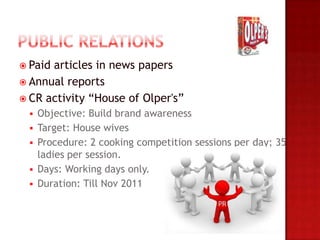

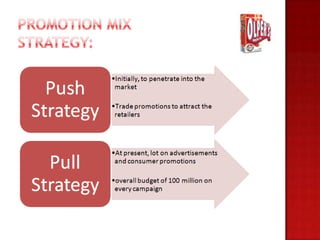

Olper's entered the Pakistani milk market in 2006 when sales of Haleeb were declining. It is now one of the top competitors with a 7% market share. The document discusses Olper's growth strategy, targeting consumers in urban areas aged 25-35. It analyzes Olper's positioning compared to competitors and opportunities to expand its product line and distribution network across Pakistan. Promotional strategies include aggressive advertising campaigns on multiple channels and platforms.