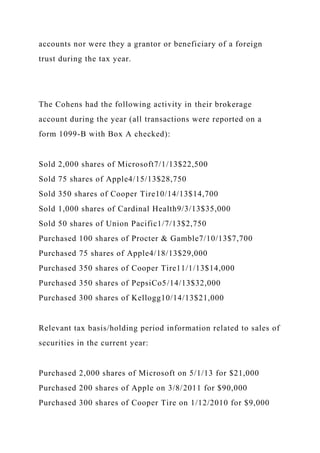

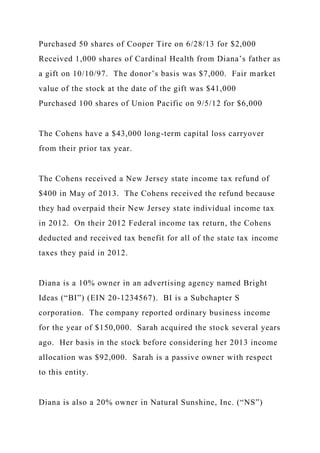

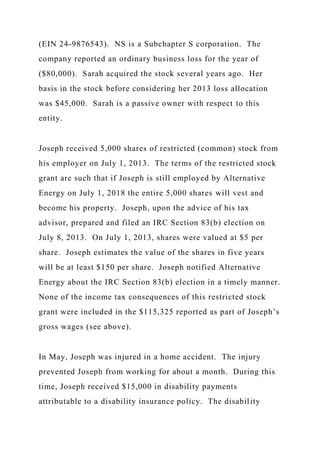

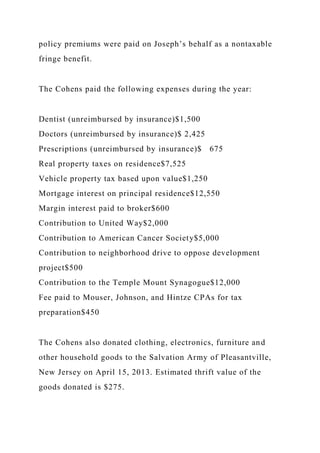

The document provides detailed instructions for completing the 2013 federal individual income tax return for Joseph and Diana Cohen, who reside in Pleasantville, New Jersey, and have three children. It includes their financial details, such as income from Joseph's employment, Diana's consulting business, and various investment incomes, along with a list of deductions and expenses they incurred throughout the year. Additionally, it highlights their contributions, including education expenses for their daughter Rebecca, and indicates their preferences for tax refund method.