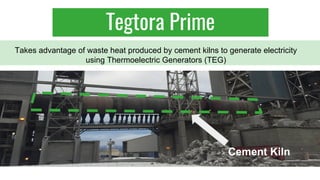

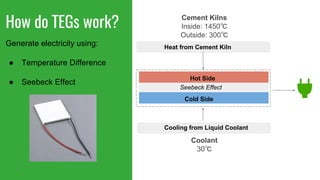

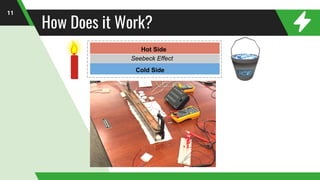

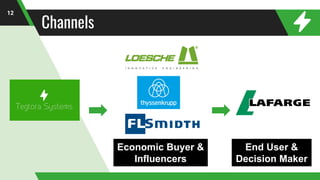

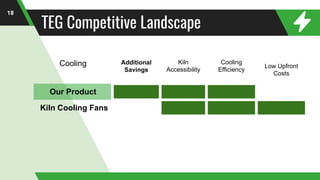

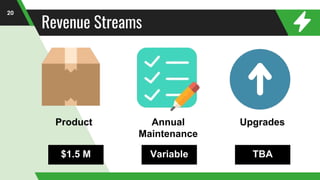

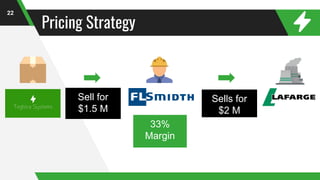

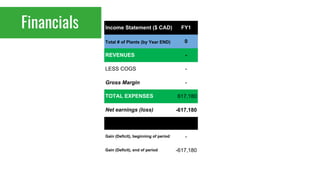

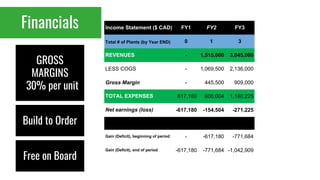

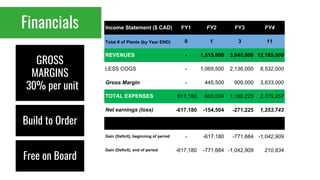

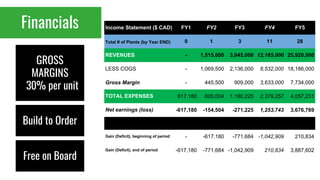

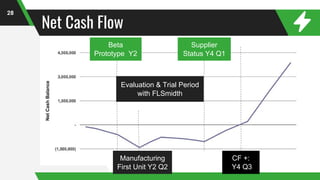

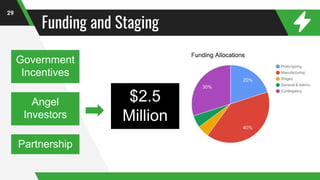

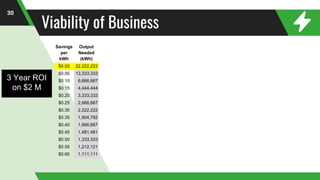

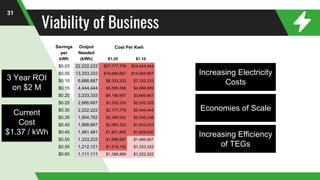

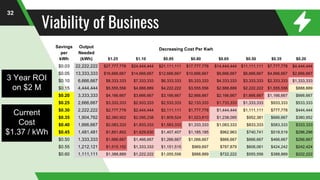

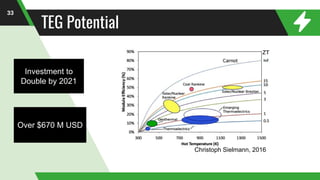

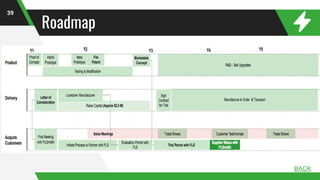

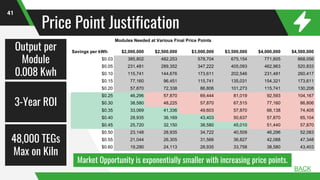

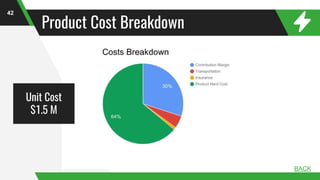

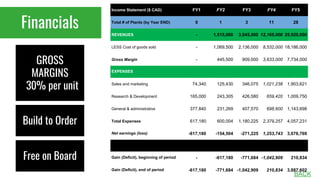

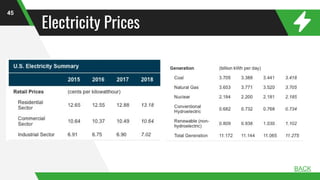

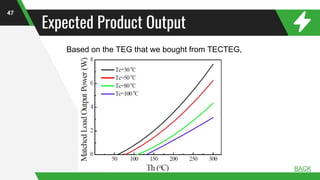

Tegtora Systems provides thermoelectric generator solutions for cement manufacturers to cut costs and implement more sustainable practices. Their product, Tegtora Prime, uses waste heat from cement kilns to generate electricity via thermoelectric generators, replacing cooling fans. It offers savings of $0.20 to $0.45 per kWh and a 3-year return on investment. The company projects installing their technology in 1 plant in year 1, 3 plants by year 3, and 28 plants by year 5, achieving $26 million in annual revenues at a 30% gross margin by then.