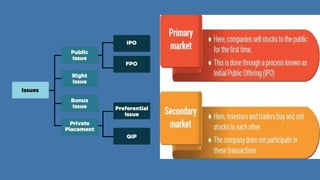

- The document discusses the stock market and provides information on key concepts like shares, shareholders, IPOs, and trading.

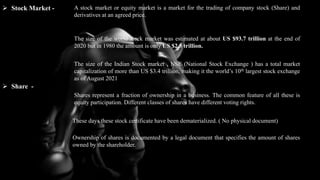

- It explains that a stock market allows for the trading of company shares and derivatives at agreed prices, and that the world stock market was estimated at $93.7 trillion in 2020.

- The Indian stock market through the National Stock Exchange has a total market capitalization of over $3.4 trillion, making it the 10th largest exchange globally.