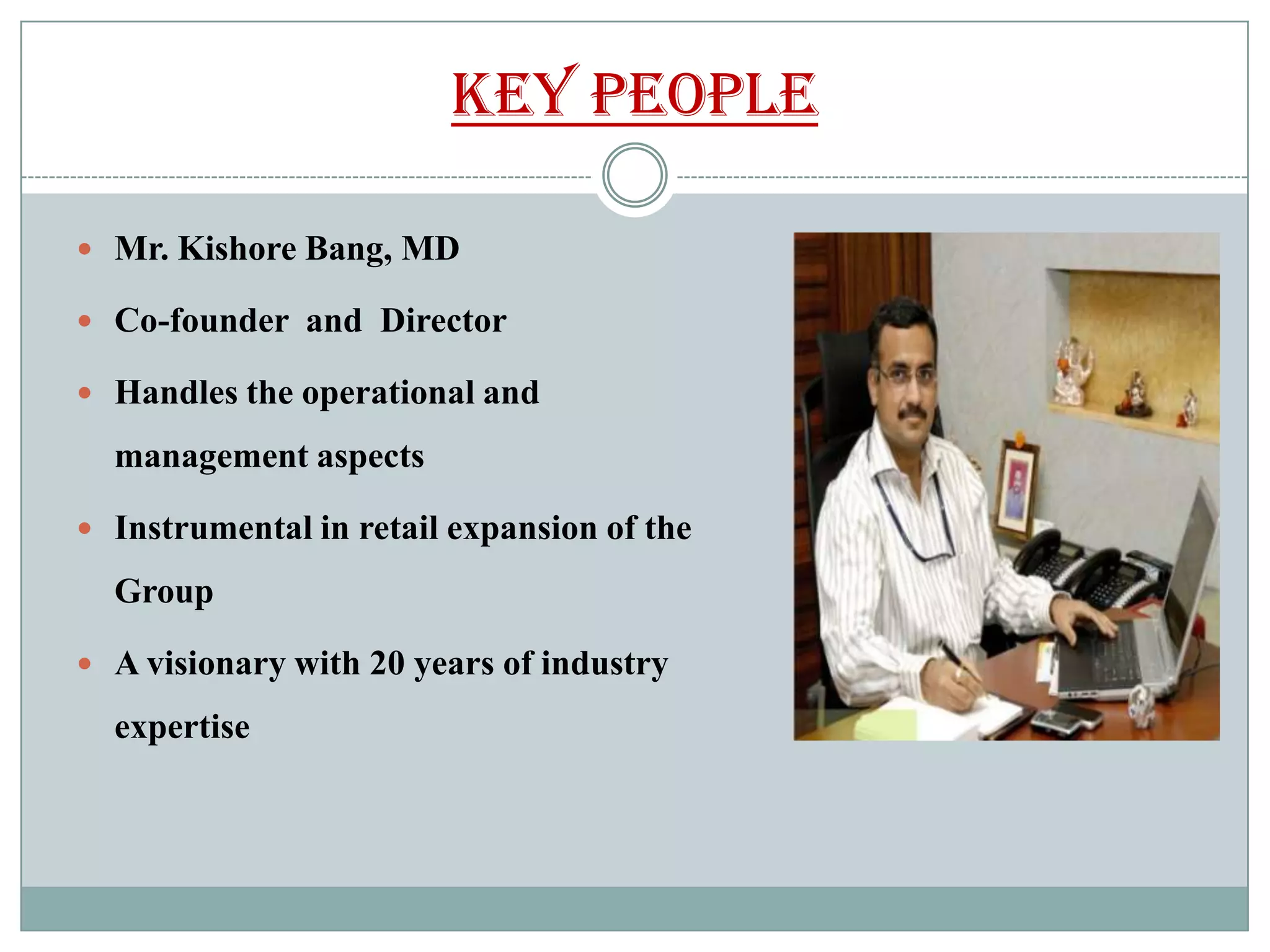

Nirmal Bang Securities is one of the largest retail broking houses in India. It was founded in 1986 and has over 450 branches and 8000 employees. It provides a range of financial services including stock broking, mutual funds, portfolio management, and insurance products. The company has over 28 lakh investors and an average daily turnover of Rs. 930 crore. It is a member of various exchanges like BSE, NSE, MCX, and NCDEX. The document discusses Nirmal Bang's history, products, services, competitors, and key personnel. It also outlines the objectives and research methodology of analyzing Nirmal Bang's online trading strategies.