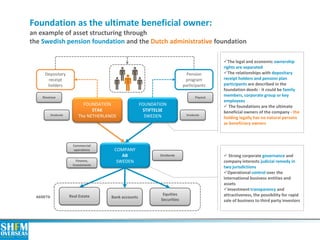

This document discusses the use of foundations in Sweden for asset structuring and protection purposes. It provides examples of how Swedish foundations and Dutch administrative foundations can be used together to separate legal and economic ownership of assets. A Swedish pension foundation and a Dutch administrative foundation can jointly own a Swedish company, providing corporate governance and protection of business interests in two jurisdictions. A Swedish private foundation can also own the controlling shares of a holding company, acting as the fiduciary owner while natural person shareholders retain rights to dividends and a call option on company shares. Foundations thus provide an effective vehicle under Swedish law for managing assets and business interests.

![SWEDISH FOUNDATION [STIFTELSE]

Formation

Bank Accounts

Administration & Support](https://image.slidesharecdn.com/stiftelseswedeneng-141208044724-conversion-gate01/85/SWEDISH-FOUNDATION-STIFTELSE-1-320.jpg)