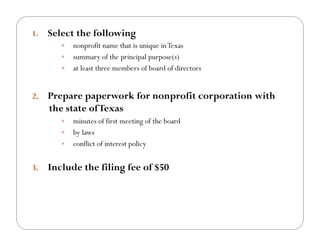

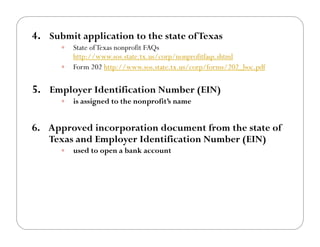

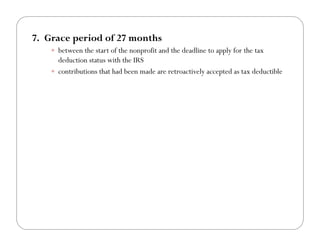

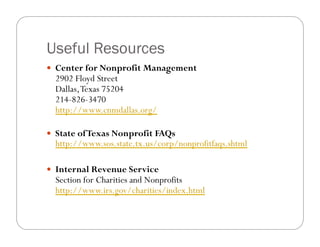

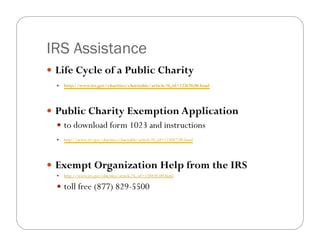

The document outlines the steps to gain nonprofit and 501(c)(3) tax deduction status in Texas, including selecting a unique name, forming a board of directors, preparing necessary paperwork, and submitting an application with the IRS. It highlights a 27-month grace period for tax-deductible contributions and advises having a CPA review the application before submission. Additional resources and links for assistance in completing the application process are provided.