Embed presentation

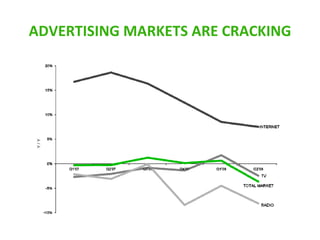

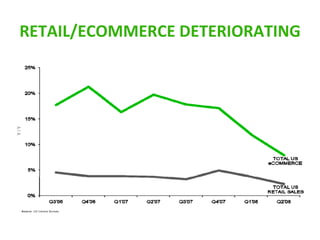

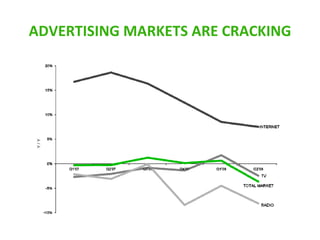

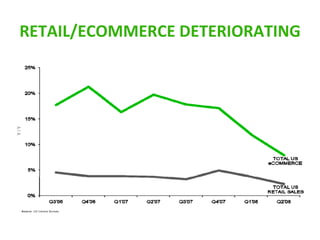

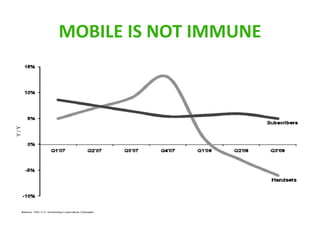

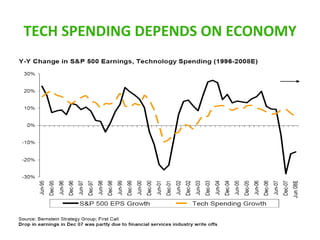

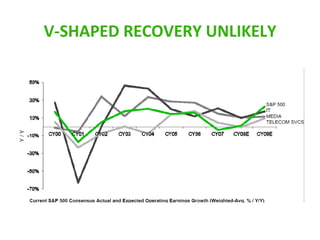

The document outlines the current economic challenges, including a housing recession, over-leveraged businesses, and deteriorating retail markets. It emphasizes the need for companies to control what they can, focus on core values, and adapt quickly to survive. Suggested strategies include performing situation analyses, employing zero-based budgeting, and pursuing profitable growth while managing cash flow.