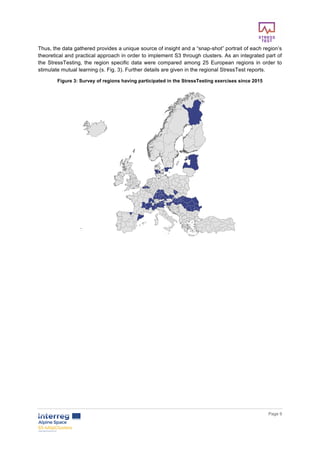

The document summarizes the findings of the S3-4alpclusters project, which aims to implement smart specialization strategies (S3) through regional clusters in the Alpine Space to foster innovation and economic growth. Key conclusions include the essential role of cluster initiatives in developing and implementing S3, the need for better alignment of policies across regions, and the identification of cross-regional cooperation as vital for success. The report emphasizes that a synchronized approach without additional funding can enhance cluster collaboration and innovation in the region.