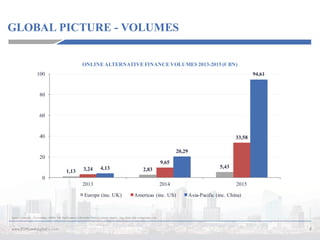

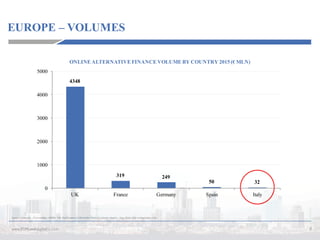

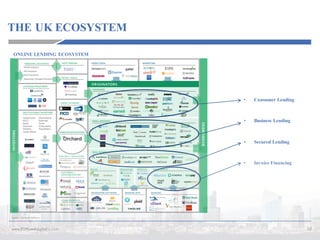

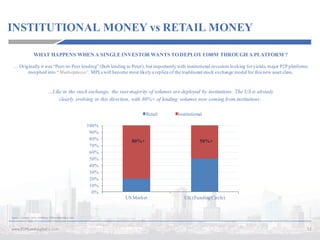

This document discusses the growing trend of peer-to-peer (P2P) lending and why traditional asset managers should be interested. It notes that central banks' policies have negatively impacted income-seeking investors, while benefiting return-seeking investors. As an alternative, it presents P2P lending as a new asset class that offers higher yields than government bonds and has grown significantly in recent years in the UK, US and Europe, though volumes remain low in Italy. It argues that P2P lending platforms are evolving to resemble traditional stock exchanges, with institutions providing the majority of lending volumes. Overall, the document advocates that P2P lending represents a growing global phenomenon that asset managers should consider moving into.

![ALTERNATIVE CREDIT – A NEW ASSET CLASS (i)

5www.P2PLendingItalia.com

Source: Exane BNP Paribas estimates Sept 2016, Deutsche Bundesbank, P2PLendingItalia.com

“If credit were like any other good, one would expect that if prices increase in line with risk there

should still be actors willing to provide it. However [...] even banks with a clear legal mandate to accept

all customers [...] arenot willing to provide credit to this slice of the market.”

Deutsche Bundesbank – Discussion Paper: “How does P2P Lending fit into the consumer credit market?”

Born in the A.C. – After Crisis (i.e. post 2008) – era from the gradual,unstoppable, fragmentation/dissolutionof traditional banking models...

“HOW MUCH CAPITAL IS ENOUGH?” - TOTAL ASSETS / TOTAL EQUITY OF SPANISH BANKS:](https://image.slidesharecdn.com/p2plibocconidef2-161130114424/85/Talk-Bocconi-5-320.jpg)