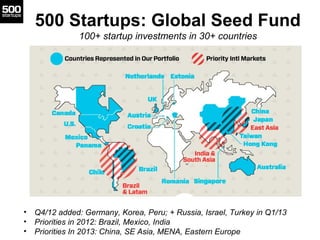

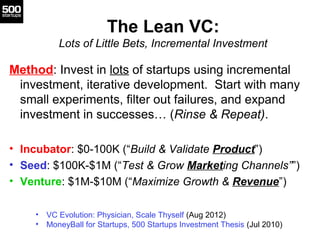

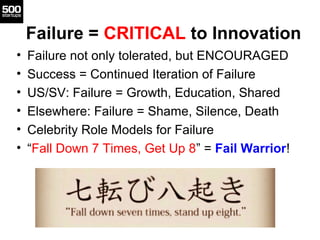

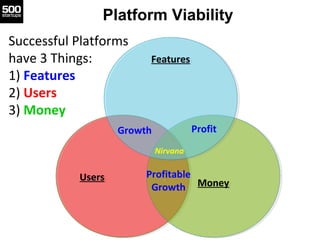

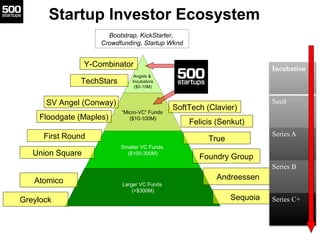

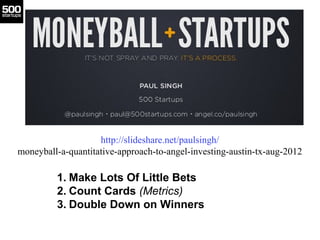

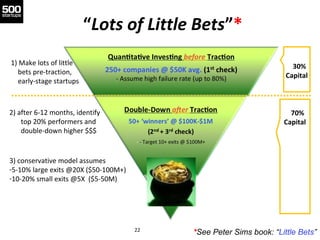

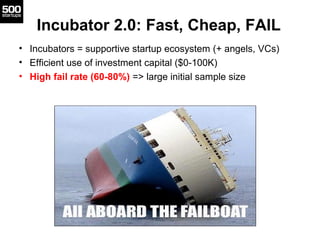

The document discusses the startup ecosystem and the role of 500 Startups, highlighting its global seed fund operations and investment strategies. It emphasizes the importance of metrics, mentorship, and structured innovation processes while promoting the idea of 'failing fast' to drive growth and learning. Additionally, it covers various investment stages and the necessity for collaborative environments to foster successful startups.