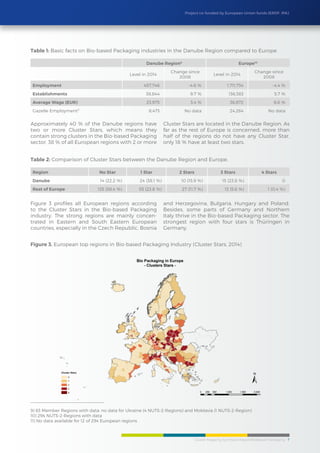

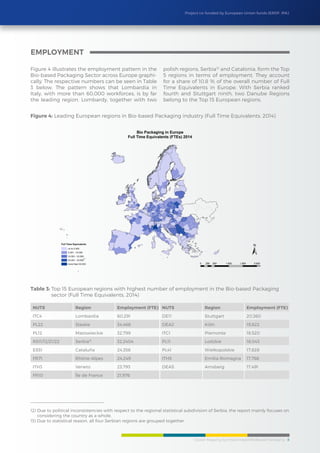

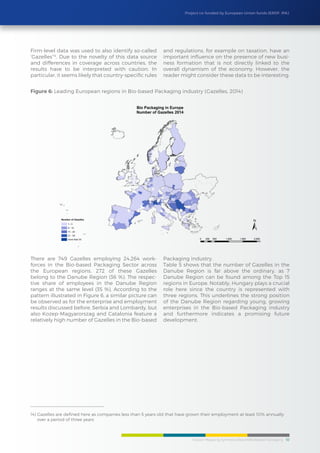

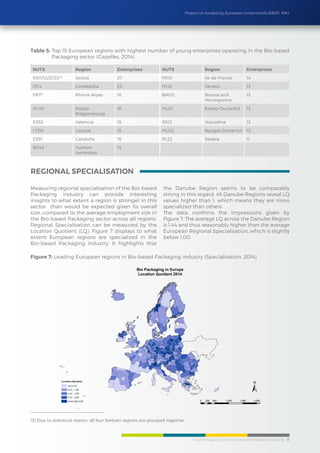

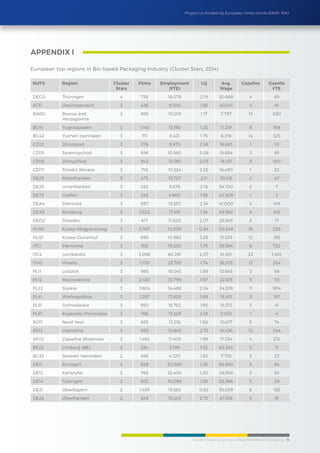

1) The document analyzes the bio-based packaging sector across the Danube Region through a cluster mapping approach. It identifies over 450,000 employees in the region working in bio-based packaging, representing around 27% of total European employment in the sector.

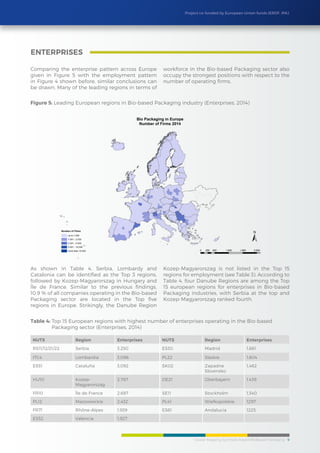

2) The cluster mapping divides the bio-based packaging value chain into key nodes like cultivation, production, and processing. It then categorizes over 300 companies in the region according to their node and industry classification. Around 40% of companies operate in plastic packaging manufacturing.

3) While the Danube Region represents a sizable share of European bio-based packaging employment and firms, its performance is mixed compared to Europe. Employment declined 4.6% since 2008 versus