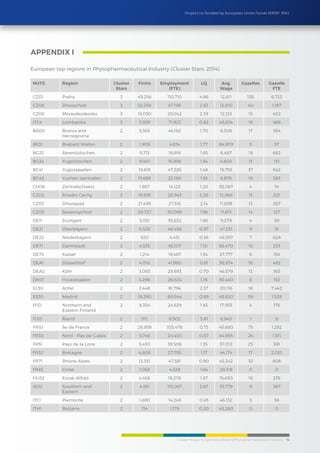

The cluster mapping synthesis report focuses on the phytopharmaceutical industry within the Danube region, detailing the sector's composition, employment, and productivity metrics. Funded by the European Union, the report highlights the importance of establishing bio-based industry networks to foster eco-innovation and strengthen regional economies. The research involved extensive data collection and analysis from various stakeholders to evaluate the dynamics of the phytopharmaceutical clusters across the region.