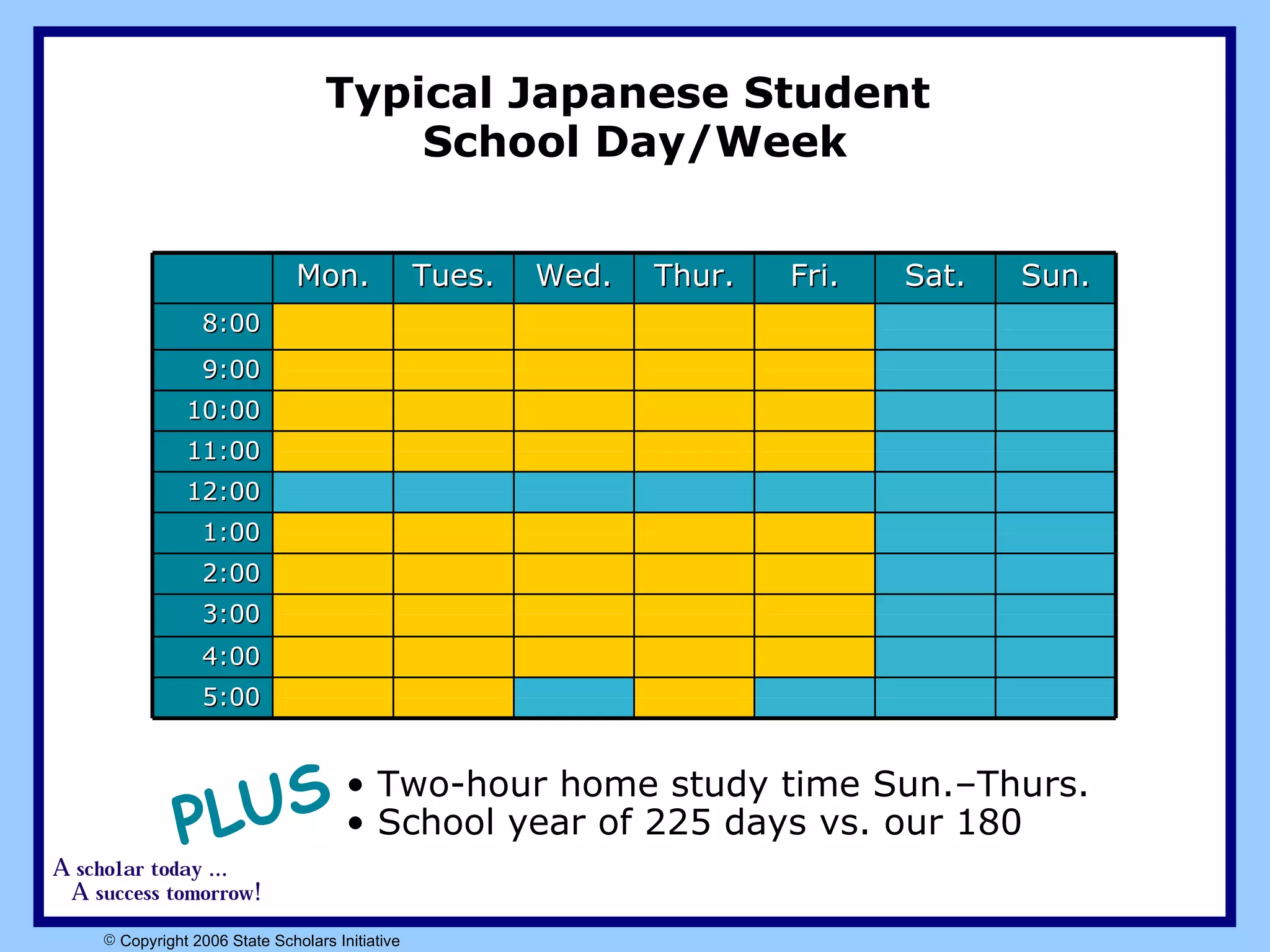

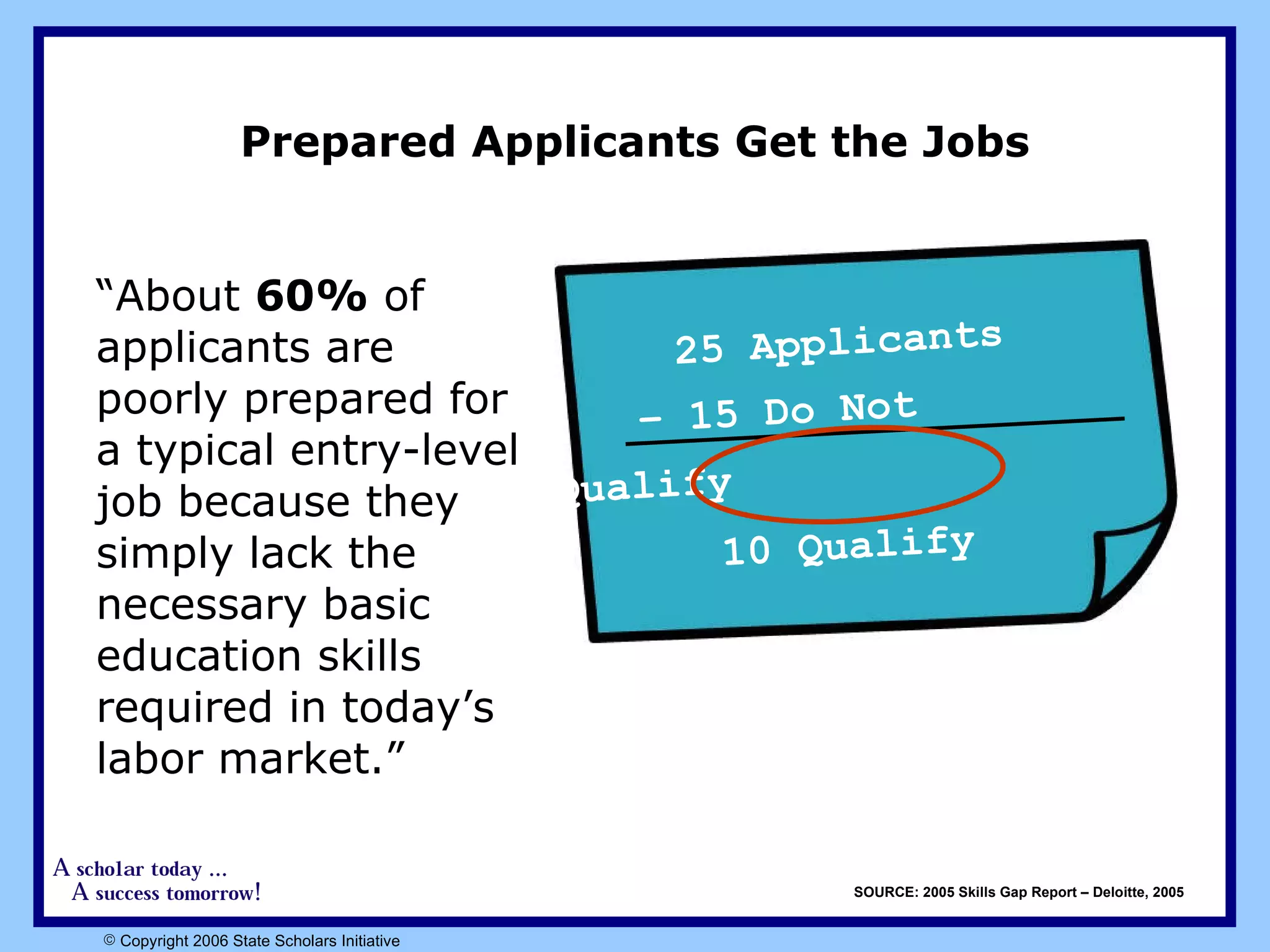

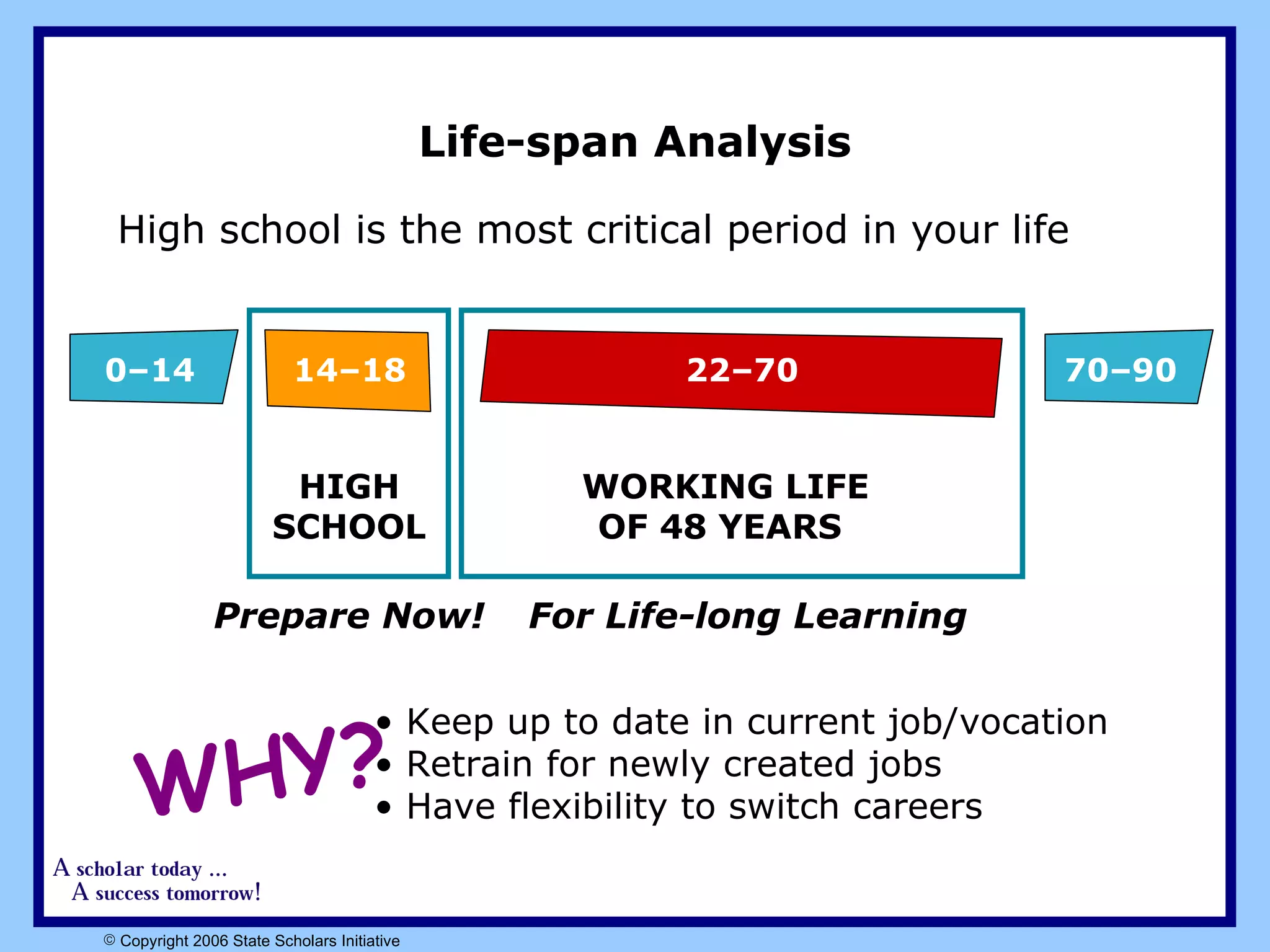

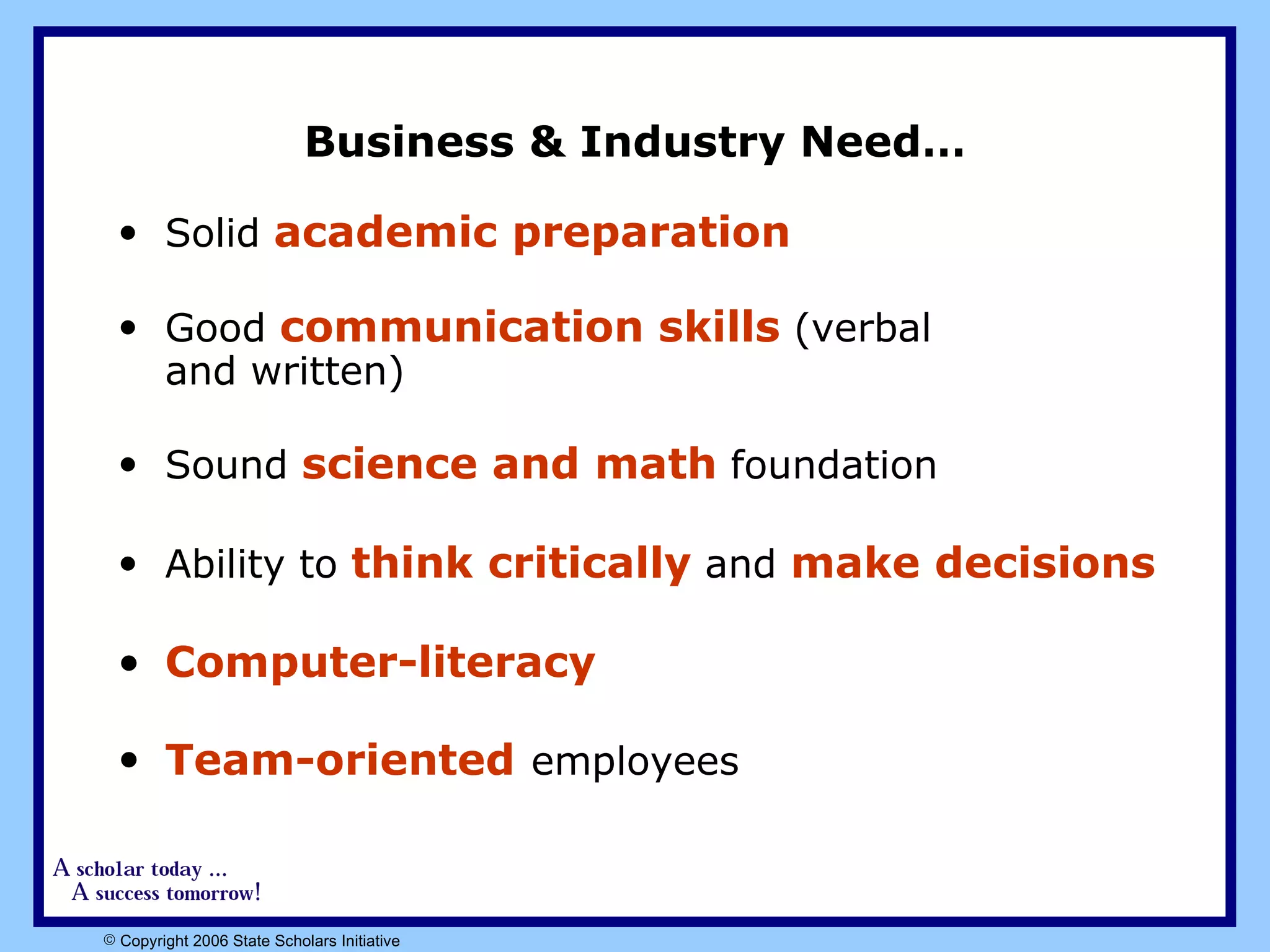

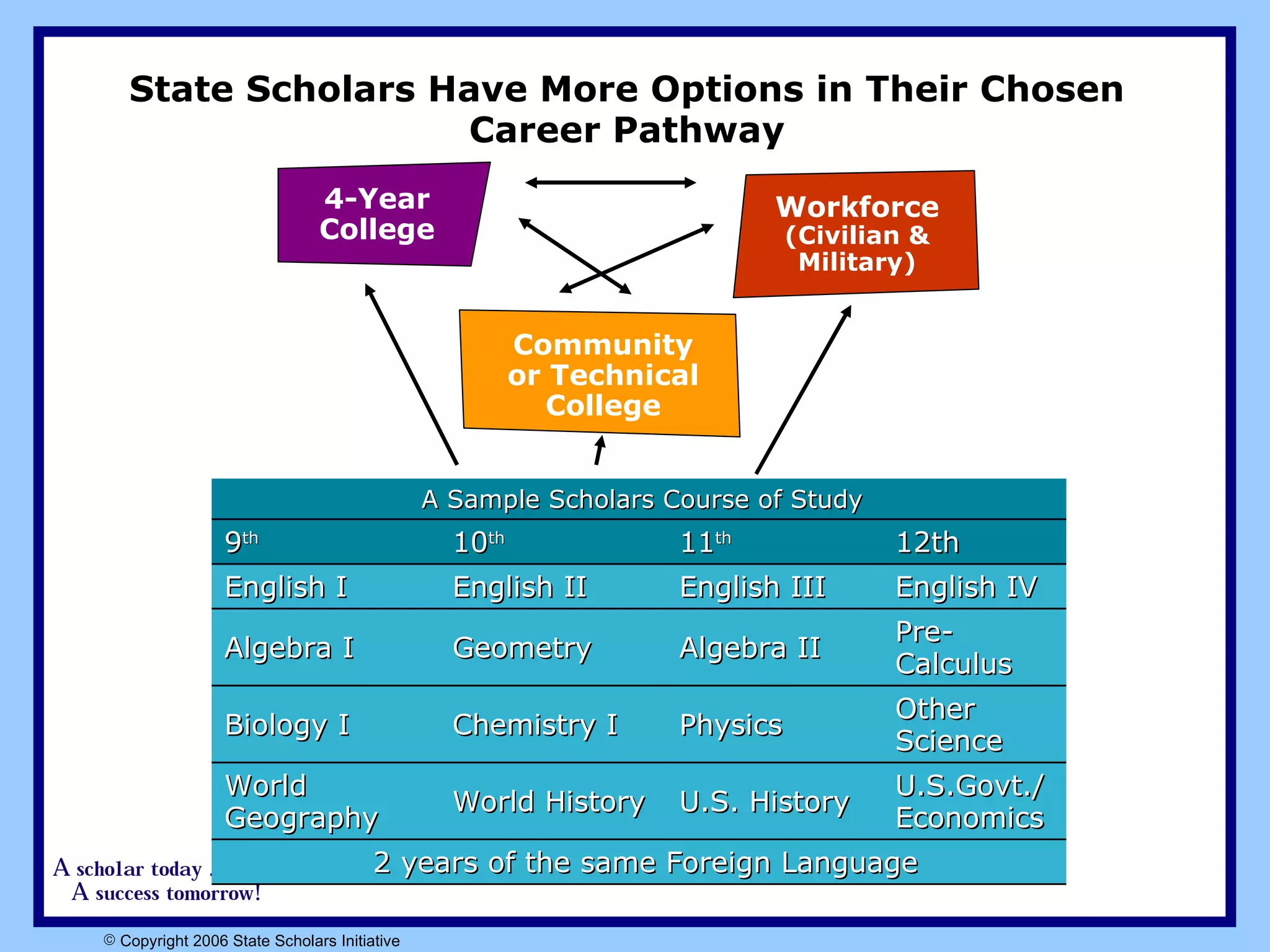

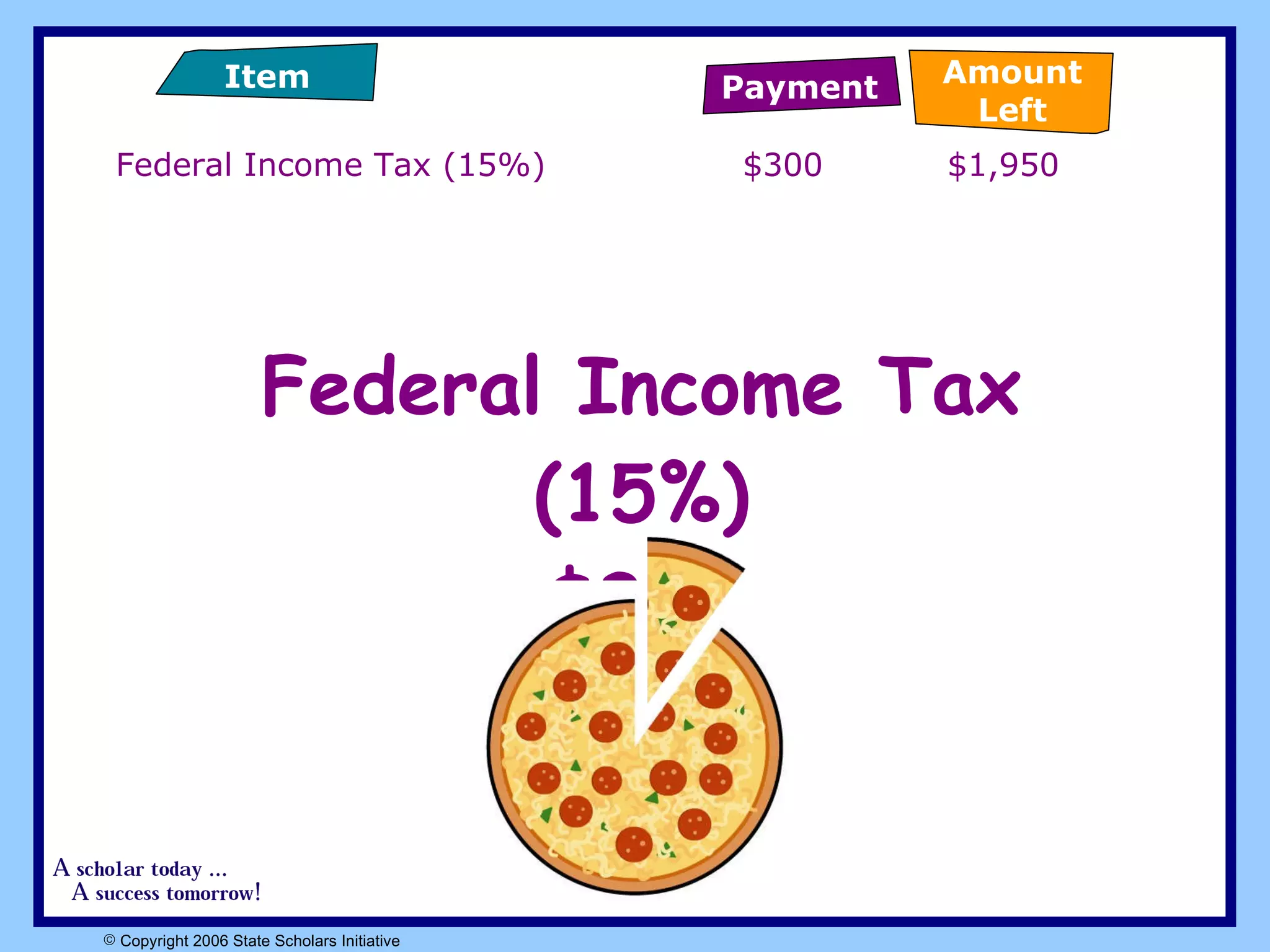

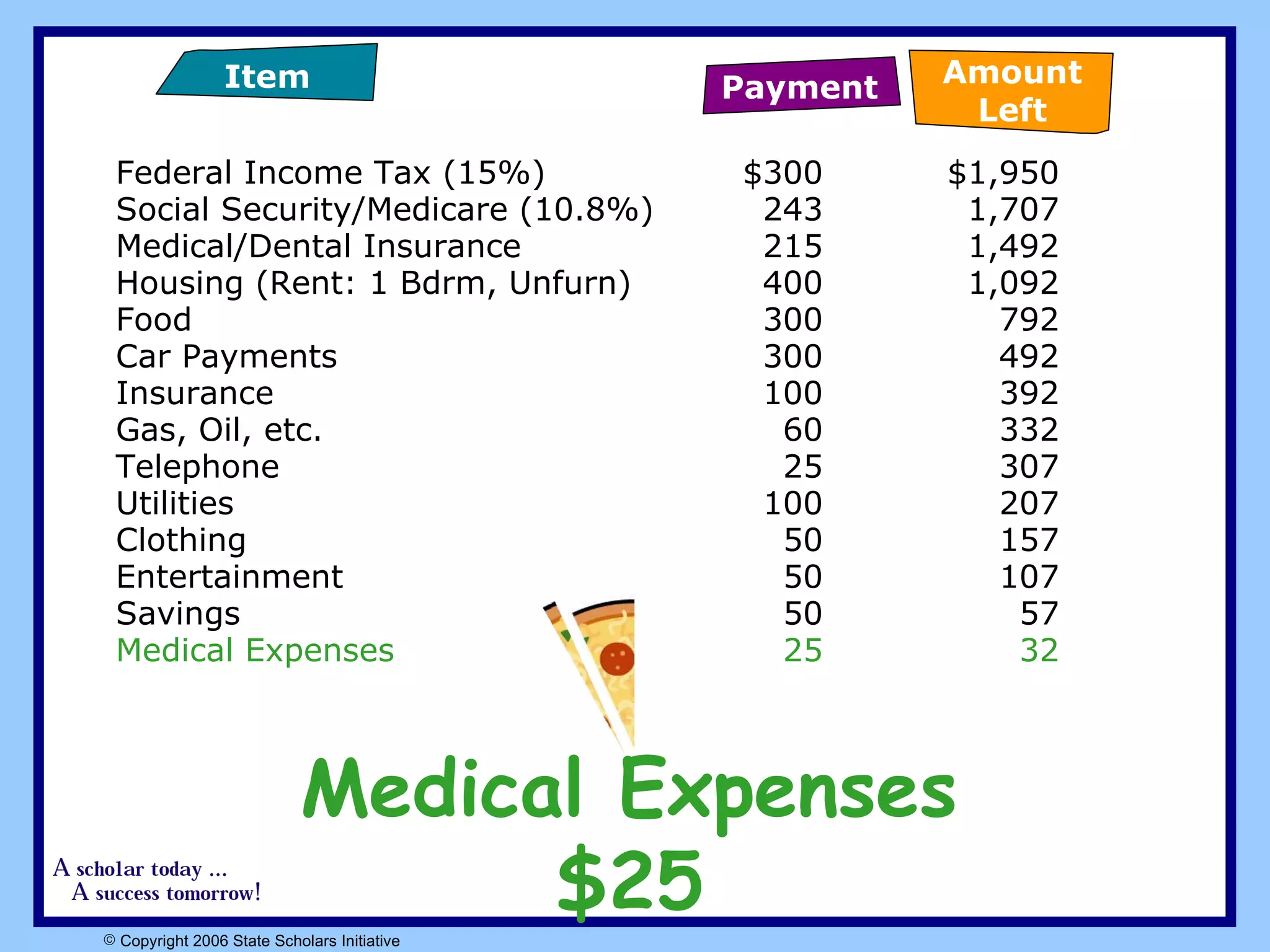

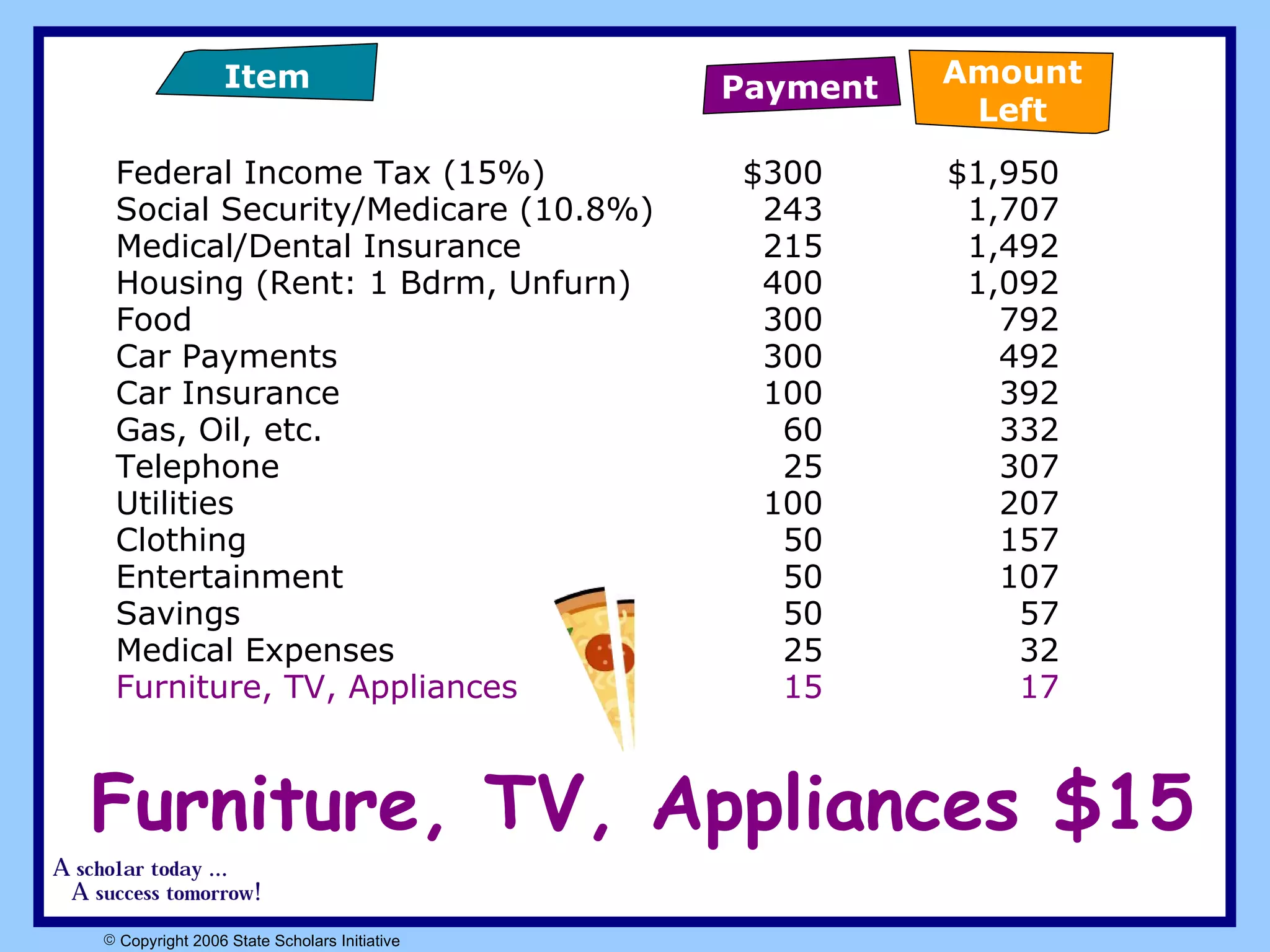

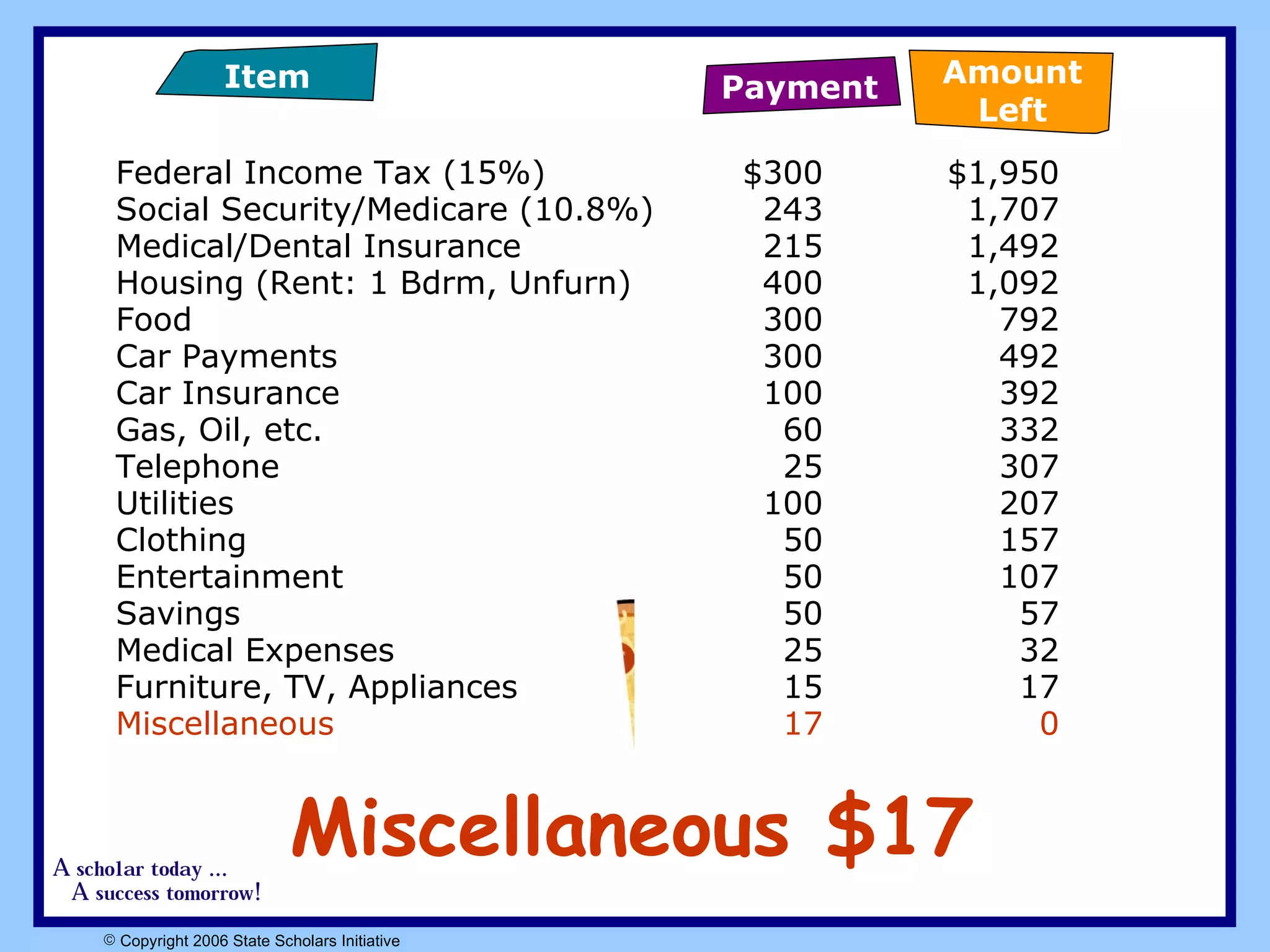

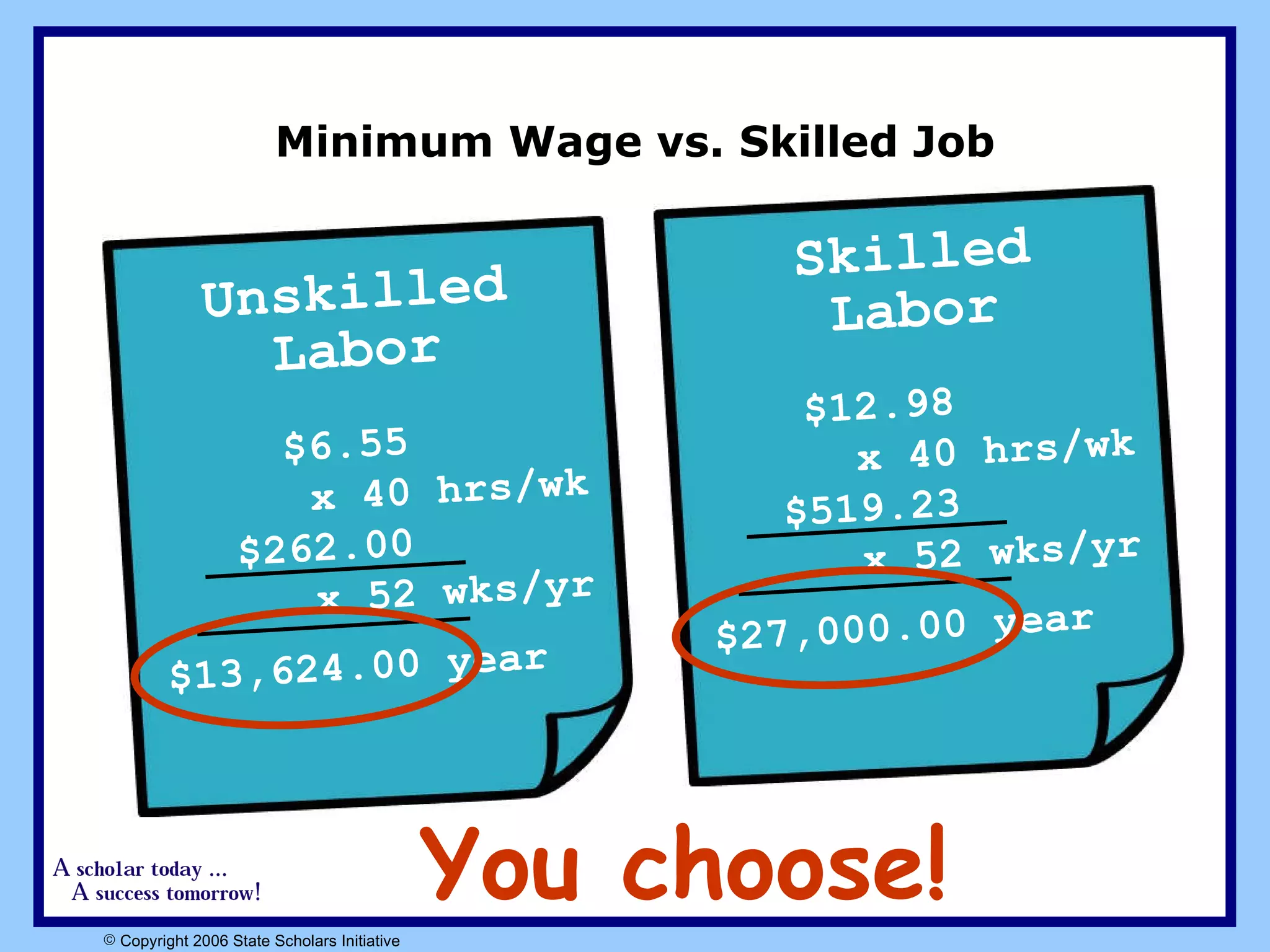

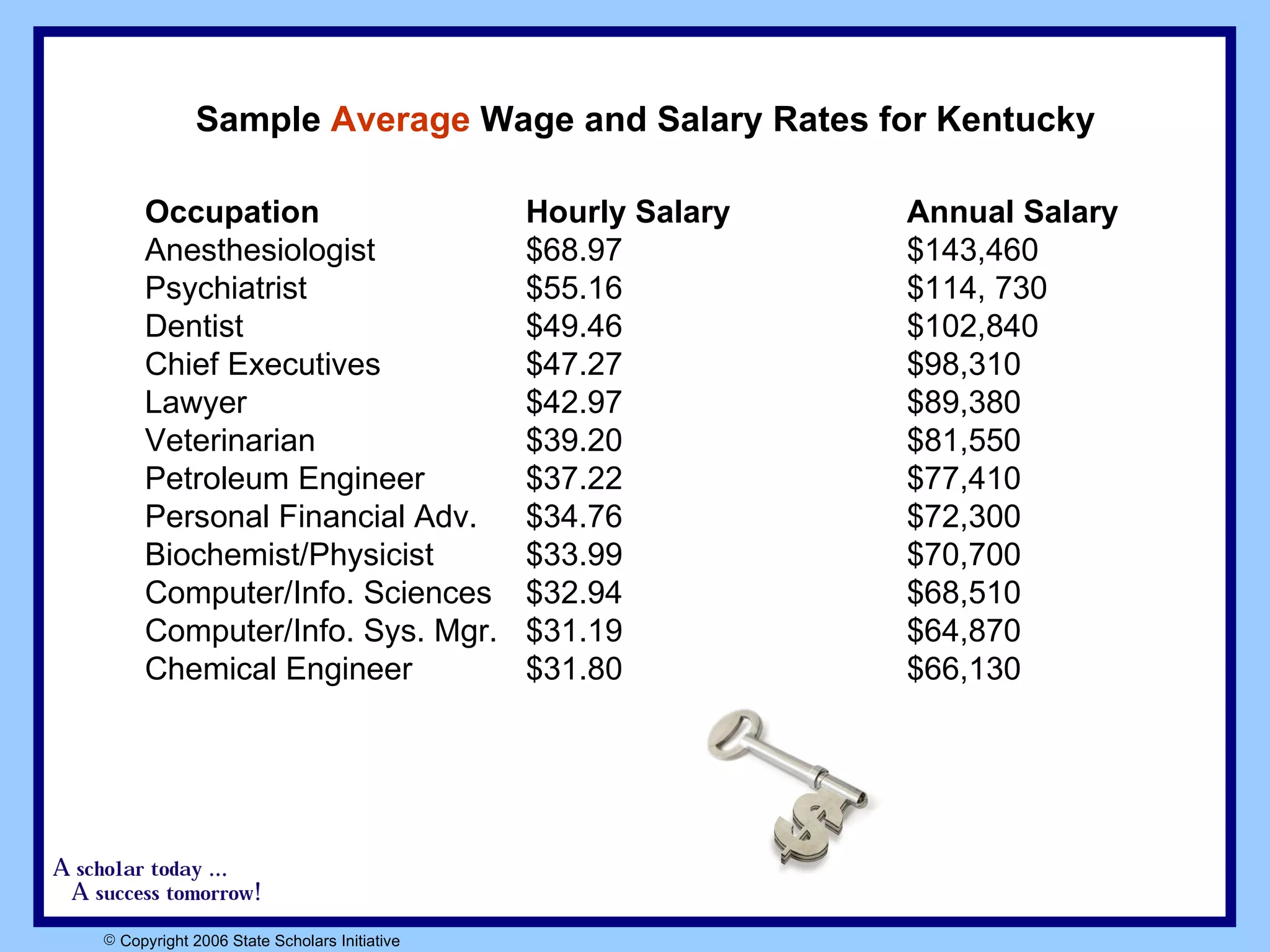

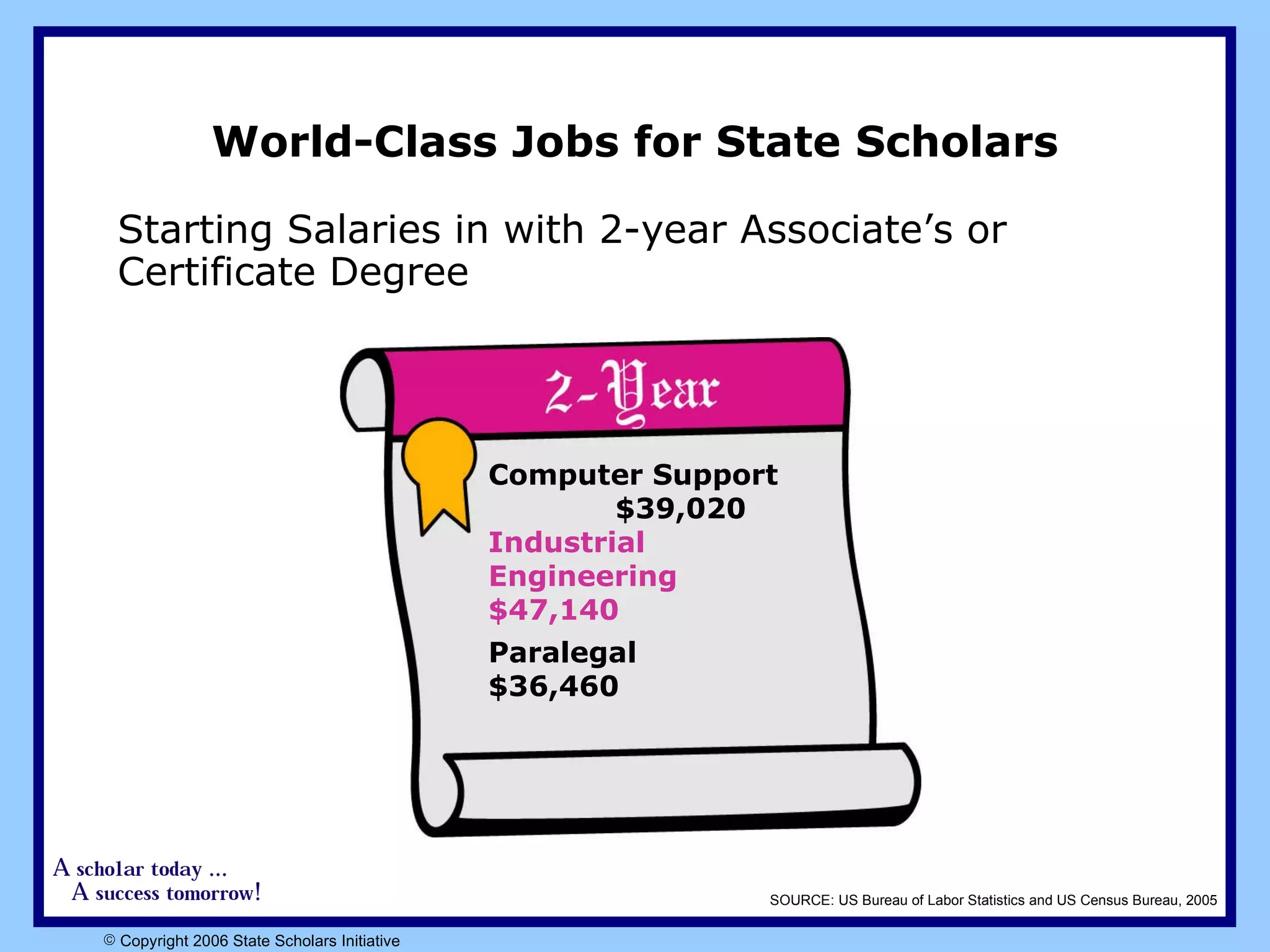

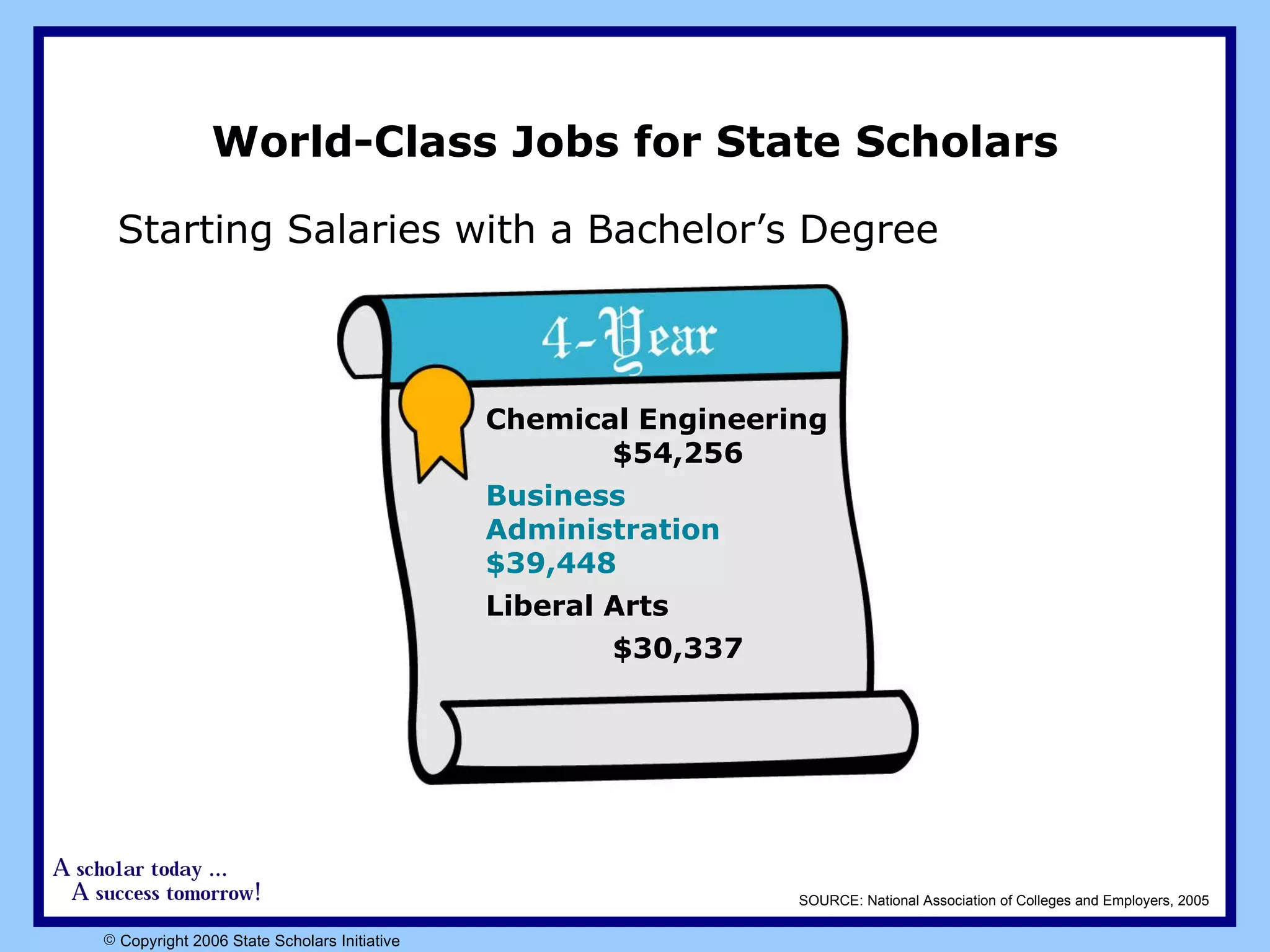

The document emphasizes the importance of education in preparing students for future job markets, highlighting a disparity in the time spent studying between American and Japanese students. It discusses the skills necessary for success in the workforce, including a solid academic foundation and critical thinking abilities, while pointing out that many applicants lack these skills. Additionally, it outlines potential earnings for skilled versus unskilled jobs and encourages students to take advantage of their high school education to improve their future prospects.