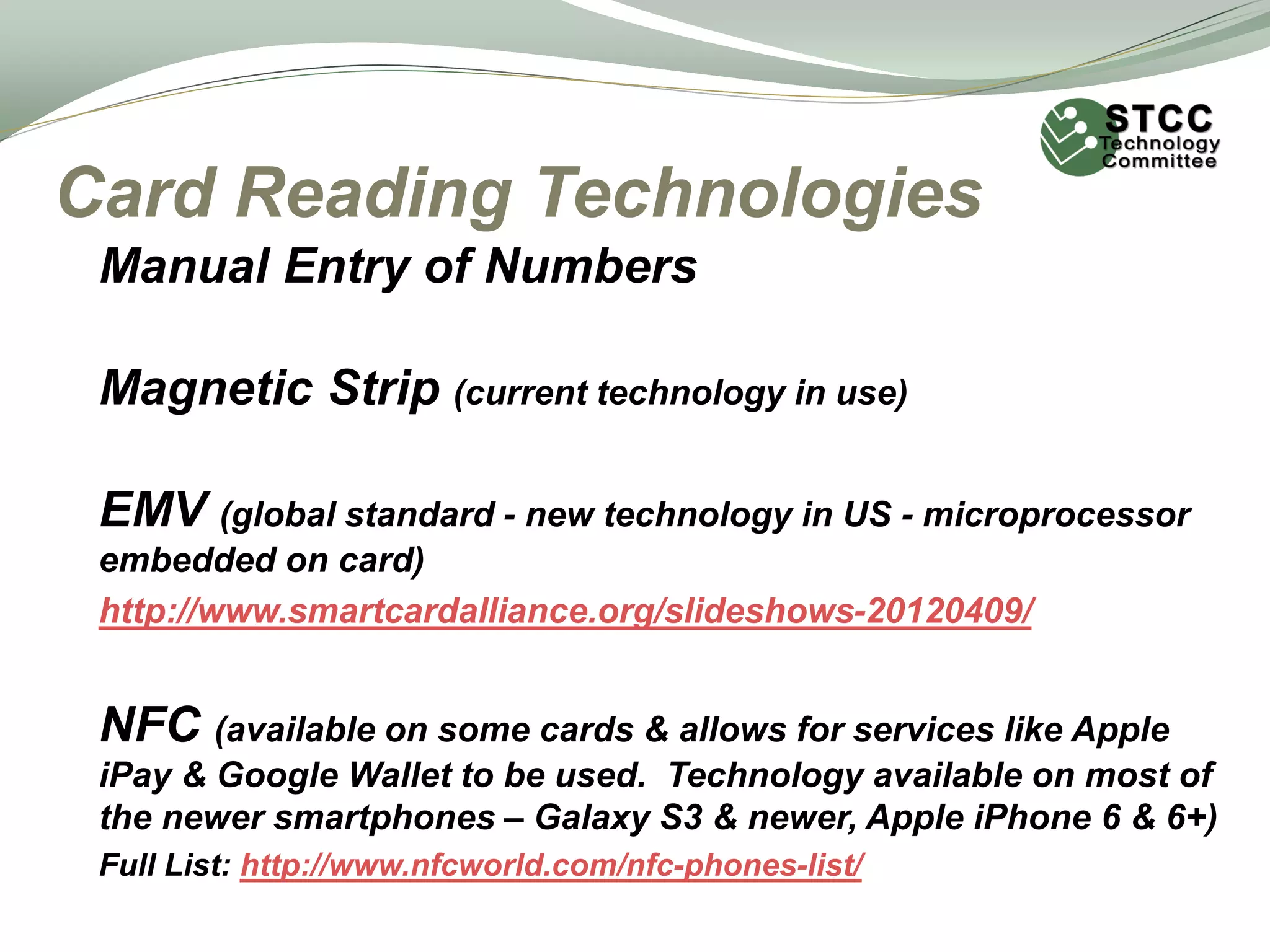

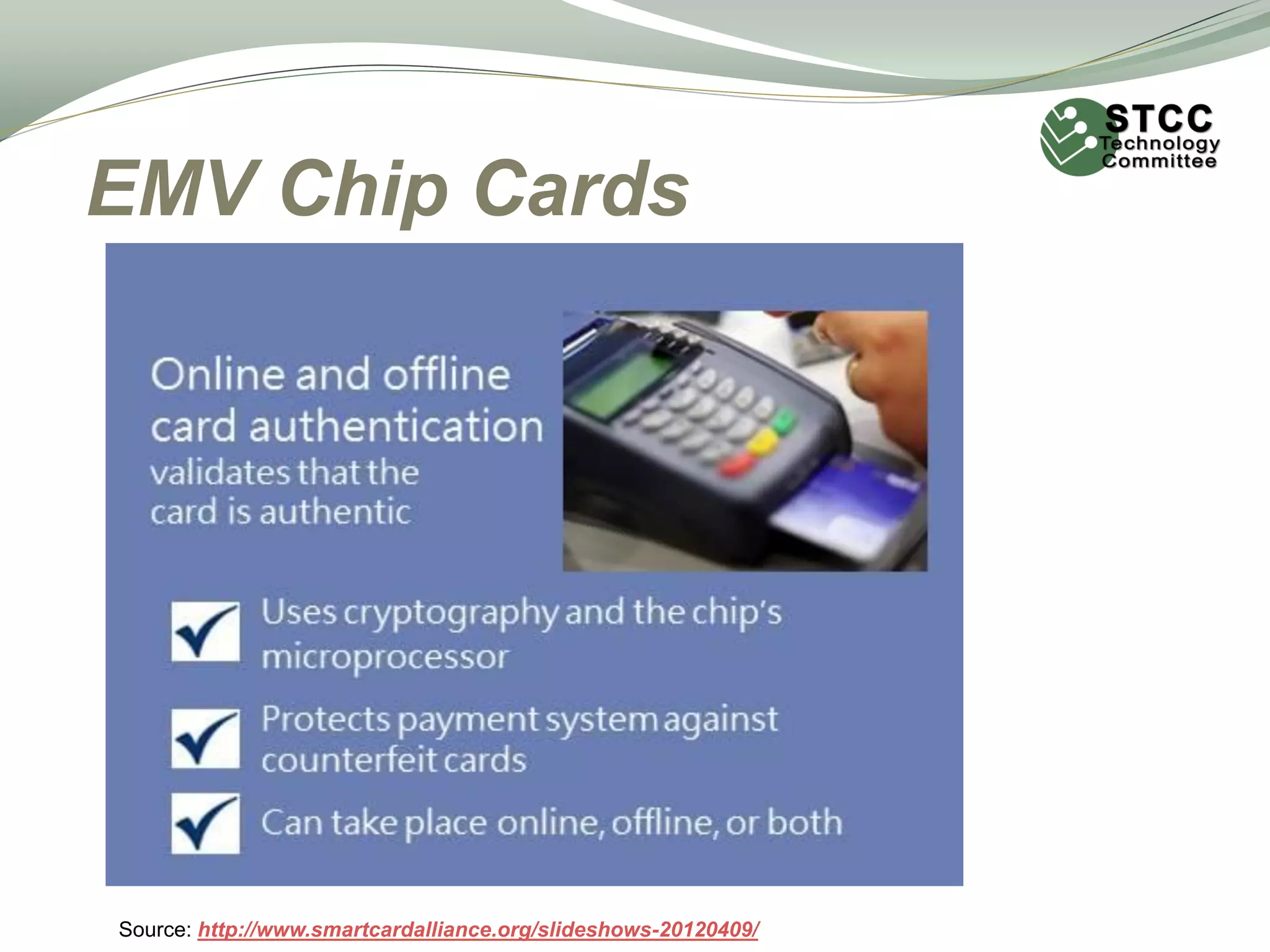

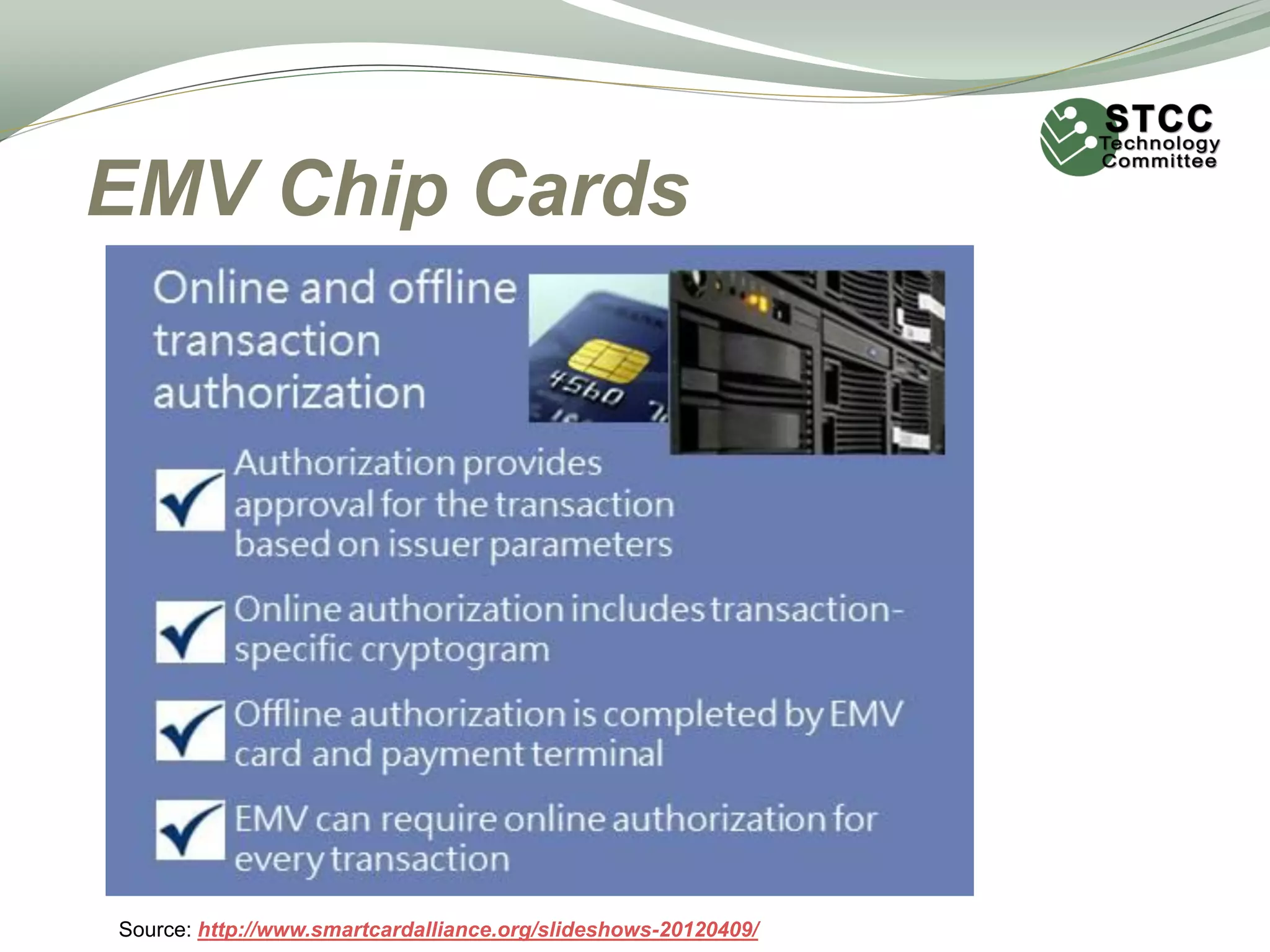

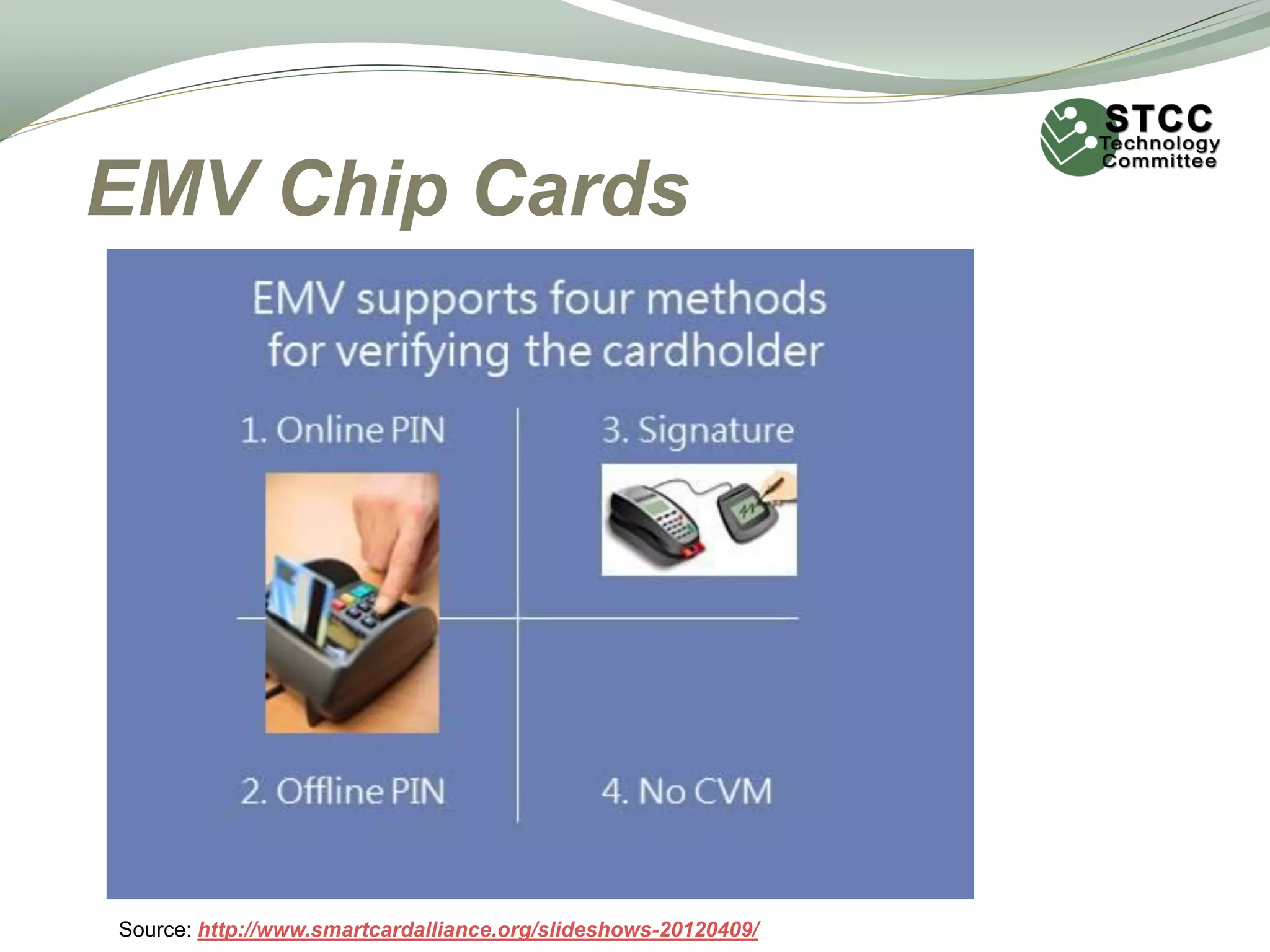

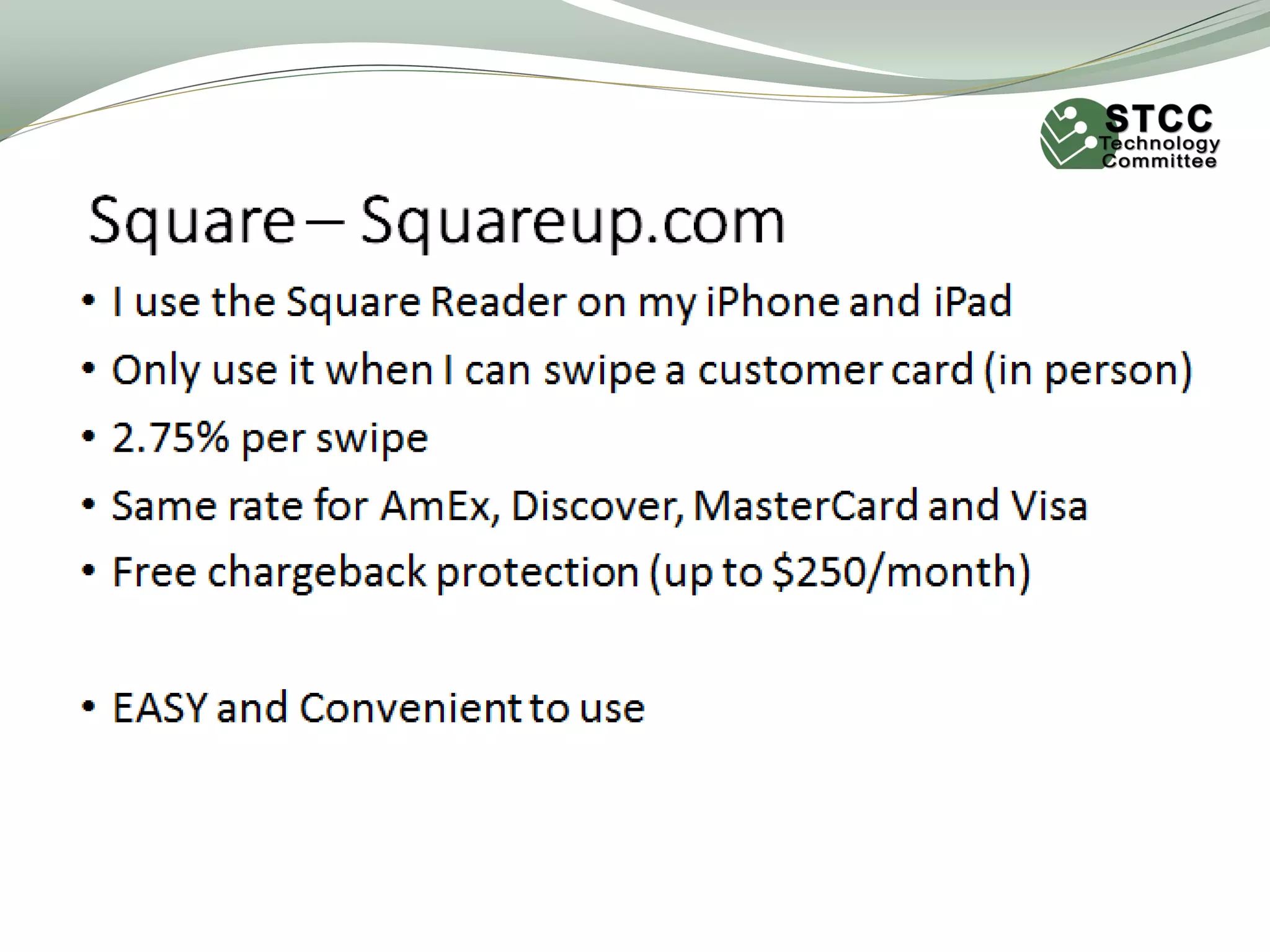

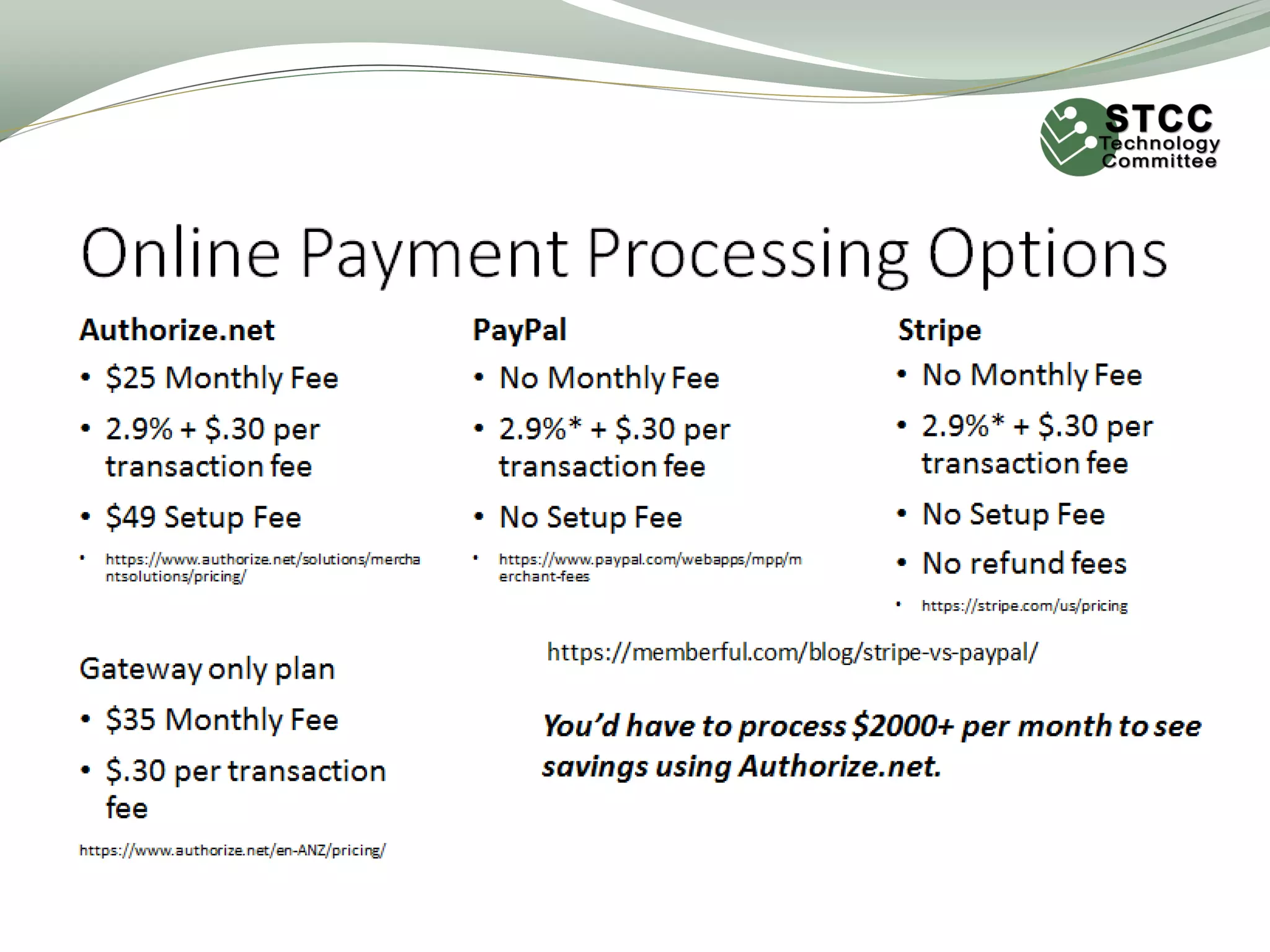

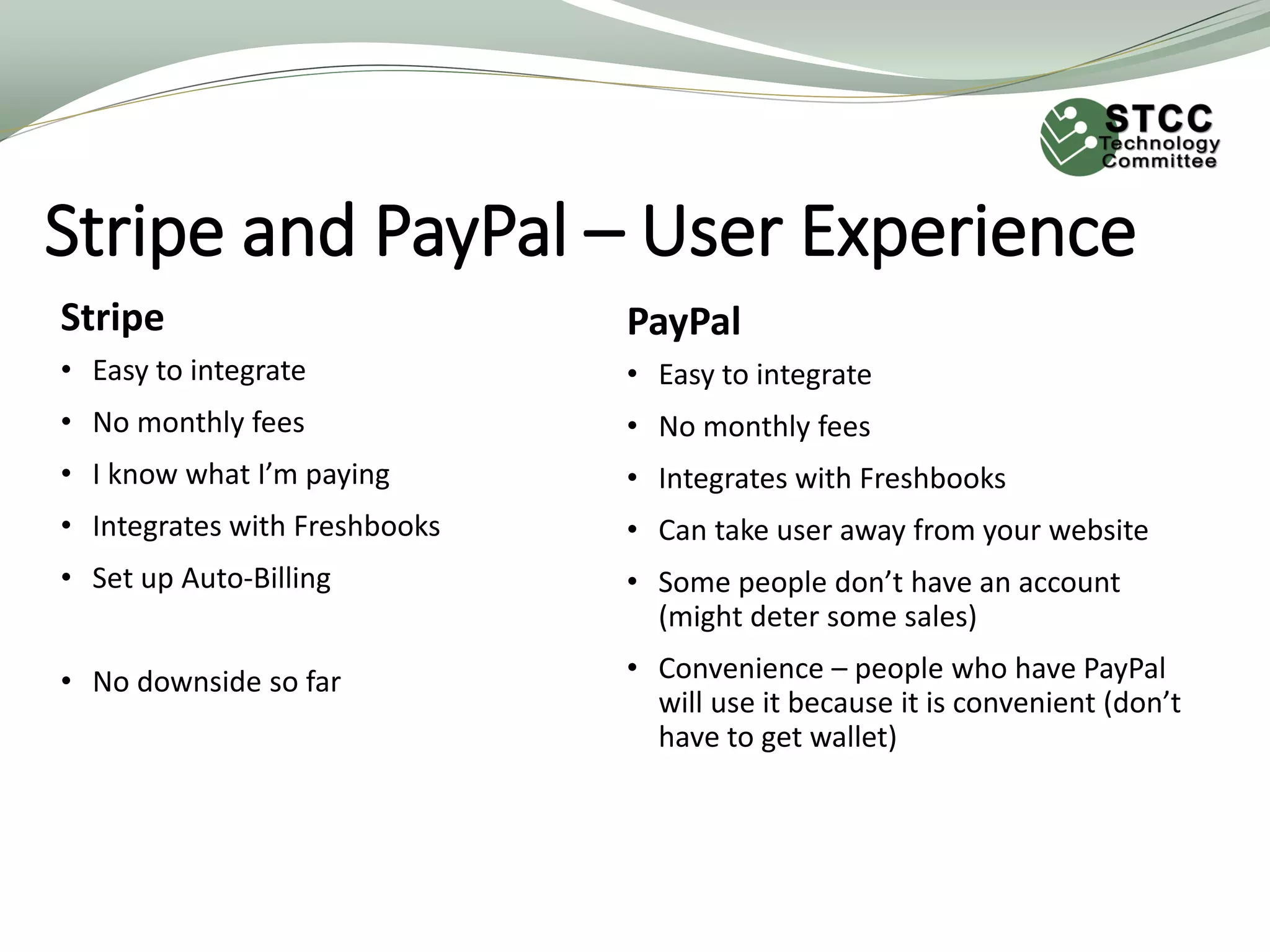

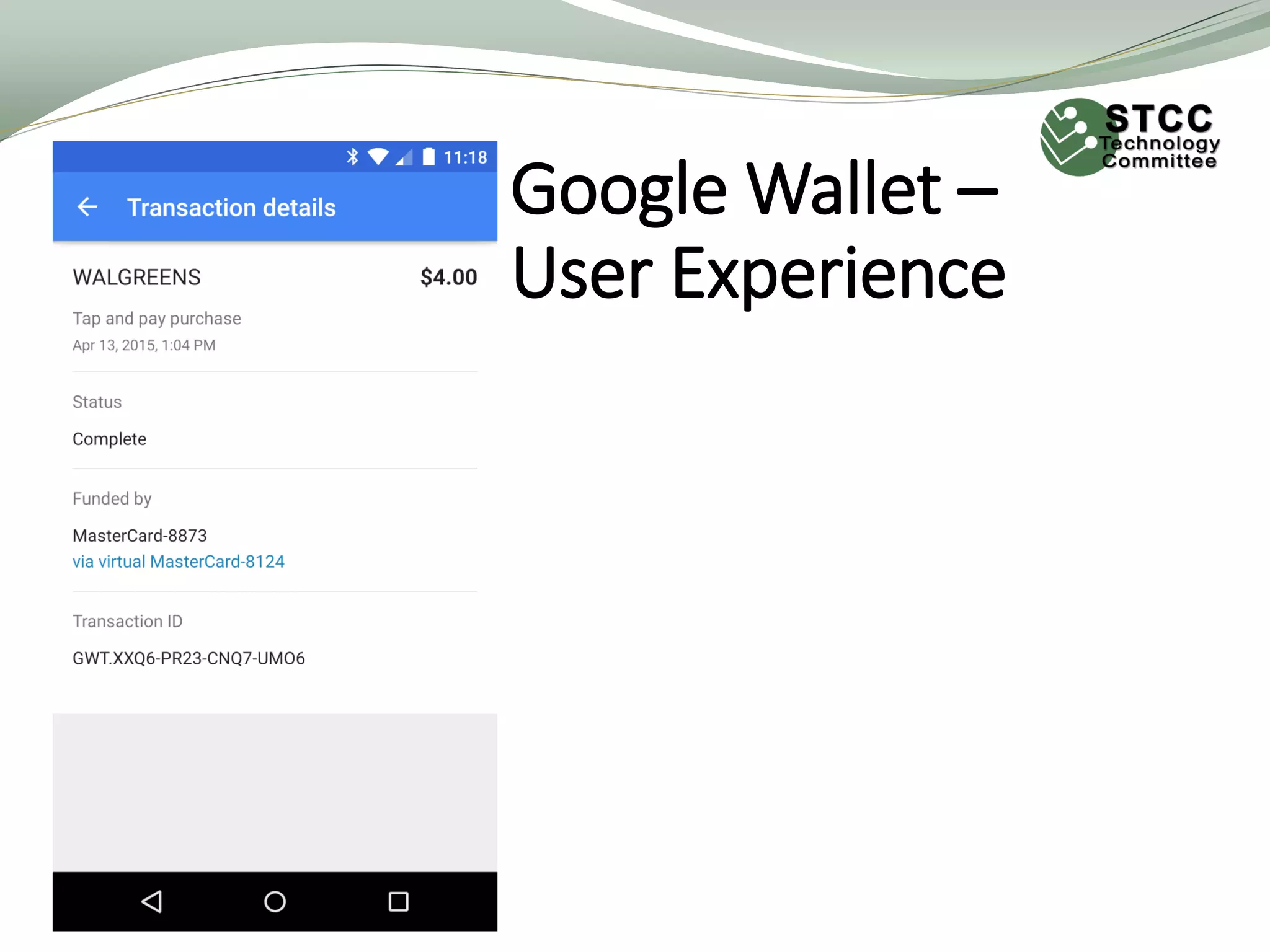

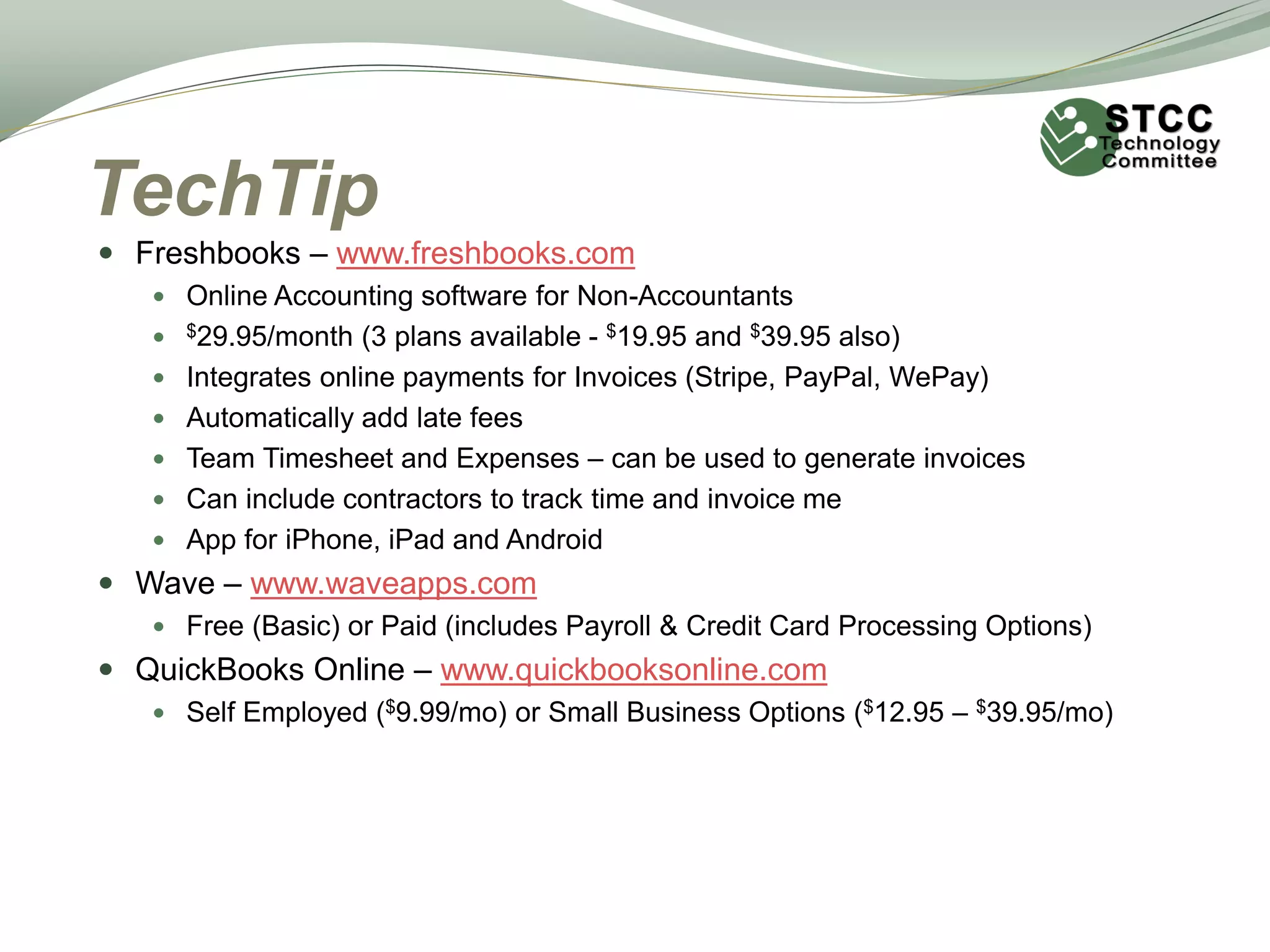

The meeting aims to introduce technological topics relevant to chamber members, highlighting various payment technologies such as EMV chip cards and NFC. Participants are encouraged to engage with subcommittee members for more in-depth discussions and seek technology solutions for their businesses. Upcoming events include topics on streaming services and visual marketing.