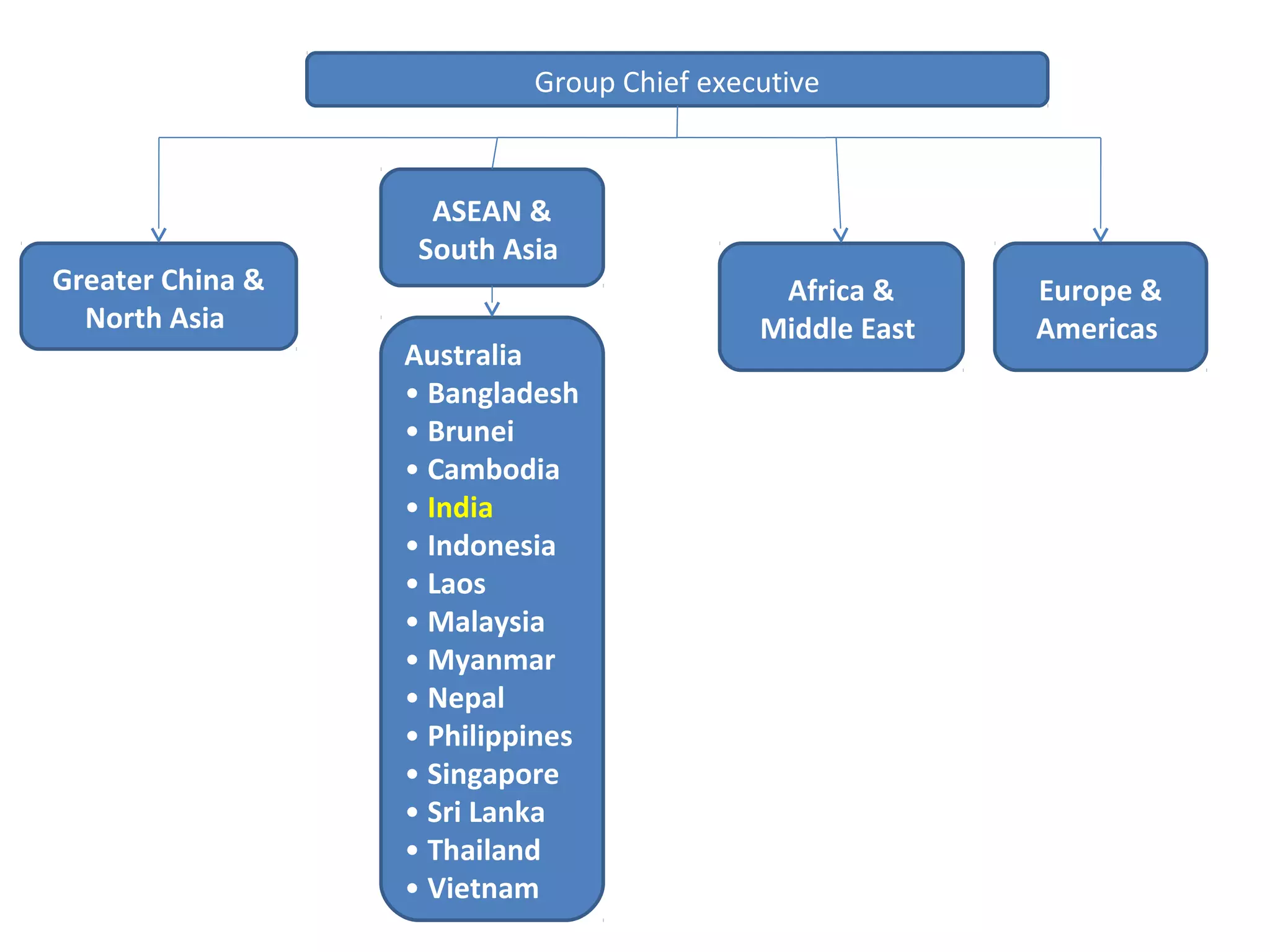

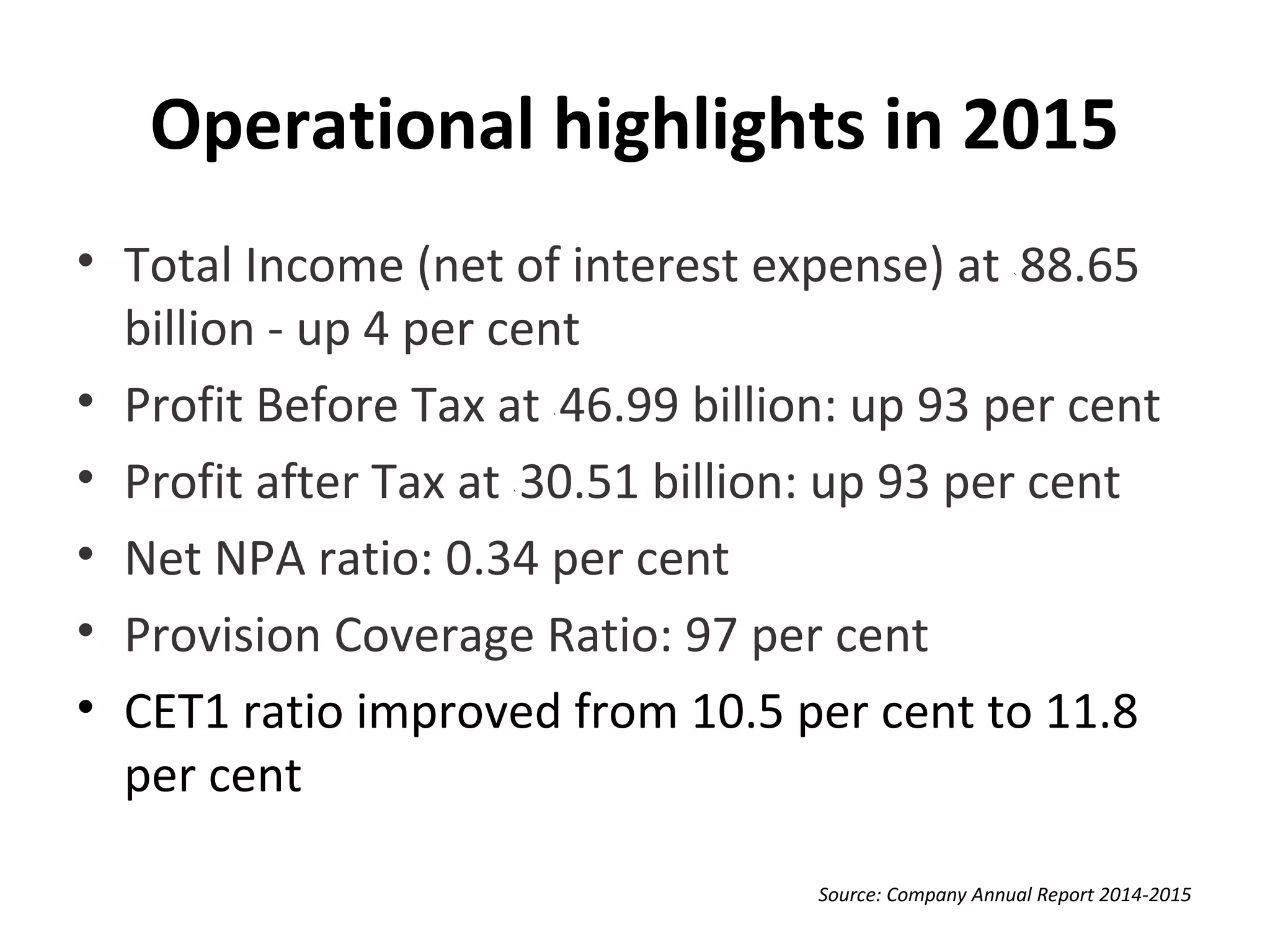

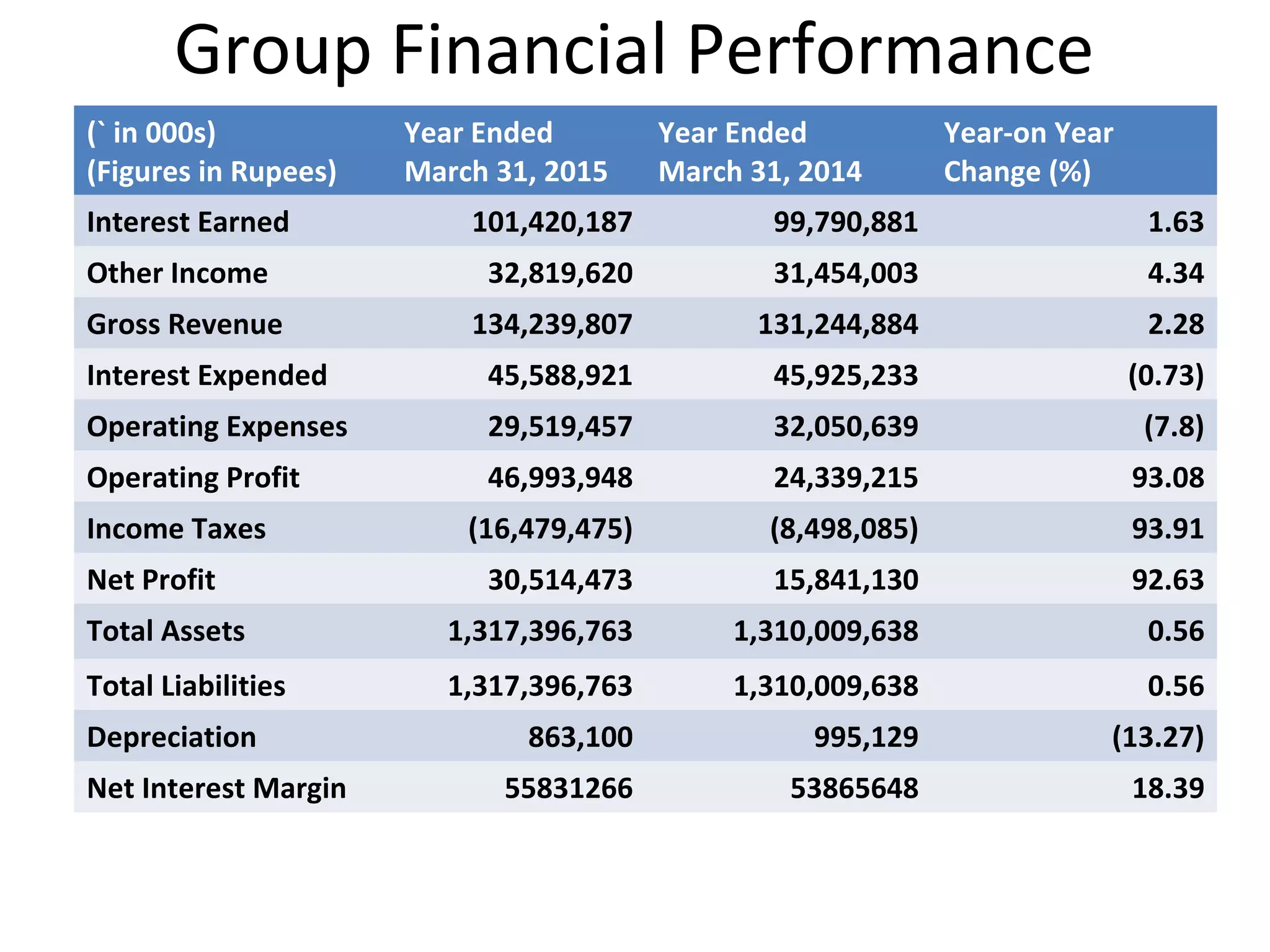

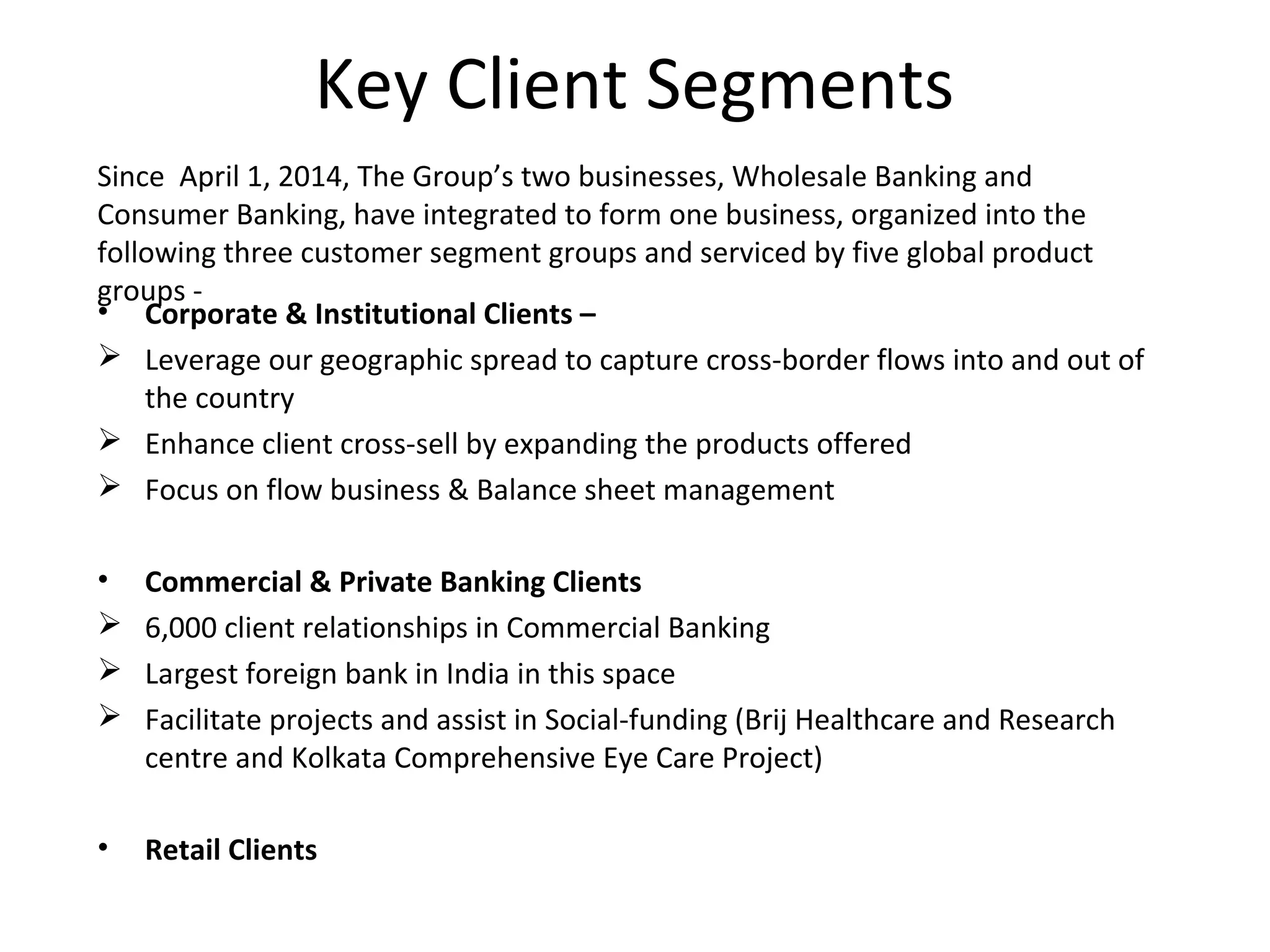

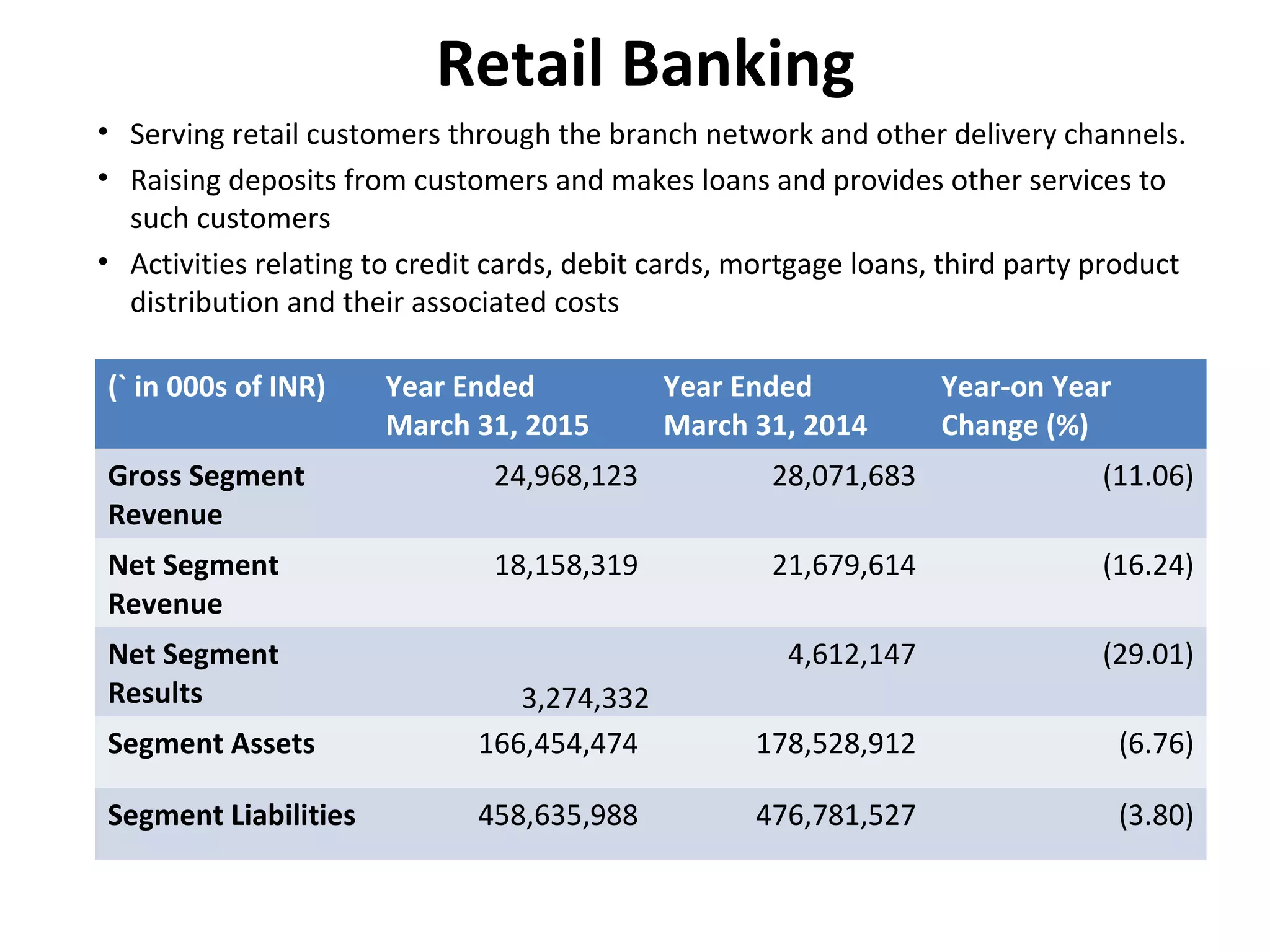

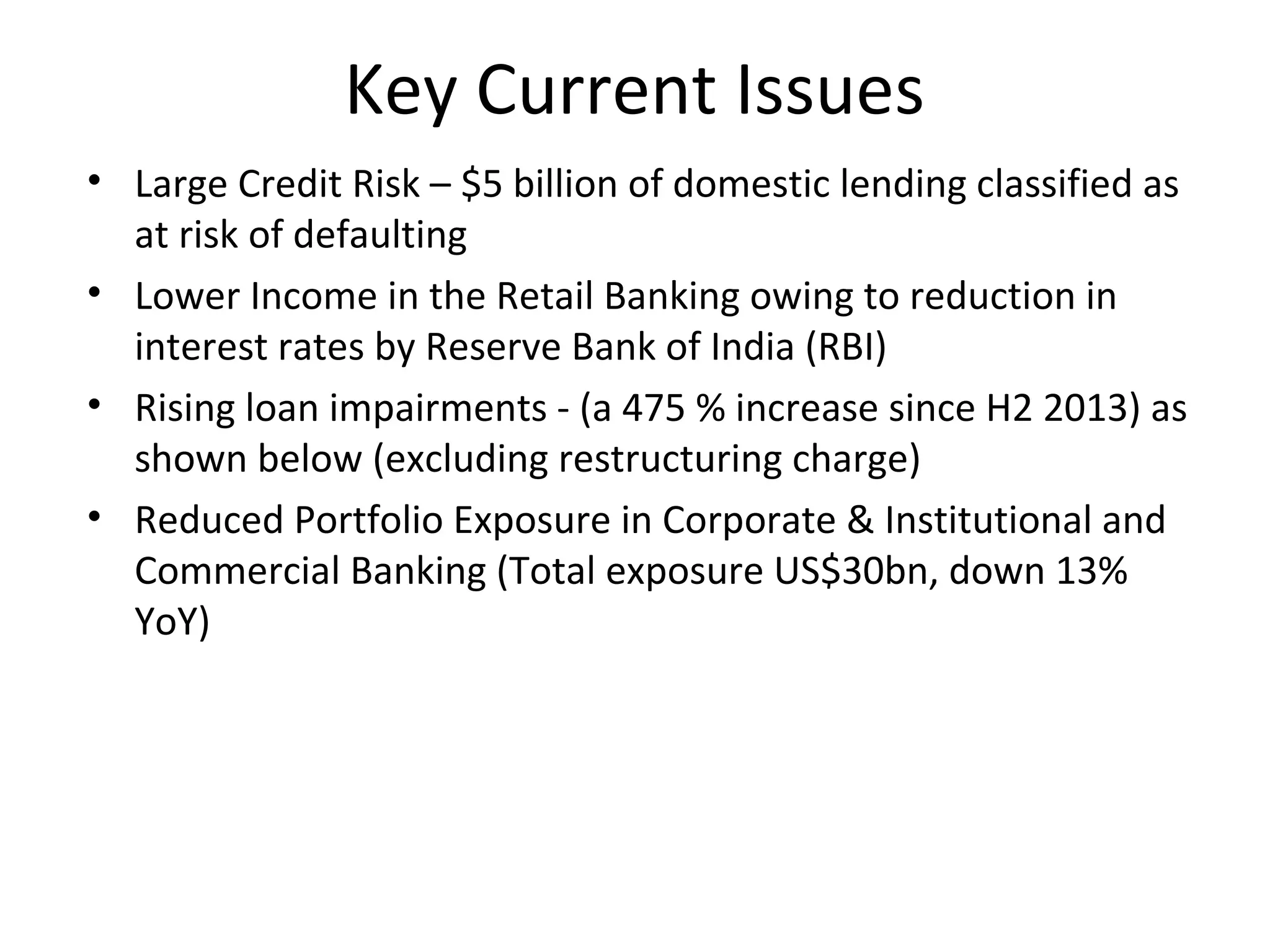

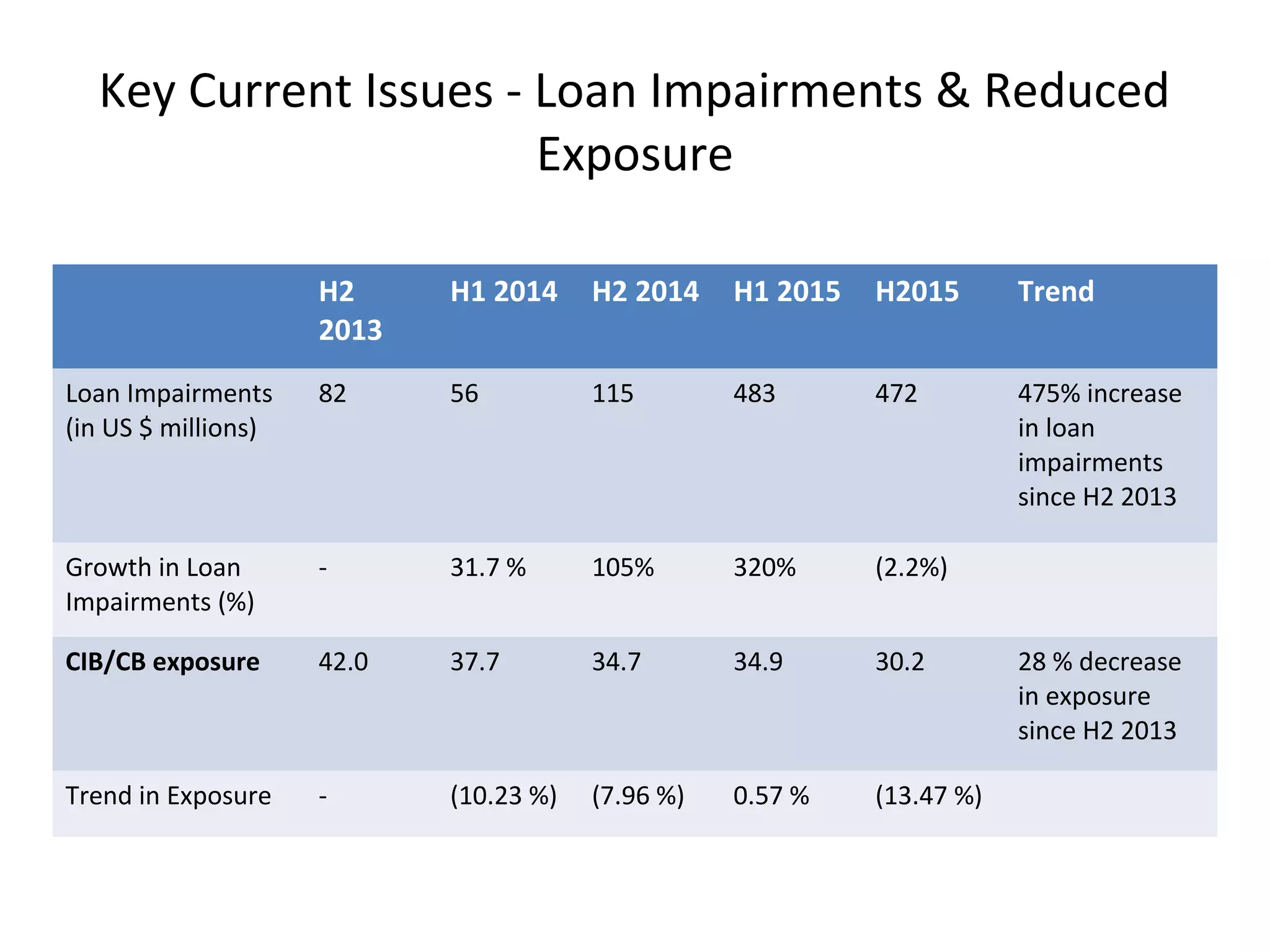

Standard Chartered Bank commenced operations in India in 1858, with its headquarters in Mumbai, and serves 2 million retail customers and over 2,500 corporate clients through 100 branches and 279 ATMs. The bank reported a significant year-on-year growth of 93% in profit before tax for the financial year ending March 31, 2015, amidst challenges like rising loan impairments and large credit risks. Notably, the bank has reorganized its corporate structure to cut costs and improve efficiency, aiming for substantial cost savings by the end of 2017.