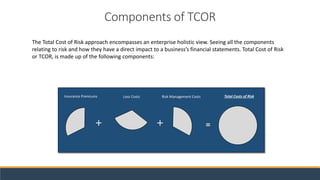

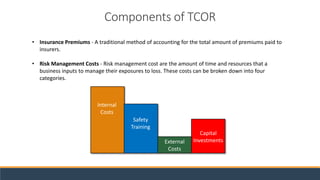

The document discusses the Total Cost of Risk (TCOR) in business, emphasizing that focusing solely on insurance premiums can overlook controllable indirect costs that significantly impact profitability. TCOR encompasses insurance premiums, risk management costs, and both direct and indirect loss costs, highlighting the importance of understanding all risk-related expenses for better financial outcomes. Implementing a TCOR strategy can lead to increased productivity, reduced overall costs, and improved risk management effectiveness.