Embed presentation

Download to read offline

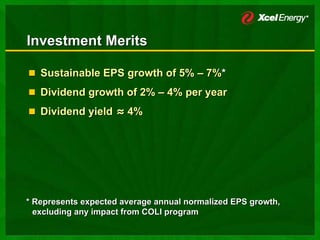

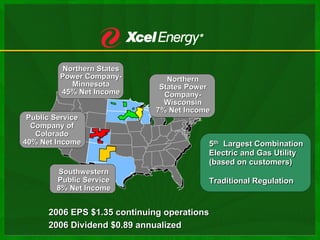

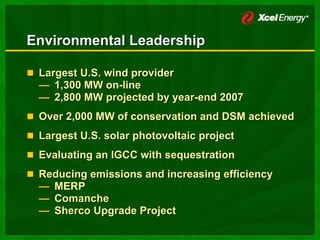

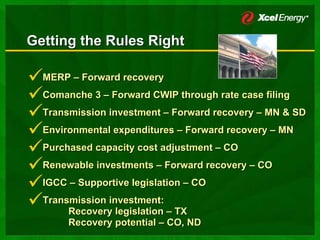

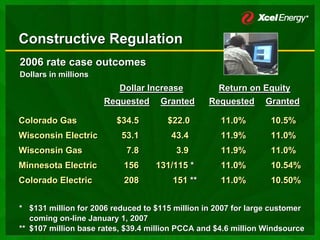

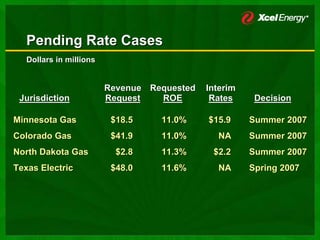

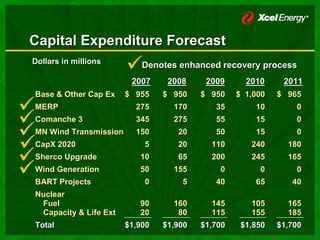

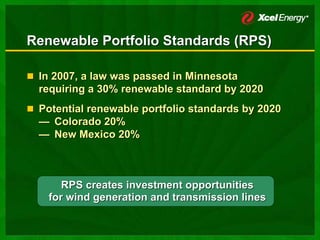

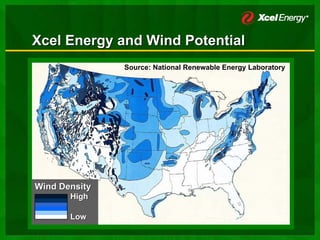

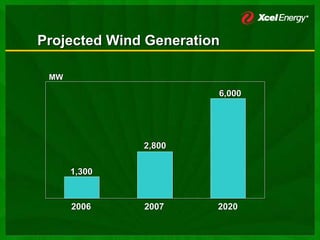

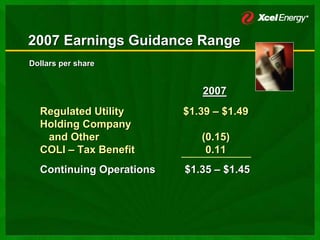

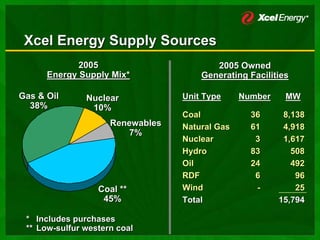

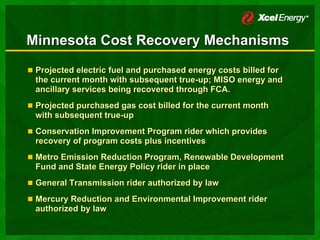

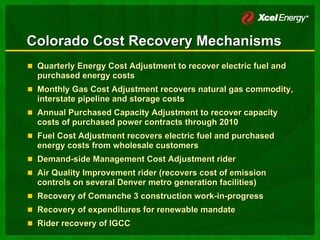

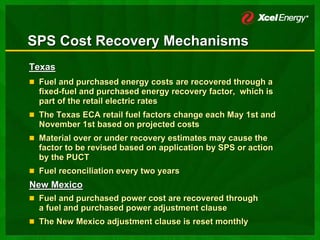

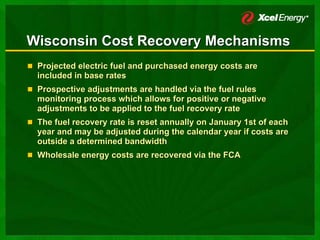

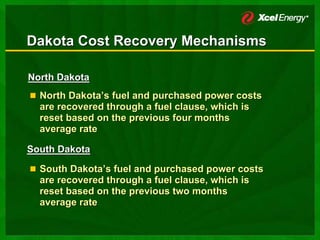

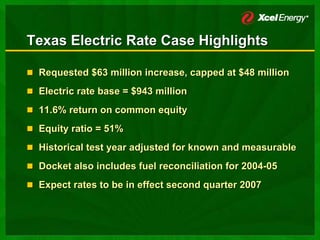

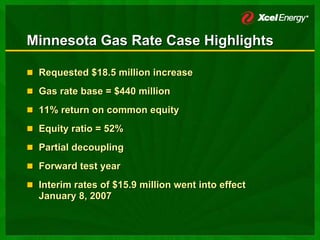

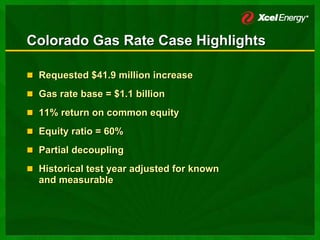

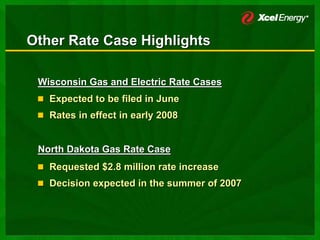

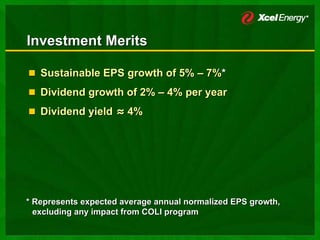

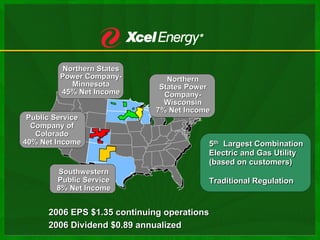

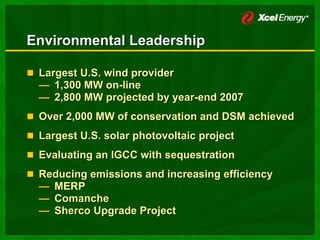

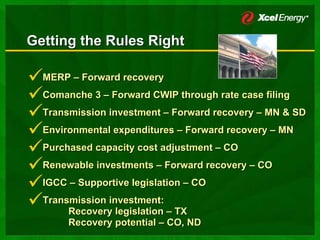

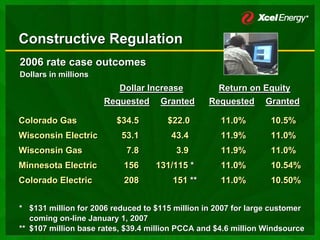

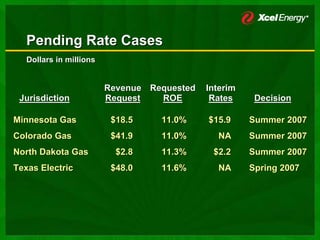

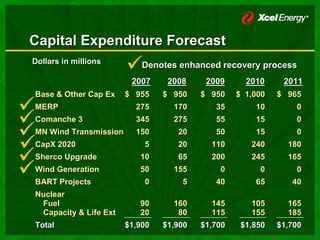

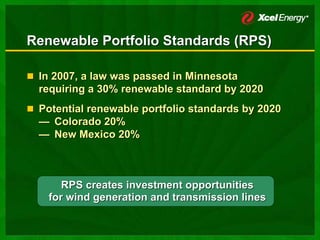

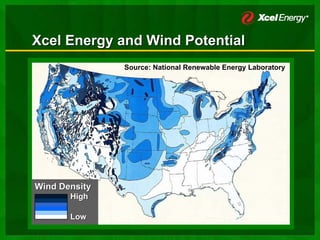

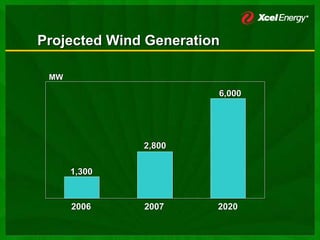

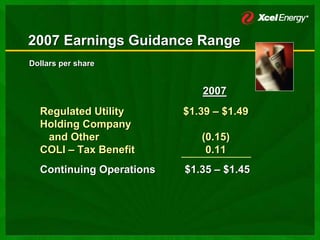

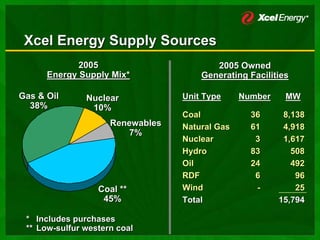

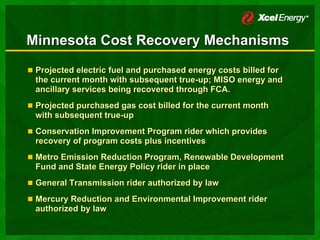

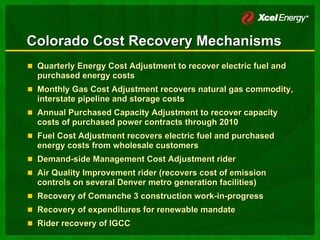

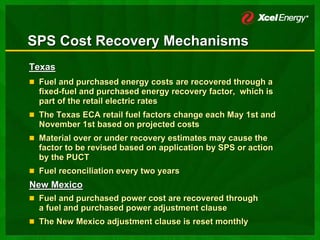

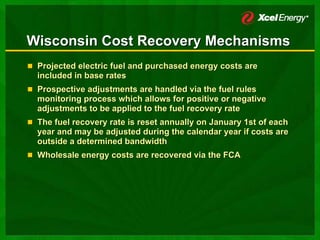

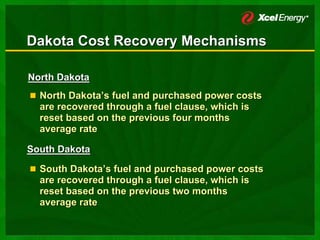

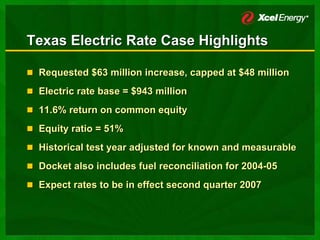

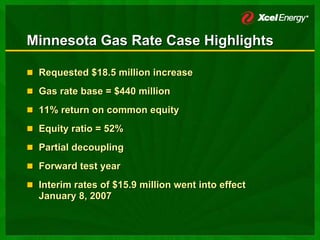

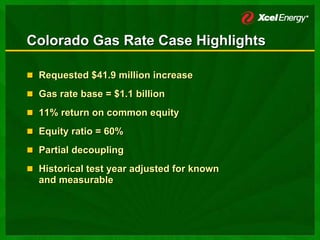

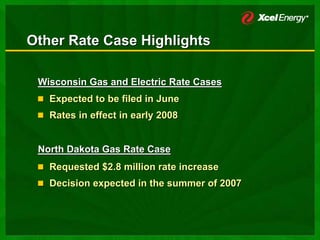

This document summarizes a presentation made by Xcel Energy to investors in March 2007. It discusses Xcel's strategy of investing in regulated utility operations to drive sustainable earnings growth of 5-7% through initiatives like renewable energy, transmission expansion, and environmental upgrades. It also outlines Xcel's constructive regulatory relationships and cost recovery mechanisms across its eight-state service territory.