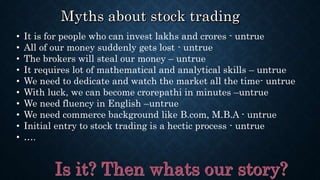

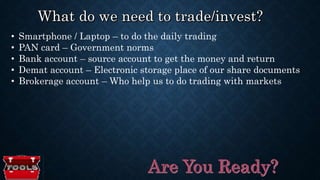

The document provides an overview of stock trading and how to get started. It discusses various ways to earn money and then dispels common myths about stock trading. It then covers the basics of companies and shares, stock exchanges and regulators. The remainder of the document outlines a 5 day course to learn about technical analysis, fundamentals, derivatives and golden rules for stock trading. It provides tips on paper trading, analyzing markets and using indicators like Bollinger bands to identify trading opportunities.