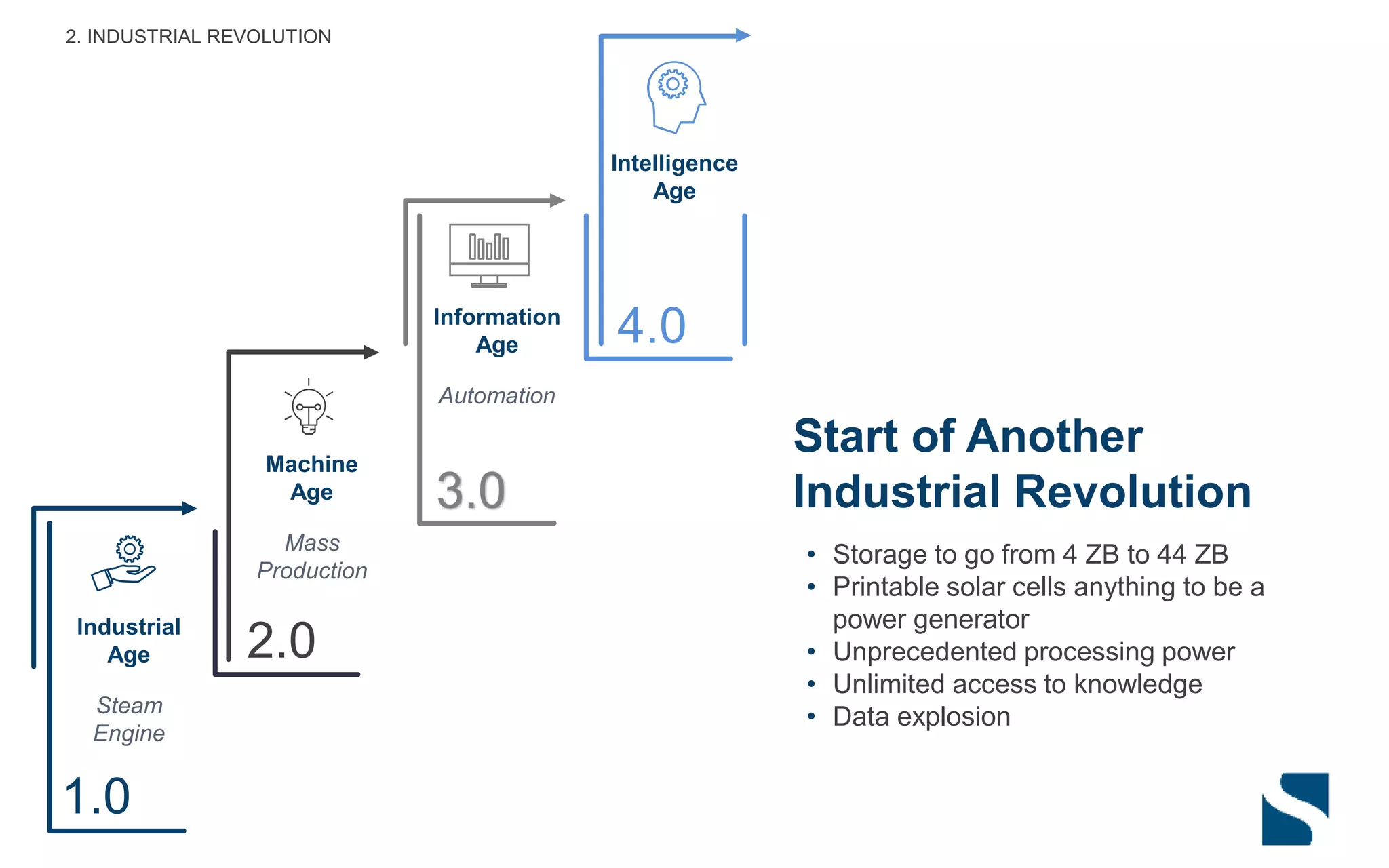

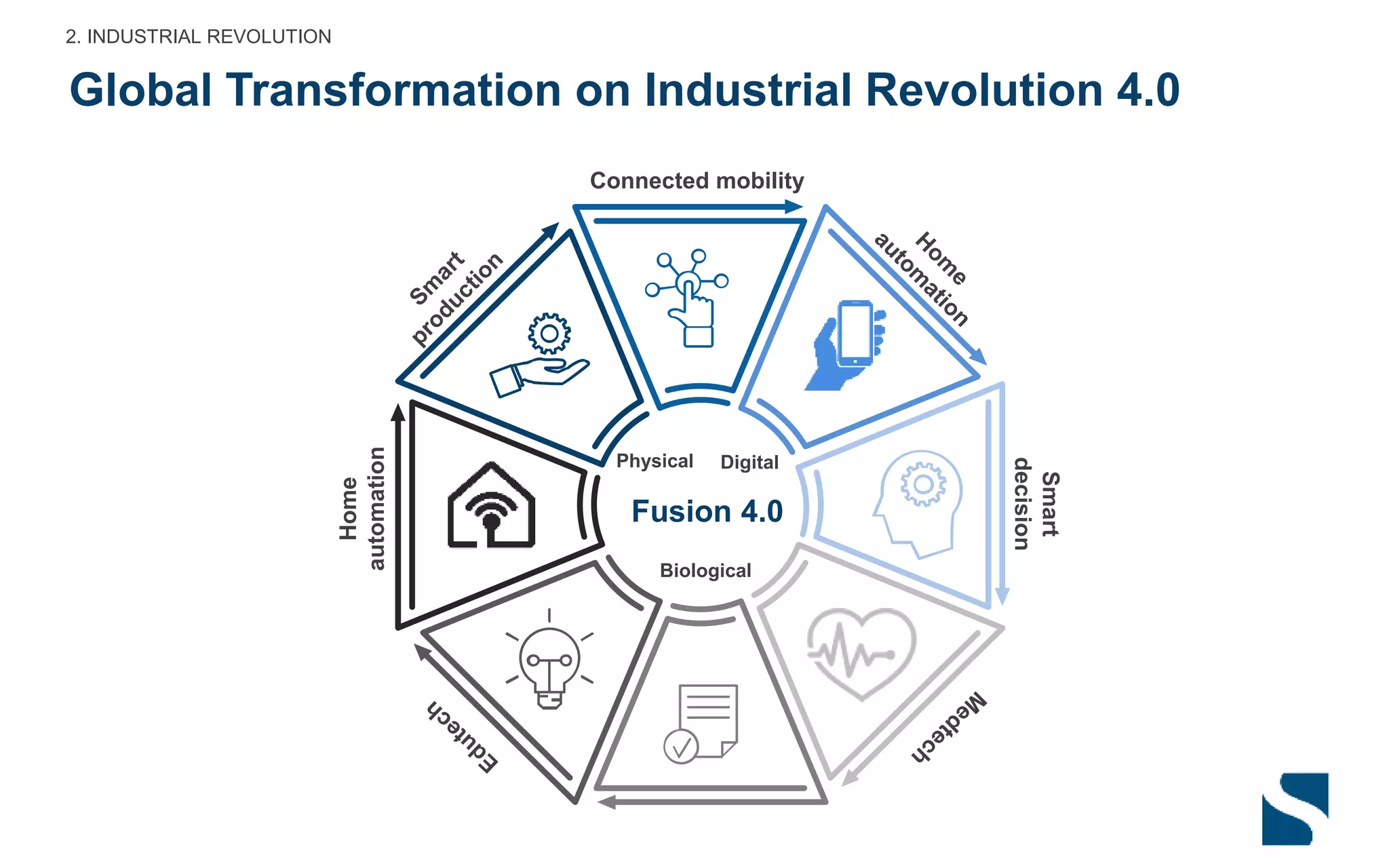

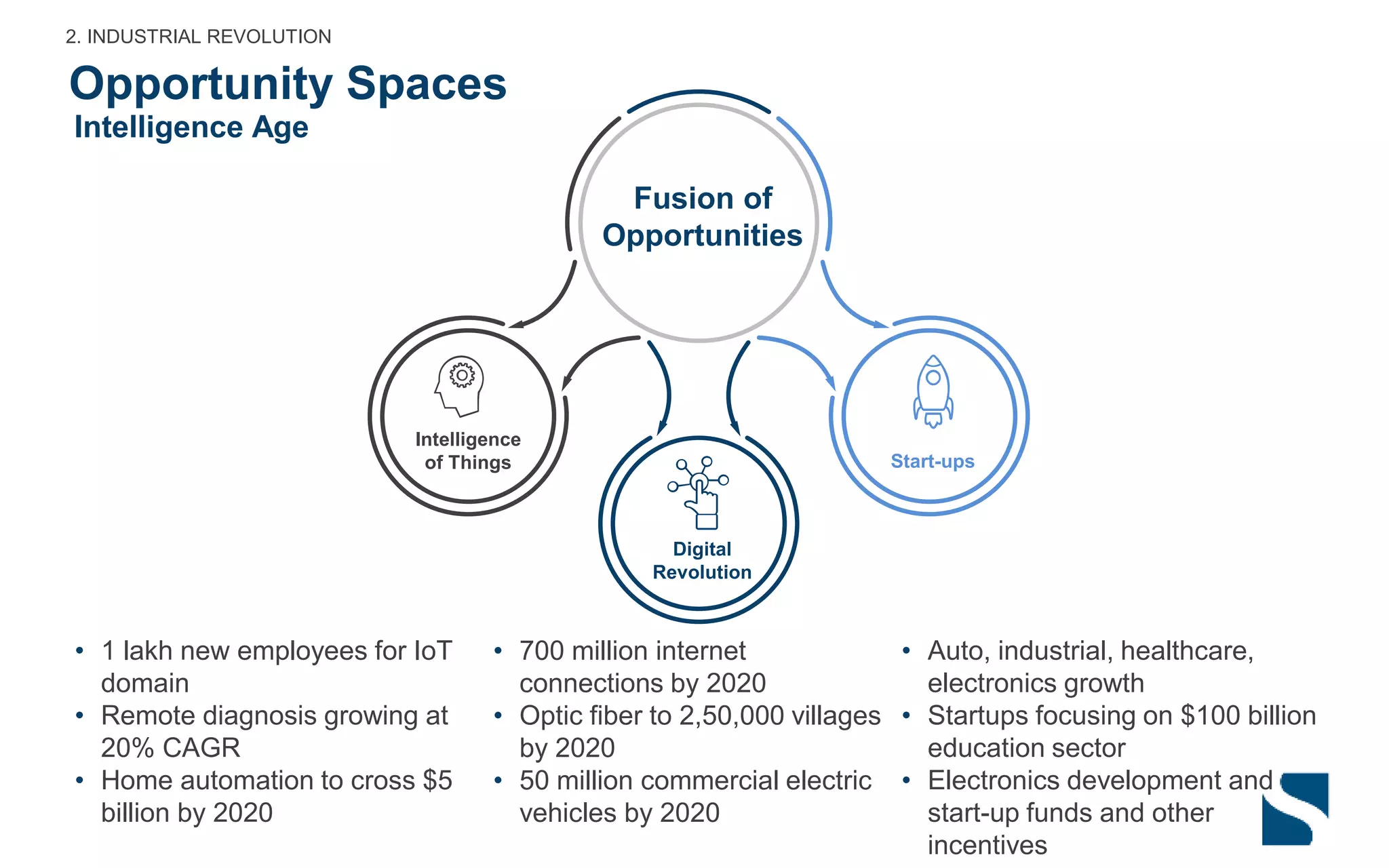

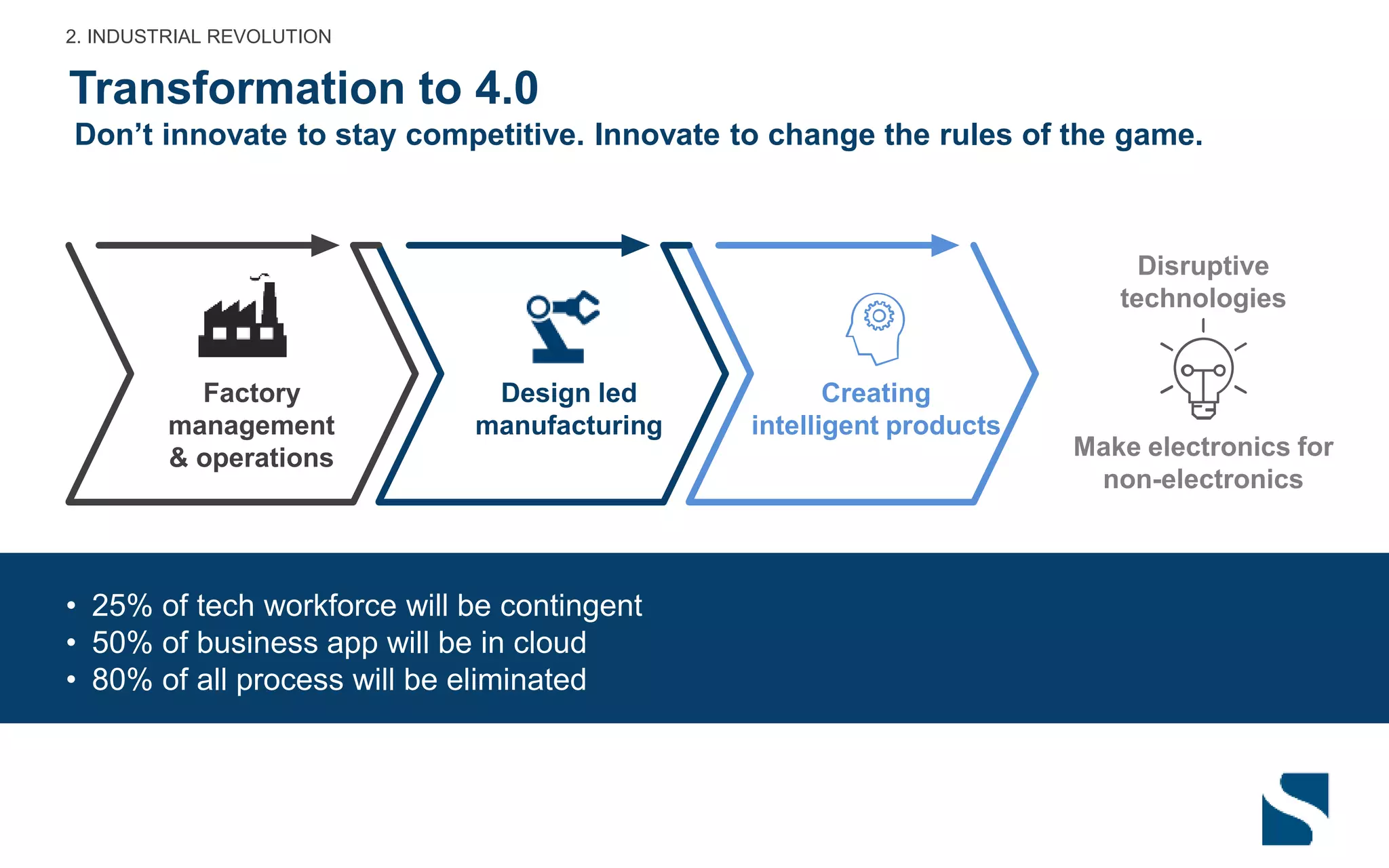

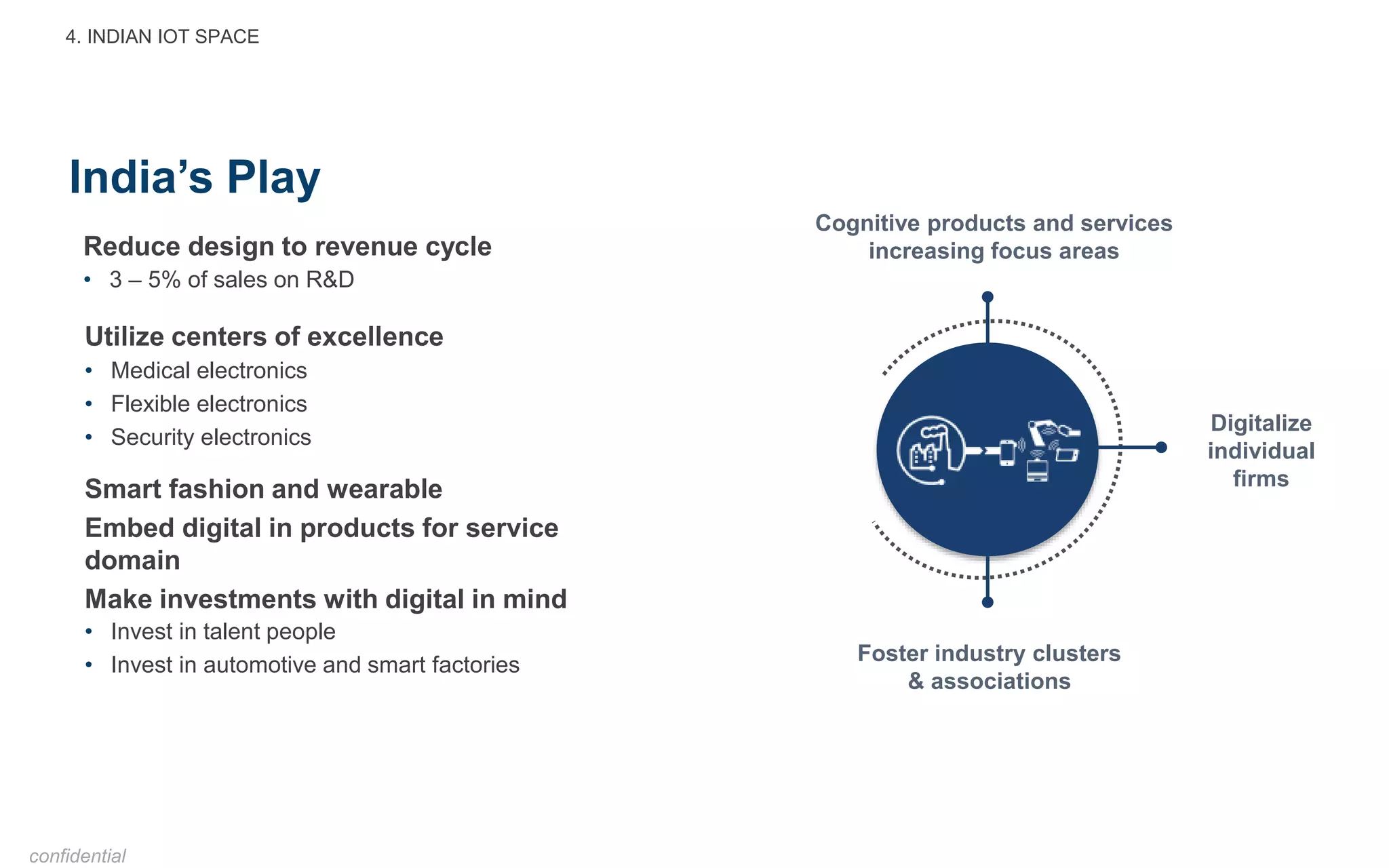

The document outlines a roadmap for enhancing local value addition in electronics manufacturing in India, focusing on the role of Syrma Technology and the need for innovation in the context of the fourth industrial revolution. It discusses the potential of India's IoT market, emphasizes the importance of the local supply chain, and presents strategies to address challenges in the manufacturing sector. Key opportunities include fostering a strong start-up ecosystem and connecting to the global ecosystem to drive growth.