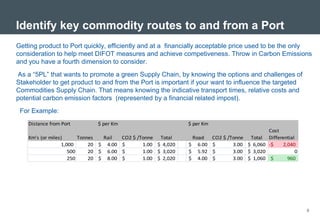

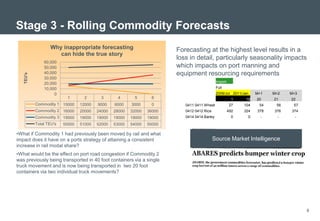

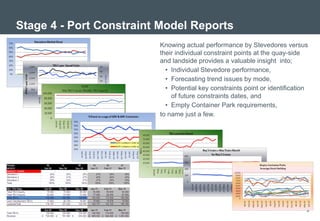

This document provides a status update on a container port supply chain project. It outlines a 6-stage process to construct an integrated planning model for the port: 1) Improve commodity forecasts and identify key routes; 2) Map routes using CAD/GIS; 3) Develop rolling commodity forecasts and shipping requirements; 4) Model port constraints; 5) Link revenue data; 6) Benchmark ports and develop reports. The goal is to provide management forward visibility and illustrate how supply chain principles can influence container movements and productivity.