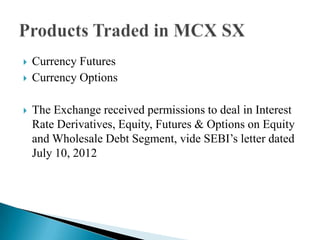

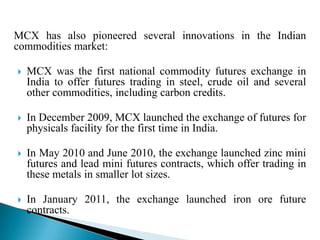

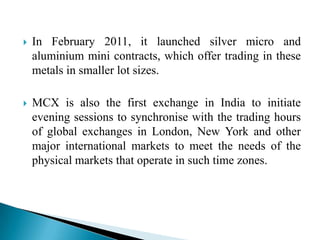

The document discusses MCX Stock Exchange Limited (MCX-SX), India's new stock exchange. It provides details on MCX-SX's operations and regulatory approvals to trade various financial instruments. It also summarizes MCX-SX's competitive membership fees and how it has signed up over 700 prospective members, which could trigger other exchanges like BSE and NSE to revise their own fee structures.