This document summarizes a presentation given by Professor Sungwon Hong, the director of the Institute of Arctic Logistics in Busan, Korea. The presentation covered the following topics:

1. An introduction of the Institute of Arctic Logistics and its research projects related to the Northern Sea Route.

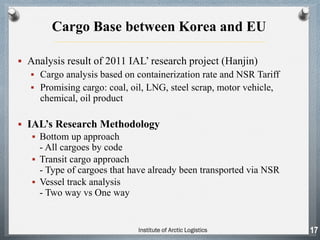

2. An analysis of the market conditions for transit shipping via the Northern Sea Route, including current cargo types and future prospects related to Arctic resource development.

3. An evaluation of cargo shipping between Korea and other countries via the Northern Sea Route from 2011-2013, including the types of cargoes transported and ships used.

4. A discussion of potential cargo types that could be transported between Korea and Europe

![Market condition for NSR transit

2) Mid term prospect

Increase of Arctic hydrocarbon resources transportation

(Yamal LNG Project: 16.5mil tons)

Increase of Russian domestic supply & intra trade along NSR

8[Source: James Henderson(2014), Skolkovo Energy Centre (2013)]

"Comparison of Russian gas Projects to Asian market with other global gas project"](https://image.slidesharecdn.com/sungwonhong-150330214623-conversion-gate01/85/Sungwon-Hong-Institute-of-Arctic-Logistics-IAL-8-320.jpg)

![2013 NSR Transit

11

Transit type Vessel amount Cargo volume

Total 71 times 1,355,897tons

Russian intra trade & supply 43 times 237,861tons

International transit 28 times 1,118,036tons

- International transit(Laden voyage) on the NSR

19 times

* Bulk cargo: 17vessels

* General cargo: 2 vessels

1,118,036tons

(82%)

- International transit between Europe and Asia 10 times(5 times: Korea)

757,373tons

(56%)

- Ballast & Repositioning 9 times

[Source: IAL, Rosatomflot]

Institute of Arctic Logistics](https://image.slidesharecdn.com/sungwonhong-150330214623-conversion-gate01/85/Sungwon-Hong-Institute-of-Arctic-Logistics-IAL-11-320.jpg)

![Korea-related cargo traffic on NSR (2013)

Vessel

name

Shipowner

Ice

class/

Type

Cargo owner

Cargo/

Qty(mt)

Departure Arrival

Entry to

NSR

Exit from

NSR

Average

speed

(Knots)

Marinor

Marinvest Shipping

AB

Arc4/

tanker

JSC Novatek

Gas condens/

58,721

Murmansk Daesan

2013.08.15

16:00

2013.08.28

12:00

12.8

Propontis

Taskos Columbia

Shipmanagement

Arc4/

tanker

JSC Novatek

Gasoil/

108,945

Ulsan Rotterdam

2013.10.06

06:00

2013.09.25

11:45

10.8

Stena

Polaris

Stena Bulk AB

Arc4/

tanker

JSC Novatek

Naphtha/

43,854

Ust-Luga Yeosu 2013.09.28

17:20

2013.10.11

11:30

12.8

Zaliv

Amurskiy

PRISCO

Ice2/

tanker

JSC Novatek

Gasoil/

95,988

Onsan Rotterdam

2013.10.13

06:00

2013.09.30

17:25

12.5

Viktor

Bakaev

SCF Novoship

Technical Manag-t

Ice2/

tanker

Mansel oil

Kerosene/

88,024

Yeosu Rotterdam

2013.10.28

11:20

2013.10.14

09:00

14.1

Zalvi Baikal PRISCO

Ice2/

tanker

JSC Novatek

Naphtha/

79,580

Ust-Luga Yeosu

2013.10.14

15:30

2013.10.30

01:00

15.4

HHL Hong

Kong

Hansa Heavy lift

Arc4/

heavy lift

JSC “SMM” Cranes/

1,742

Ust-Luga Rajin

(N.Korea)

2013.10.25

09:30

- -

Atmoda Laskardis Shipping

Arc4/

reefer

- Ballast Busan Iceland 2013.08.14

02:50

2013.07.26

16:30

18.4

Arctic

Aurora

Fareastern shipping

Acr4/

LNG

- Ballast Ulsan Hammerfest 2013.08.18

18:30

2013.08.06

23:30

11..8

[Source : Rosatomflot 2013]

13Institute of Arctic Logistics](https://image.slidesharecdn.com/sungwonhong-150330214623-conversion-gate01/85/Sungwon-Hong-Institute-of-Arctic-Logistics-IAL-13-320.jpg)

![Top 10 imports from EU

(2013, over 200 thousand tons)

Passenger car 180thousand tons

60% of Korea imports

Pork 114 thousand tons

39% of Korean imports

Main imports are natural

resources

Food such as wheat, corn &

pork are imported

Each cargo will be analyzed

[Source: trass.kctdi.or.kr]

Name Amount(thou $) Weight(ton)

Naphtha 2,841,859 3,038,531

Crude oil 2,395,032 2,835,388

Wheat 208,934 735,519

Corn 222,782 647,885

Lumber 257,064 380,224

Organic compound 1,546,671 280,582

Coal 43,274 252,822

Scrap 177,041 239,284

Other chemical products 1,343,835 226,654

Other plastic 931,875 226,516

Other textiles 294,030 213,539

Gas 175,592 206,461

19Institute of Arctic Logistics](https://image.slidesharecdn.com/sungwonhong-150330214623-conversion-gate01/85/Sungwon-Hong-Institute-of-Arctic-Logistics-IAL-19-320.jpg)

![Top 10 Exports to EU

(2013, over 200 thousand tons)

[Source: trass.kctdi.or.kr]

Name Amount(thou $) Weight(ton)

Other oil products 2,503,904 2,531,192

Vessel 5,739,850 1,774,723

Light oil 844,430 923,067

Alloy steel plate 948,971 877,980

Synthetic plastic & its products 1,640,098 637,080

Passenger car 5,736,779 578,572

Auto parts 3,616,008 439,833

Other general machineries 3,738,525 410,394

Organic & inorganic

compound

874,125 336,599

Polyester 434,929 279,287

Steel plate 195,329 260,019

Synthetic fiber 338,756 209,028

Polyethylene 190thousand tons

Steel product (steel bar/section

steel) 180 thousand tons

Rubber tire & tube 160thousand

tons

Passenger car, truck, tire and

auto parts are over 1.2 million

tons

Various oil and chemical

products are exported

Each cargo will be analyzed

20Institute of Arctic Logistics](https://image.slidesharecdn.com/sungwonhong-150330214623-conversion-gate01/85/Sungwon-Hong-Institute-of-Arctic-Logistics-IAL-20-320.jpg)

![Oil trading (Ulsan Port : Tank Terminals)

Name of the Terminal Storage Capacity

(10,000 bbl)

Jeongil Stolthaven Ulsan 748.8

Vopak Terminals Korea 172.8

Taeyoung Industry 157.8

Odfjell Terminals Korea 197.4

Horizon Taeyoung Korea Terminals 146.2

North East Tank Terminal 125.2

Hyosung Onsan Tank Terminal 15.7

Onsan Tank Terminal 61.6

G-Hub(SK Gas) 308.3

Hyundai Oil Terminal 163.6

TOTAL 2,097

[Independent Tank Terminals]

The Port of Ulsan has several world-famous petroleum companies

25Institute of Arctic Logistics](https://image.slidesharecdn.com/sungwonhong-150330214623-conversion-gate01/85/Sungwon-Hong-Institute-of-Arctic-Logistics-IAL-25-320.jpg)