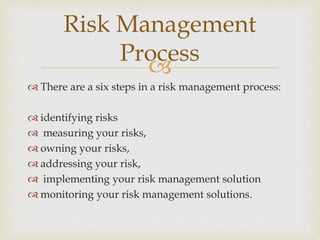

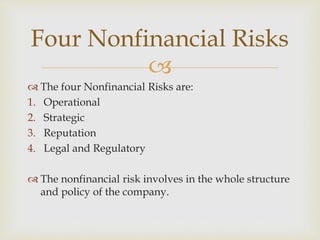

This document summarizes a tutorial on risk management, outlining its essential role in business and detailing a six-step risk management process. It categorizes risks into financial (business, market, credit, liquidity, counterparty) and non-financial (operational, strategic, reputation, legal), discussing their implications on a company's performance. Additionally, it highlights various financial risk management solutions, including options, interest rate swaps, and futures, alongside non-financial solutions like natural hedges and operational strategies.