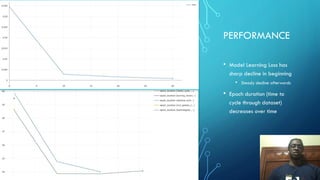

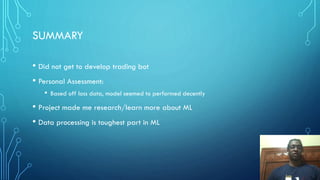

The document describes Dustin Jasmin's goal to develop a machine learning model to predict stock returns for Apple (AAPL) shares using the relative strength index (RSI) and moving average convergence divergence (MACD) indicators. It discusses importing stock data, pre-processing the data by adding it to dataframes and converting it to NumPy arrays, normalizing the data between 0 and 1, and developing a multi-layer perceptron model with an input, output, and hidden layer to make predictions. It concludes by noting the model learning loss sharply declined initially and steadily declined over time, while epoch duration decreased, indicating the model performed decently based on the loss data.