1) The document defines a startup as a new entity operating for less than 5 years with annual turnover not exceeding 25 crore and working on innovation, development or commercialization of new technologies or intellectual properties.

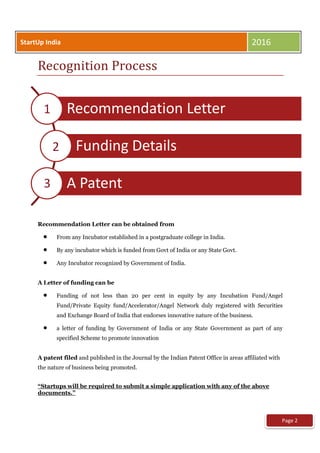

2) It outlines several government initiatives to support startups including tax benefits, relaxed public procurement norms, incubators and research parks, funding support, and reducing regulatory requirements.

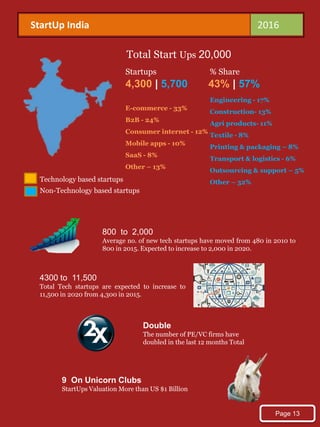

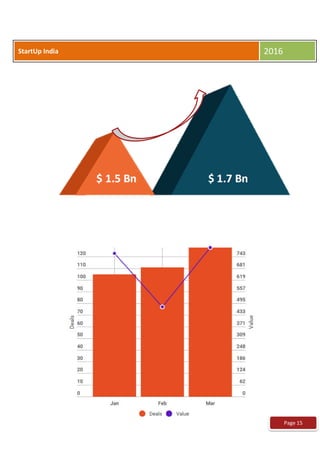

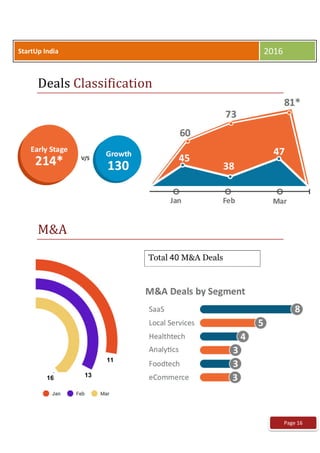

3) Statistics show the number of tech startups in India is expected to double to 11,500 by 2020, with 9 startups already valued over $1 billion. In Q1 2016, $1.73 billion was invested across 344 deals, led by e-commerce, SaaS and health-tech sectors.