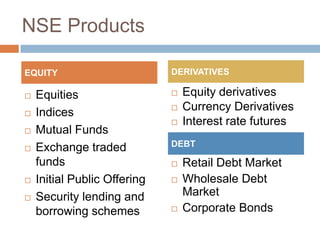

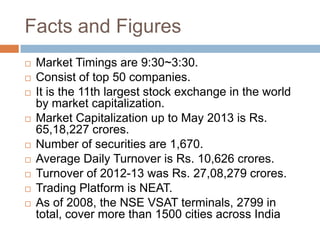

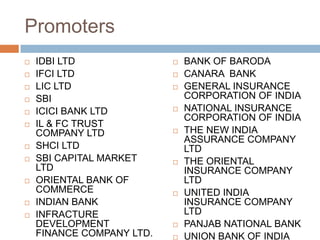

The National Stock Exchange of India (NSE) was established in 1992 on the recommendation of the Pherwani Committee. It was promoted by leading financial institutions led by IDBI and was incorporated as a tax paying company. In 1993, it was recognized as a stock exchange. The NSE launched trading in wholesale debt market, capital market, and derivatives market in 1994. The NSE offers trading in equity, equity derivatives, currency derivatives, interest rate futures, and debt instruments. It is among the largest stock exchanges in the world by market capitalization.