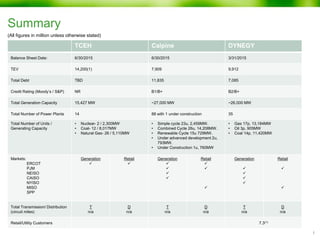

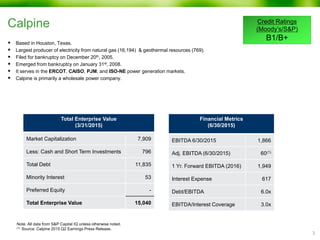

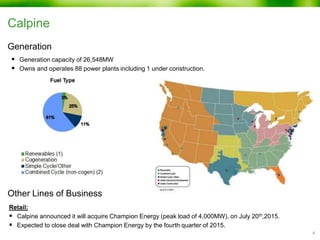

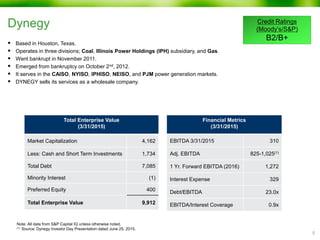

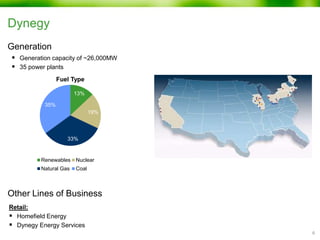

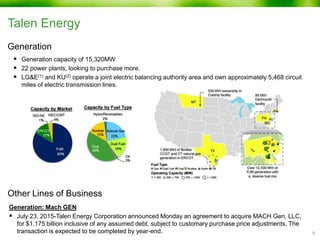

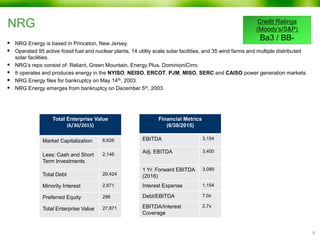

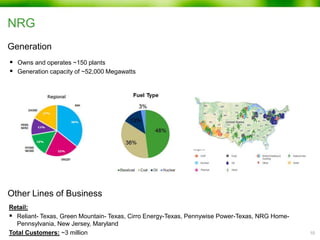

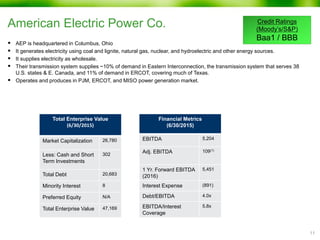

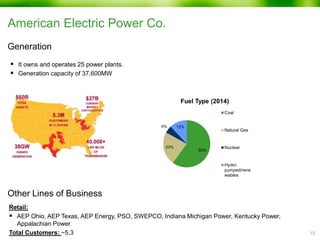

The document provides a comparison of major independent power producers in the US, including Calpine, Dynegy, Talen Energy, NRG, and American Electric Power (AEP). It summarizes key metrics such as total enterprise value, generation capacity, power plant and unit counts, fuel types, market presence, credit ratings, and financial metrics. Calpine has the largest renewable capacity and filed for bankruptcy in 2005. Dynegy emerged from bankruptcy in 2012 and has significant coal assets. Talen Energy acquired Mach Gen in 2015 and owns transmission lines. NRG has a diverse fleet across various fuel types and regions. AEP owns extensive transmission infrastructure.