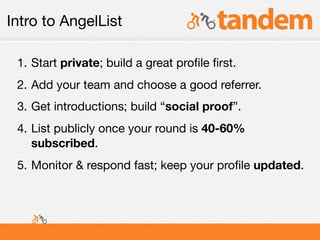

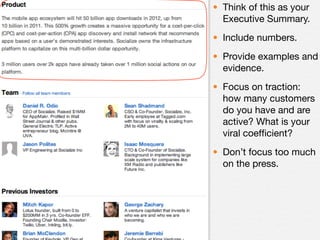

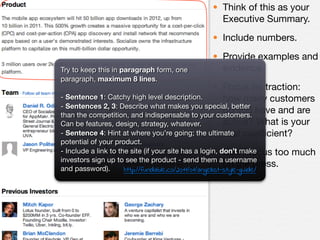

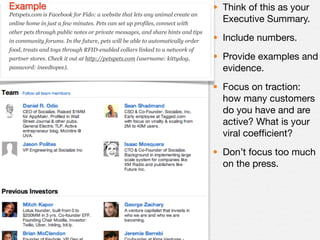

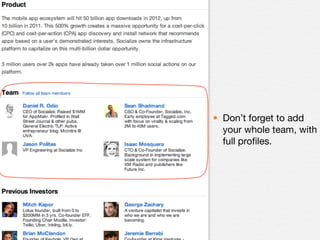

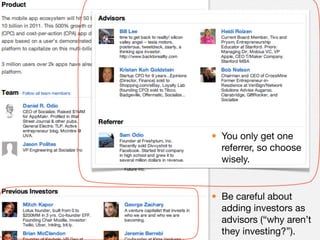

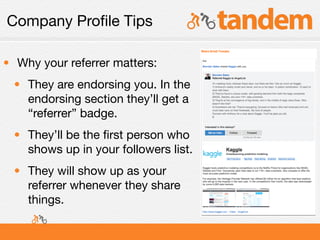

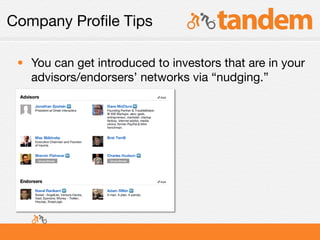

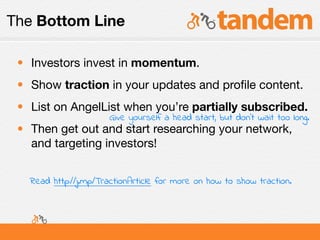

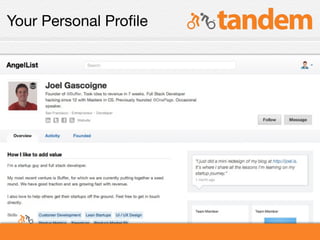

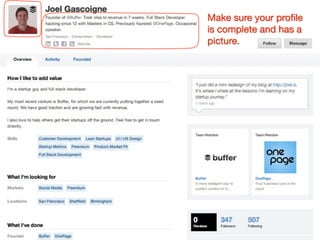

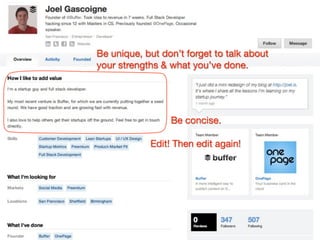

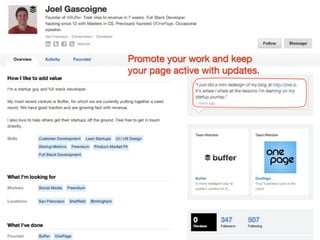

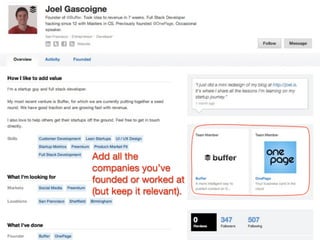

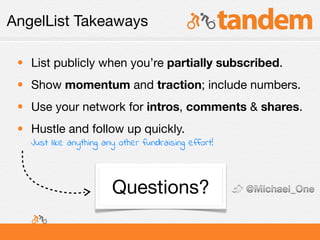

The document provides tips for building a successful profile on AngelList, emphasizing the importance of starting private, showcasing traction, and leveraging social proof. It outlines how to effectively present a company's profile, including adding the team and using a strong referrer, while also highlighting the significance of maintaining an active presence and responding quickly to investors. Ultimately, it stresses that even in an online platform like AngelList, traditional fundraising criteria still apply, such as having a strong team, differentiated product, and demonstrated traction.