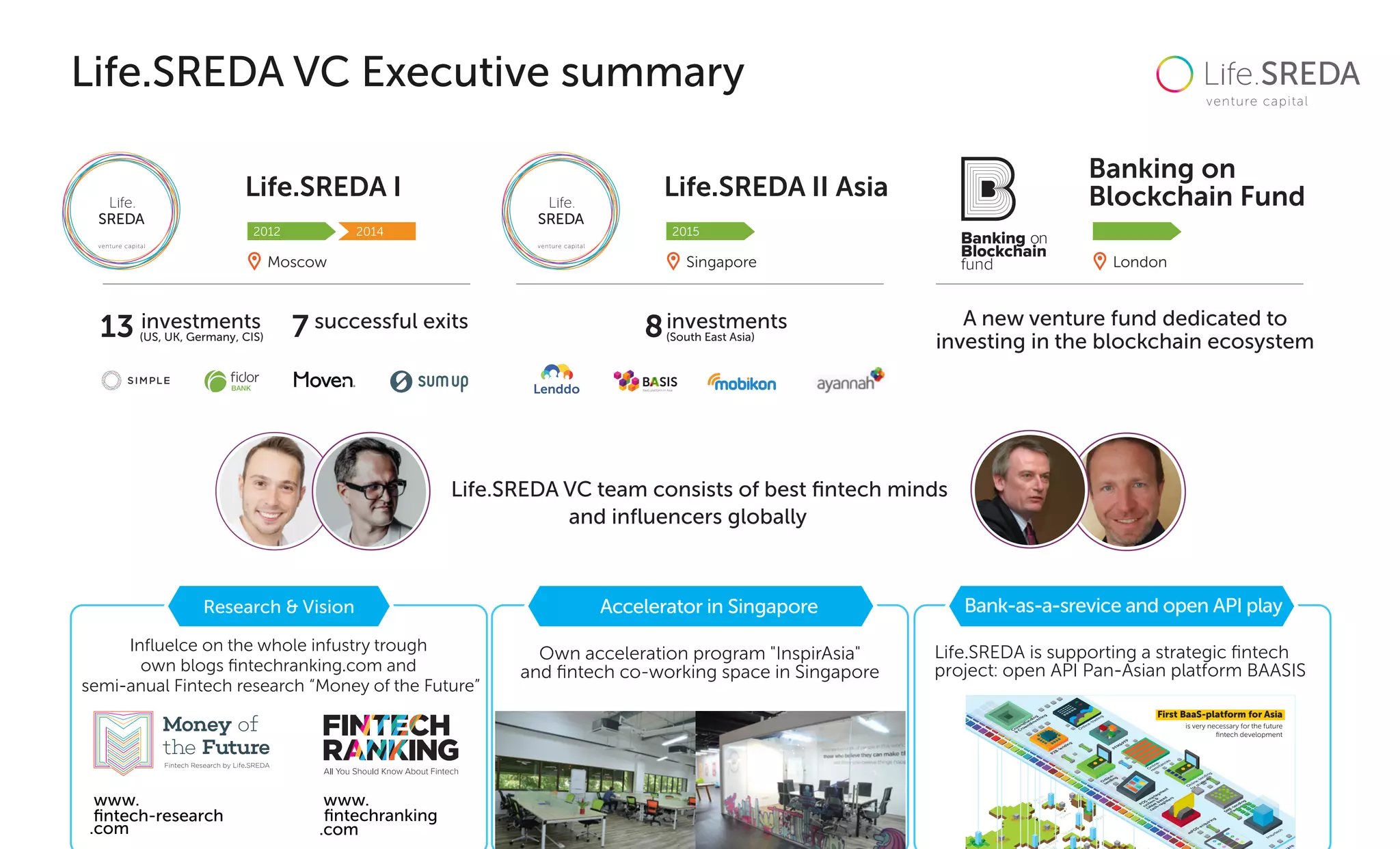

Life.SREDA VC is a venture capital firm that invests in fintech and blockchain startups. It has offices in Moscow, Singapore, and London, and has made 13 investments in Europe, the US, UK, Germany, and CIS since 2012. Life.SREDA also conducts fintech research and publishes an annual report on the state of the fintech industry called "Money of the Future". The summary highlights Life.SREDA's locations, investments, and research activities.

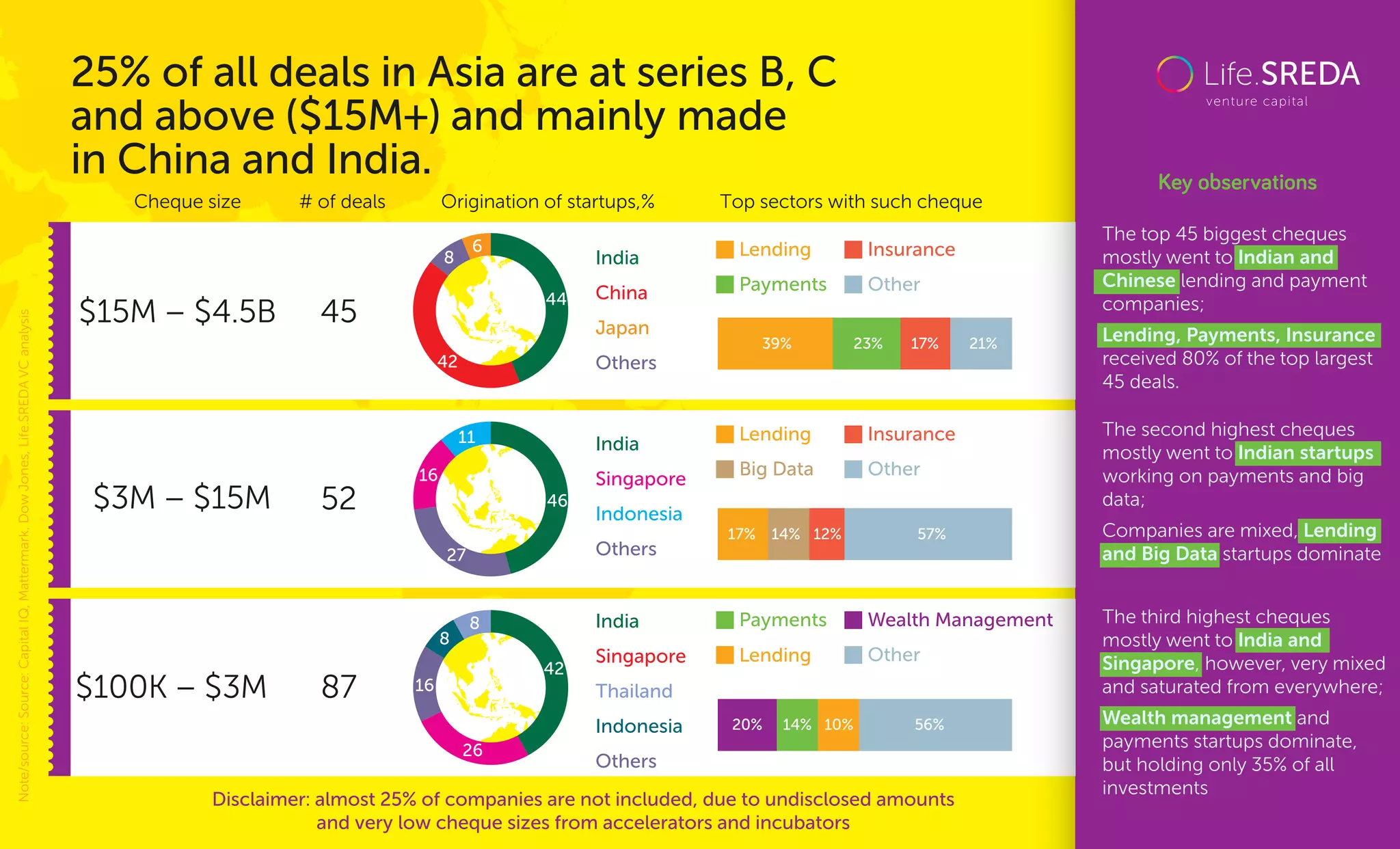

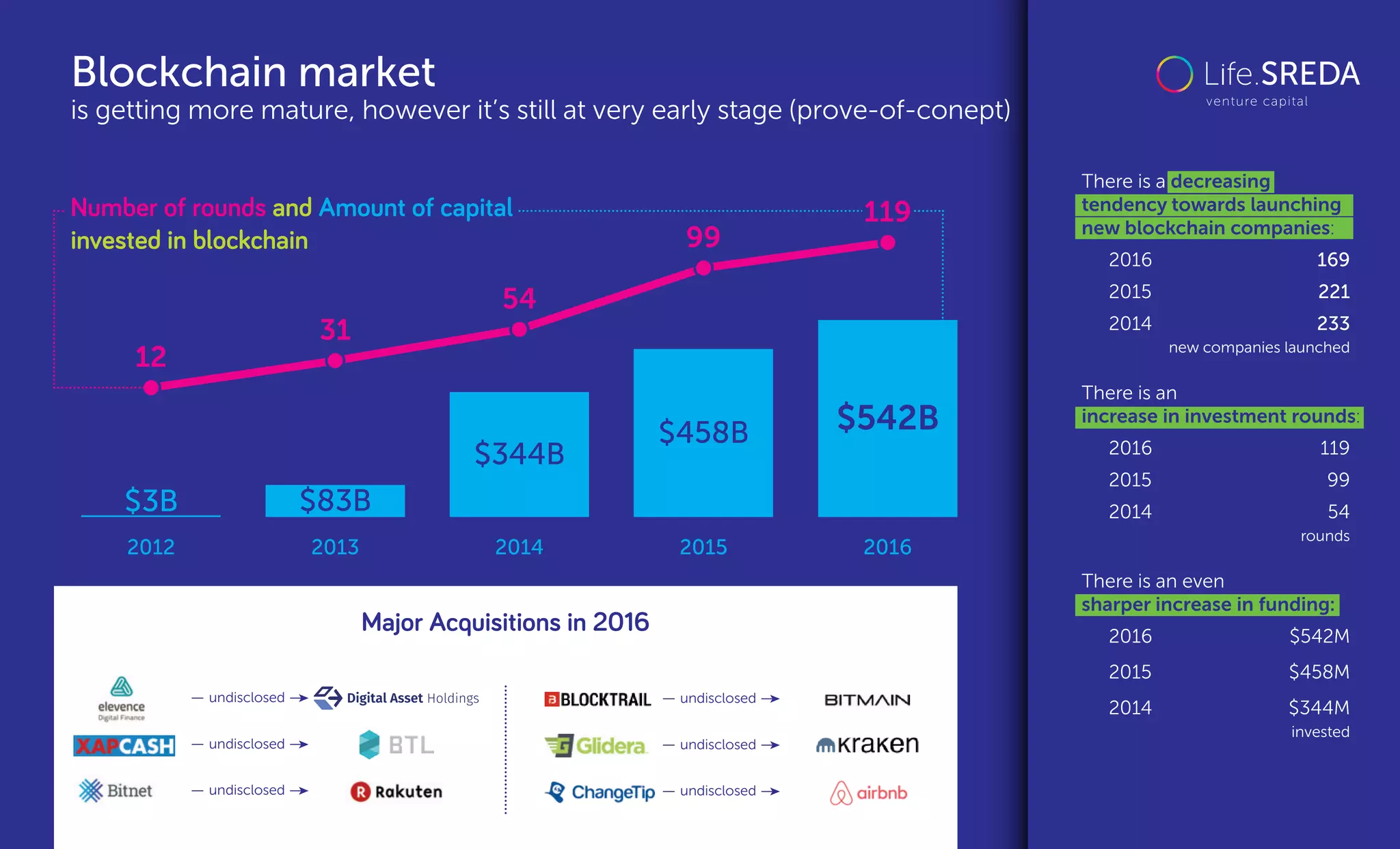

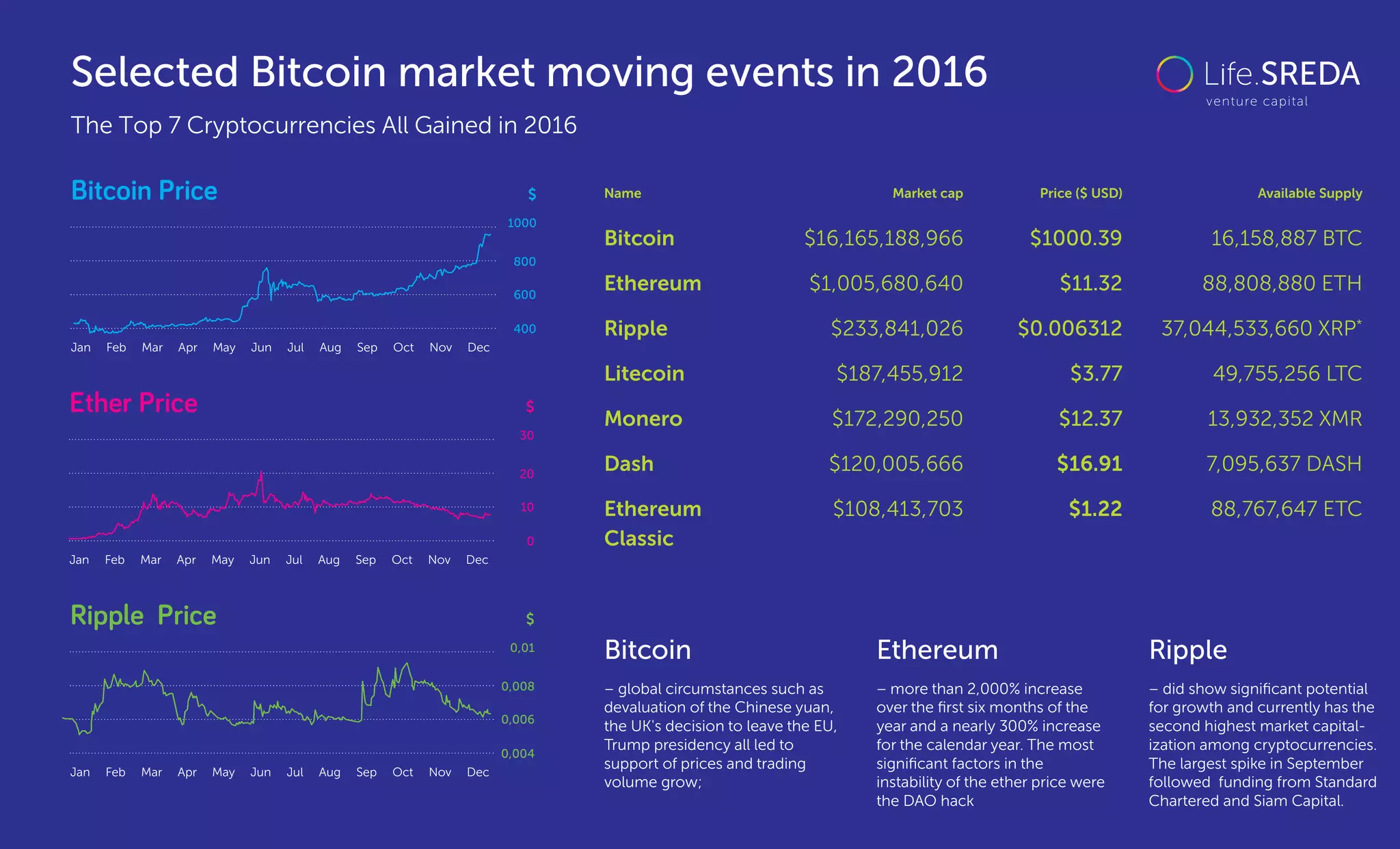

![Fintech unicorns: 4 Chinese giants are in TOP5 in 2016

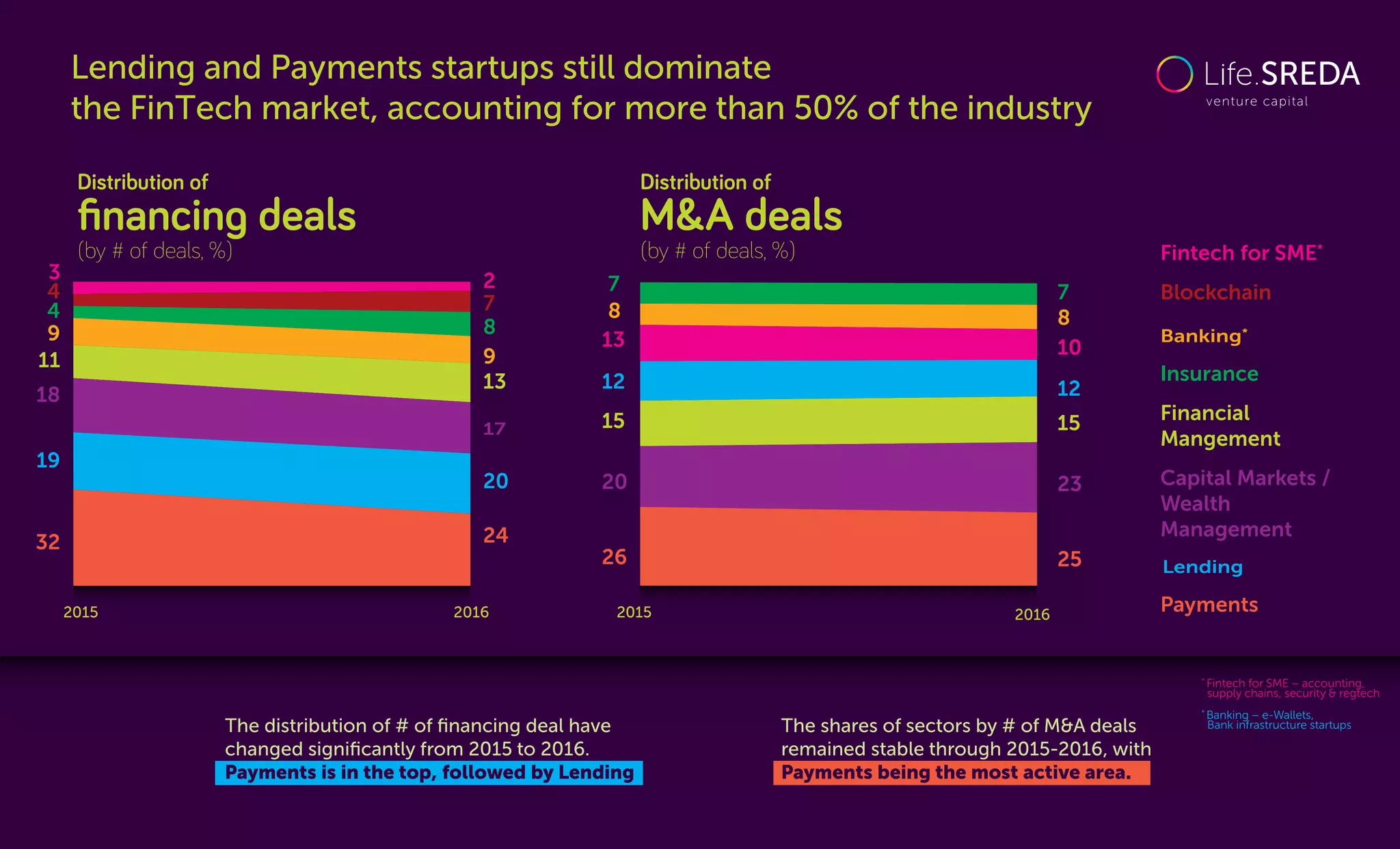

25 fintech unicorns globally valued at $150B in aggregate value

Fintech Unicorns Valuation

2015

24 unicorns

$112B Total valuation

2016

$150B Total valuation [+$38B]

25 unicorns

USA AsiaEurope

ZhongAn

Online

8,0

Kabbage

1

FundingCircle

1

Jimubox

1

Gusto

1

ChinaRapidFinance

1

Lakala.com

1,6

Rong360

1,6

Prosper

Marketplace

1,9

Avant

2,0

GreenSky

2,0

3,6

PayTM

1,9

4,8

Adyen

2,3

Mozido

2,4

CreditKarma

3,5

SoFi

4,0

Transferwise

1,1

new

Lufax

18,5

10,0

AntFinancial

60,0

45,0

Zenefits

4,5

2,0

JD.com

7,4

Stripe

9,2

5,0

Qufenqi

1

5,9

Klarna

1,4

2,3

Oscar

1,4

2,7

123456789101112131415161719212224 2325 20 18

Disclaimer: Public companies are not included; only $1B>;

no SaaS, Cloud, enterprise software, hardware etc; only FinTech

accordiing to Life.SREDA

$B](https://image.slidesharecdn.com/lsft2017slava-170609062803/75/Fintech-Insurtech-and-Blockchain-results-of-2016-and-trends-for-2017-10-2048.jpg)