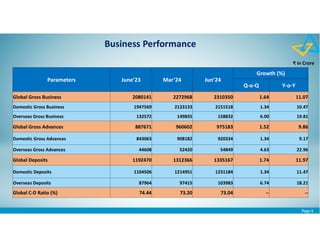

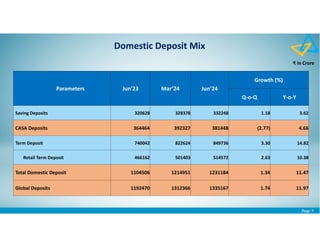

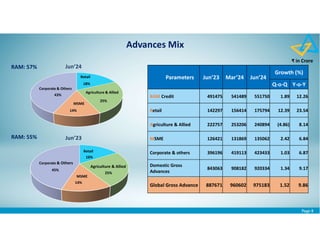

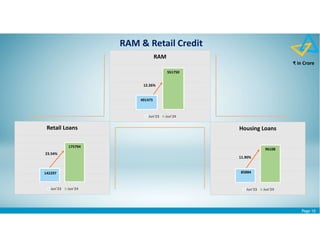

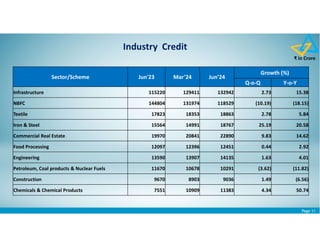

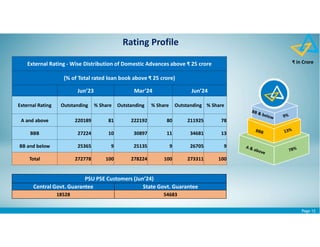

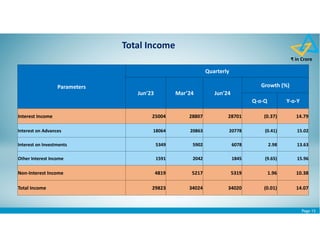

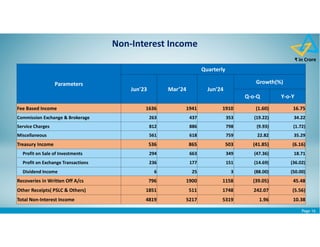

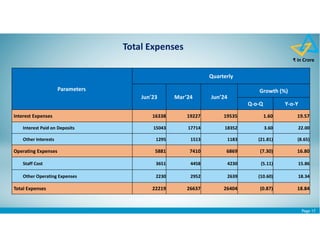

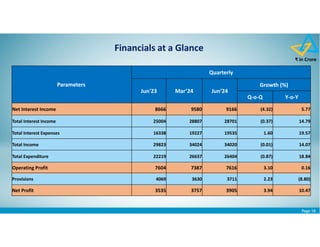

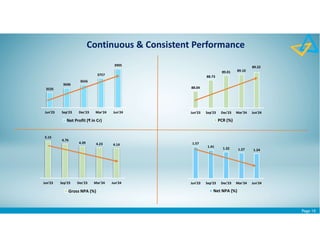

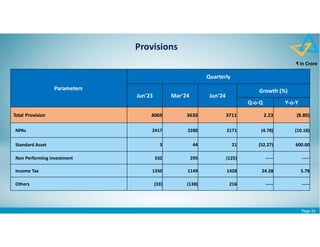

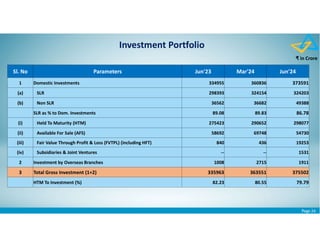

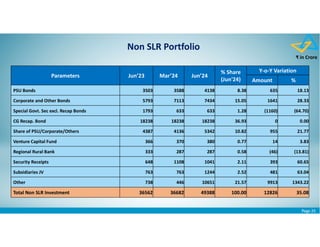

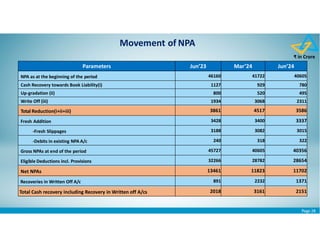

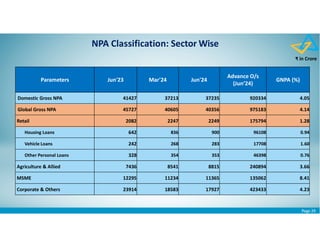

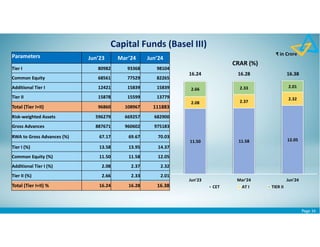

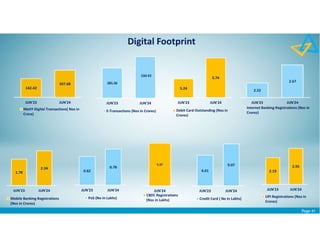

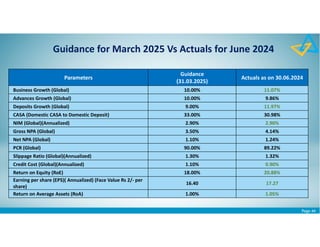

The financial results for Q1 FY 2024-25 show significant year-on-year growth in key metrics, including a 10.47% increase in net profit and an 11.97% growth in global deposits. Asset quality remains strong with gross NPA declining to 4.14% and net NPA to 1.24%. The report highlights a diversified growth in credit, particularly in retail and agriculture sectors, driving customer satisfaction and digital growth.