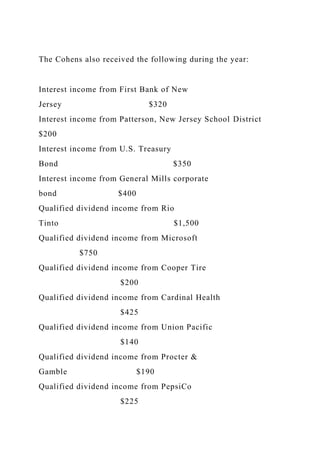

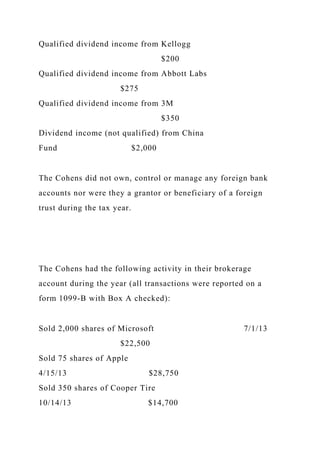

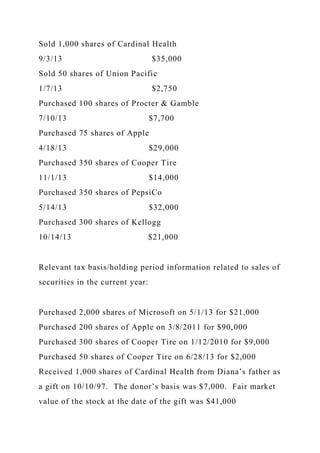

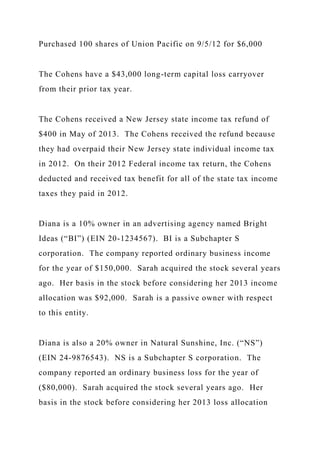

The document provides detailed instructions for completing the federal individual income tax return for Joseph and Diana Cohen for the 2013 tax year, including personal information, income sources, and applicable deductions. Joseph is an employee with specific wages and tax withholdings, while Diana earns consulting revenue and incurs business expenses. The Cohens have dependents and various investment incomes, along with contributions and deductions to be considered for their joint tax filing.