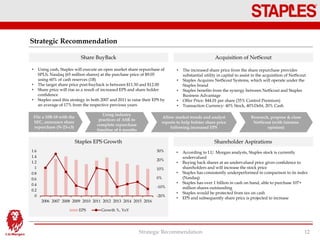

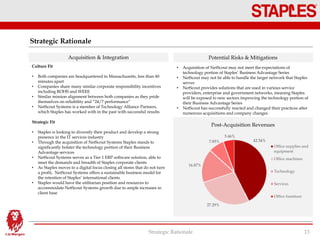

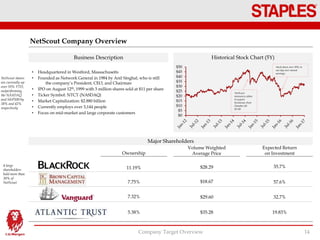

Staples is considering acquiring NetScout Systems to expand into the growing IT services market. The recommendation is for Staples to first repurchase $1 billion of its own shares to increase EPS and share price. Then, Staples would acquire NetScout for $44.01 per share, using 40% stock, 40% debt, and 20% cash. The acquisition would allow Staples to significantly bolster the technology portion of its Business Advantage services and diversify its revenues beyond office supplies.

![Staples Comparable Companies

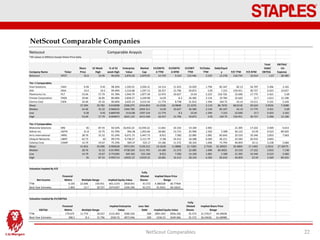

Staples Comparables 21

Staples Comparable Anaysis

*All values in Millions Except Share Price Data

Company Name Ticker

Share

Price

52 Week

High

% of 52

week High

Enterprise

Value

Market

Cap

EV/EBITD

A TTM

EV/EBITD

A NTM

EV/EBIT

TTM

EV/Sales

TTM

Debt/Equit

y P/E TTM P/E NTM

Total

Debt/

EBITDA

EBITDA/

Int.

Expense

Staples SPLS 9.02 11.37 79% 5,872.95 5,893.95 4.335 4.298 6.47 0.284 19.224 9.208 10.249 0.751 9.921

Tier 1 Comparables

Office Depot ODP 4.34 7.91 54.87% 2,608.95 3,073.95 3.511 2.922 5.672 0.18 94.136 13.525 10.914 2.031 7.989

Essendant ESND 20.77 34.99 59.36% 1,897.57 1,211.23 7.751 7.505 9.674 0.354 98.975 17.75 10.973 2.926 11.897

Micheals Cos Inc MIK 20.02 31.36 63.84% 6,916.56 4,556.11 8.253 8.308 9.562 1.408 9.53 11.45 3.305 6.012

Williams-Sonoma Inc] WSM 47.72 61.97 77.01% 4,433.18 4,626.83 6.709 6.521 8.993 0.891 0.161 15.191 14.249 0

Dicks Sporting Goods DKS 50.71 62.88 80.65% 4,254.70 4,367.25 5.776 7.846 7.834 0.585 0.357 13.614 16.723 0.009 183.617

Mean 28.712 39.822 0.671434 4022.192 3567.074 6.4 6.6204 8.347 0.6836 48.40725 13.922 12.8618 1.6542 52.37875

Median 20.77 34.99 0.638393 4254.7 4367.249 6.709 7.505 8.993 0.585 47.2465 13.614 11.45 2.031 9.943

Low 4.34 7.91 0.548673 1897.565 1211.233 3.511 2.922 5.672 0.18 0.161 9.53 10.914 0 6.012

High 50.71 62.88 0.806457 6916.564 4626.825 8.253 8.308 9.674 1.408 98.975 17.75 16.723 3.305 183.617

Tier 2 Comparables

Cabellas Inc CAB 54.26 63.3 85.72% 8,405.02 3,169.17 18.097 20.305 25.335 2.102 308.135 16.173 19.729 12.132 20.289

Autonation Inc AN 51.77 54.15 95.60% 12,630.17 6,610.57 12.657 11.409 14.509 0.605 259.384 15.349 12.993 6.107 7

Bed Bath and Beyond BBBY 40.04 52.71 75.96% 8,574.47 7,676.24 5.123 4.895 6.126 0.708 58.604 9.882 8.788 0.896 19.136

GNC GNC 8.63 35.9 24.04% 3,762.07 2,366.08 7.651 5.566 8.659 1.425 309.982 10.613 3.733 2.954 11.458

Best Buy Co BBY 44.31 49.4 89.70% 7,541.15 9,043.15 3.55 5.071 5.141 0.191 40.635 10.784 13.307 0.838 26.55

Mean 39.802 51.092 0.742044 8182.576 5773.042 9.4156 9.4492 11.954 1.0062 195.348 12.5602 11.71 4.5854 16.8866

Median 44.31 52.71 0.857188 8405.016 6610.57 7.651 5.566 8.659 0.708 259.384 10.784 12.993 2.954 19.136

Low 8.63 35.9 0.24039 3762.074 2366.082 3.55 4.895 5.141 0.191 40.635 9.882 3.733 0.838 7

High 54.26 63.3 0.956048 12630.17 9043.147 18.097 20.305 25.335 2.102 309.982 16.173 19.729 12.132 26.55

Valuation implied By P/E

Net Income

Financial

Metric

Fully

Diluted

Shares

TTM 0.93 9.53 17.75 5765.76 10738.95 650.55 8.8629 16.5075

Next Year Estmates 0.88 10.914 16.723 6248.09 9573.65 650.55 9.60432 14.71624

Valuation Implied By EV/EBITDA

EBITDA

Financial

Metric

Less: Net

Debt

Fully

Diluted

Shares

TTM 1369 3.511 8.253 4806.559 11298.36 1047 4835.559 11327.36 650.55 7.433032 17.41197

Next Year Estmates 1366.45 2.922 8.308 3992.767 11352.47 1047 4021.767 11381.47 650.55 6.182103 17.49515

Multiple Range

Implied Share Price

Range

Multiple Range

Implied Share Price

Range

Implied Equity Value

Implied Equity Value

Implied Enterprise

Value](https://image.slidesharecdn.com/2017freshmancasecompstaples-170224032442/85/Staples-Inc-Pitch-Book-21-320.jpg)