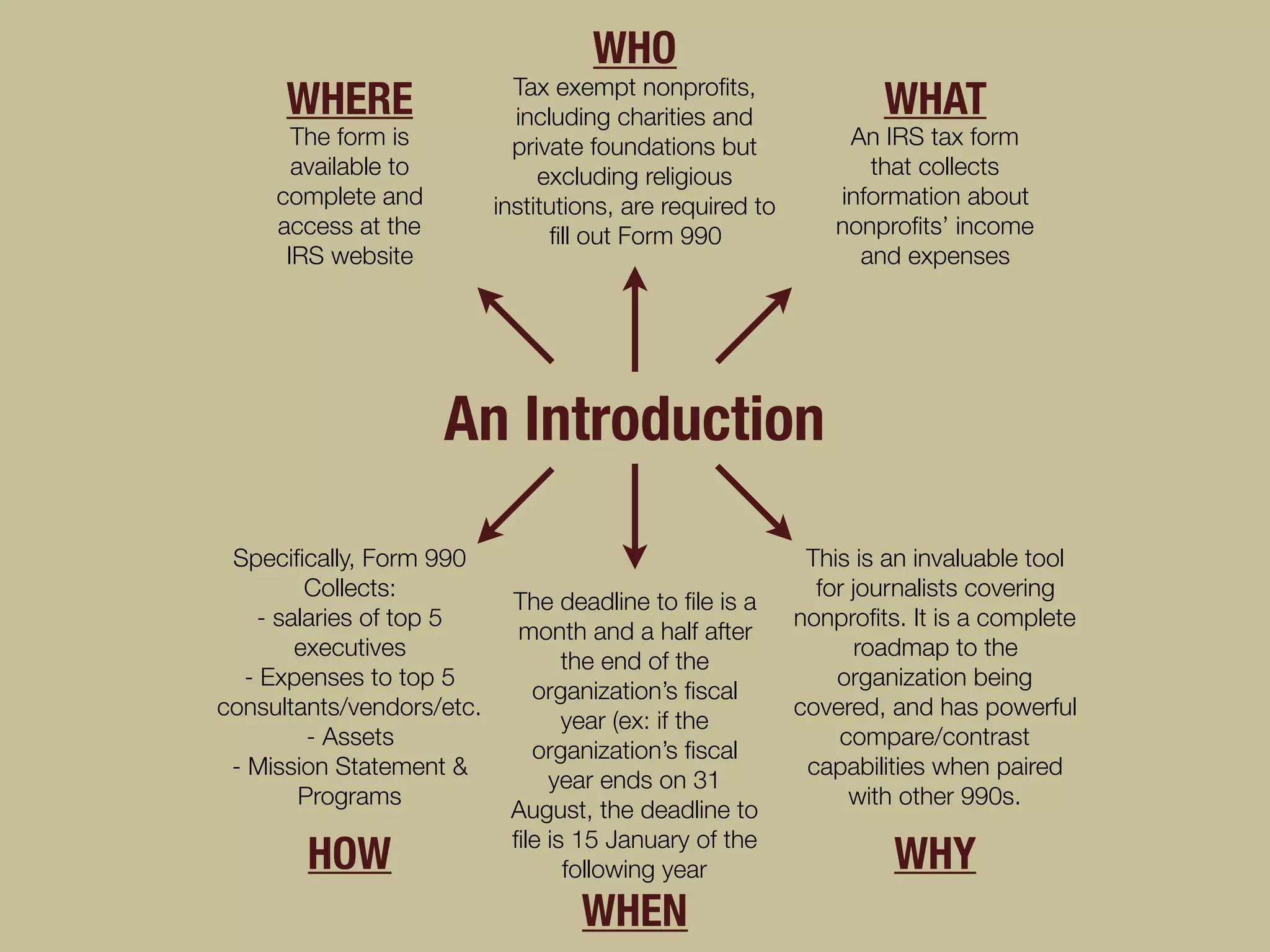

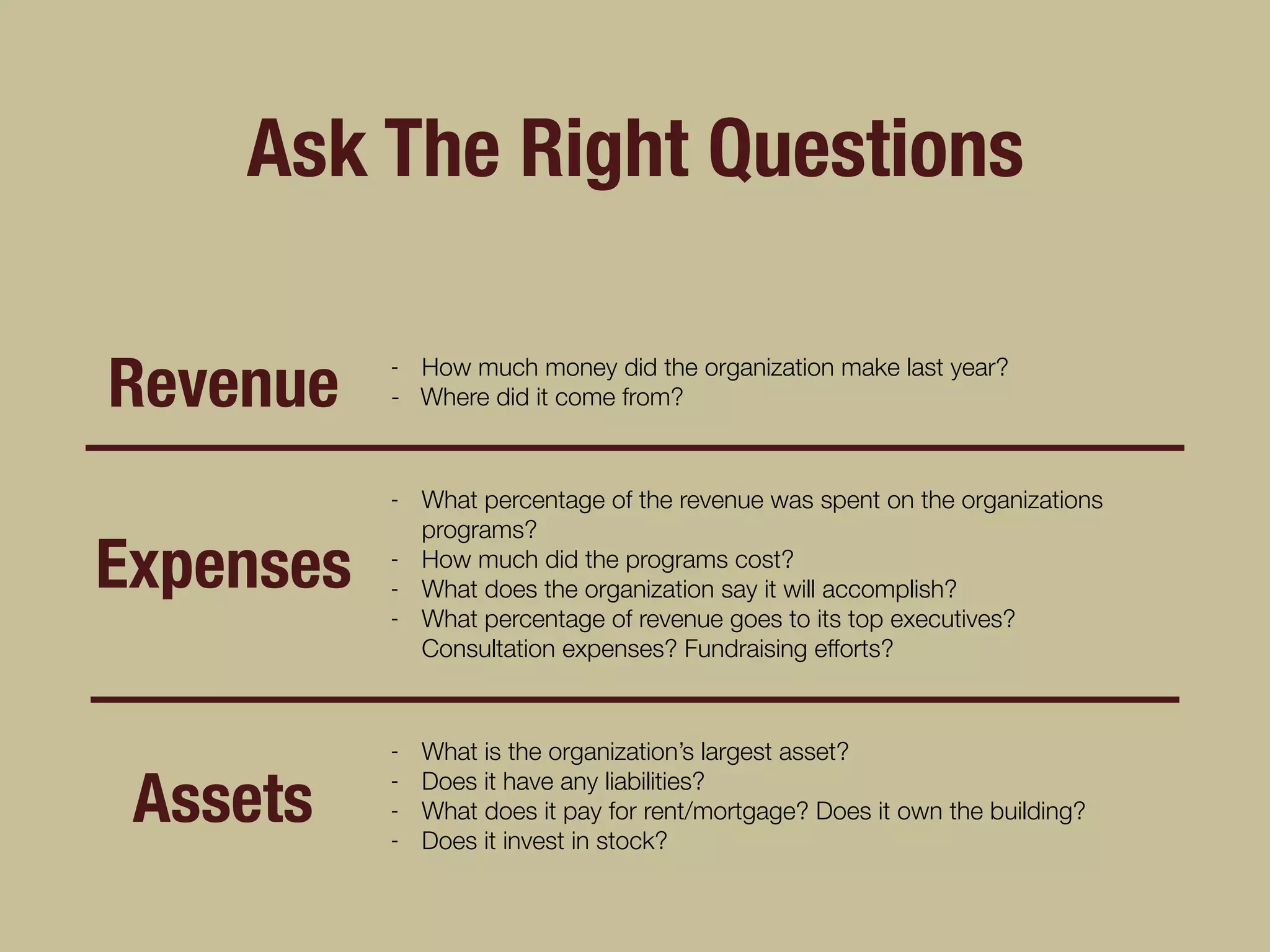

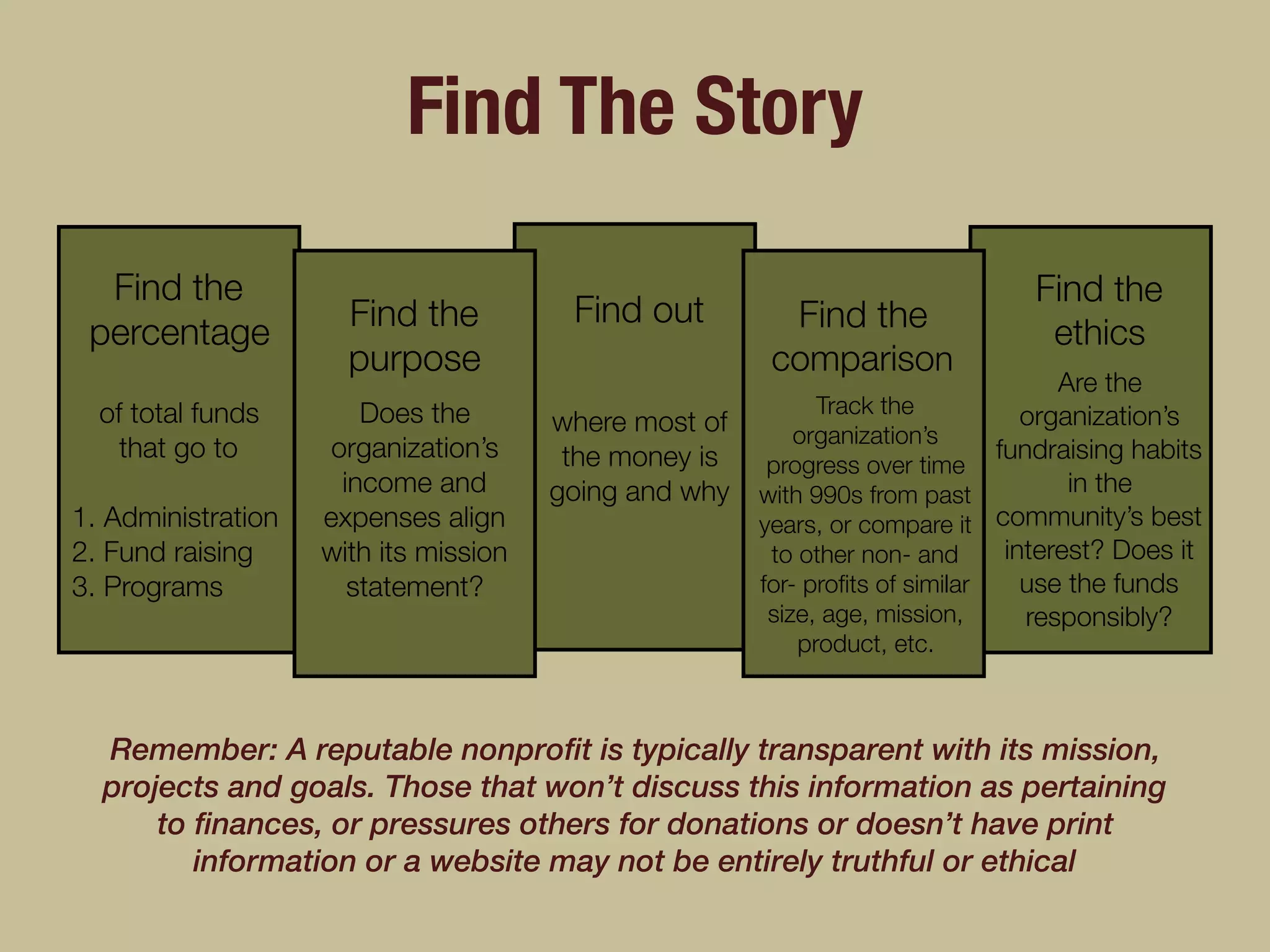

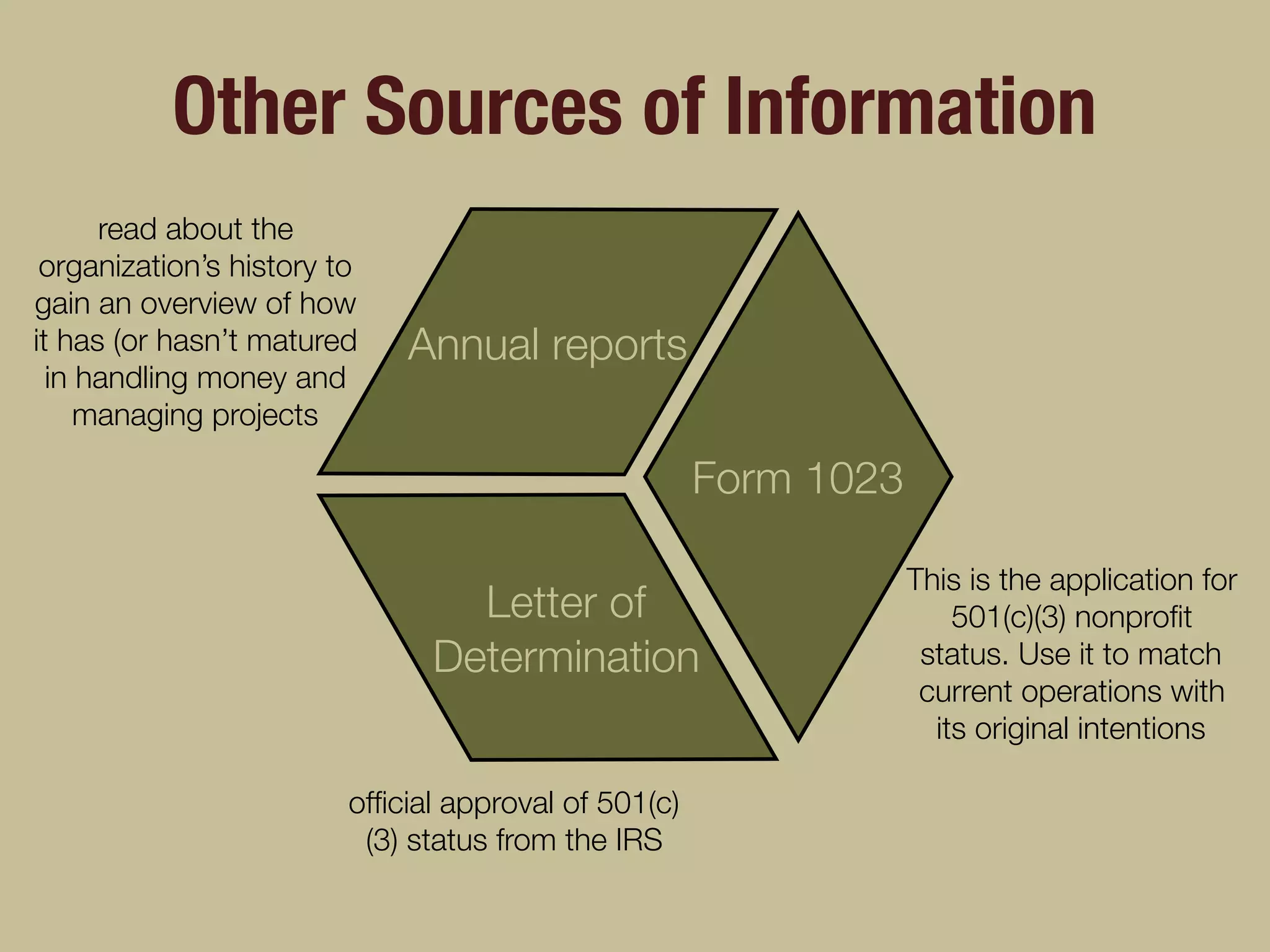

This document provides an overview of Form 990, the tax form required to be filed by most non-profit organizations with the IRS. It details what information Form 990 collects, such as salaries of top executives, expenses, assets, and mission statements. It explains that Form 990 is available on the IRS website and is due 1.5 months after the organization's fiscal year ends. The document recommends journalists use Form 990 to investigate non-profits by analyzing expenses, revenue, assets, and comparing figures over time or between similar organizations to ensure non-profits' missions align with their finances and activities. Form 990 is described as an invaluable tool for journalists covering non-profits.