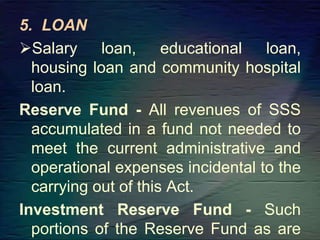

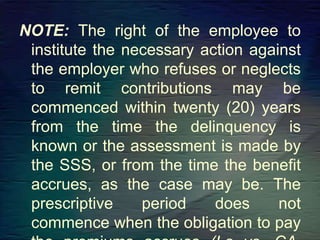

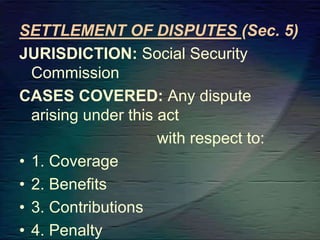

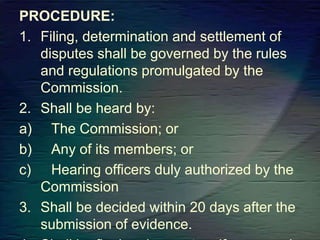

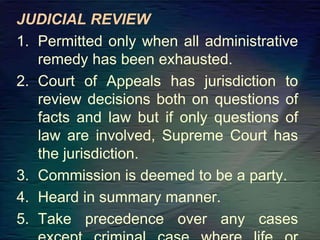

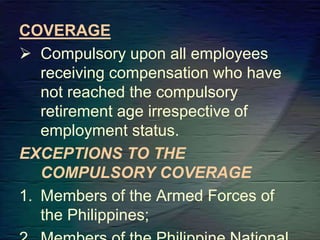

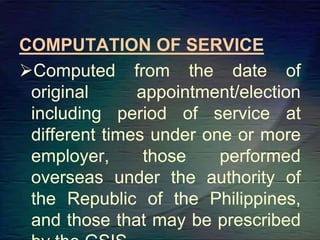

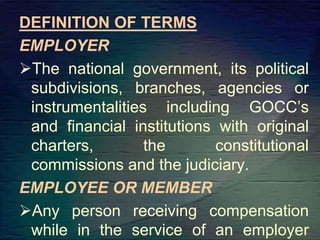

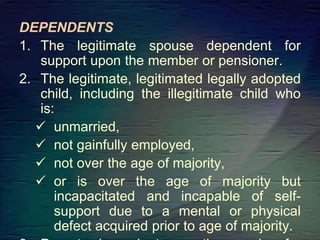

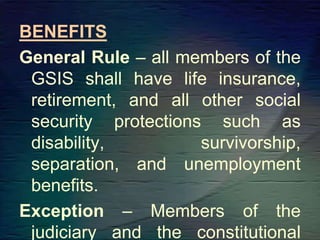

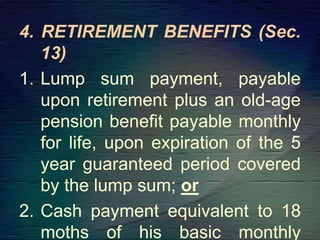

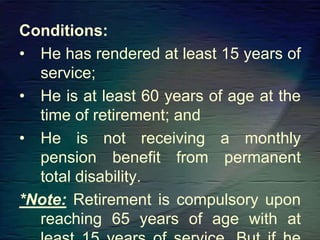

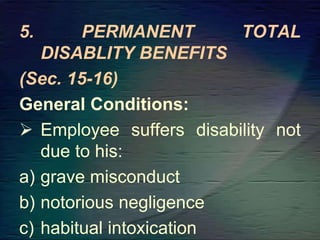

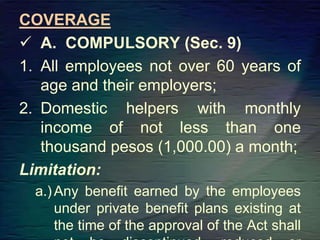

This document defines key terms and outlines the social security system in the Philippines as established by law. It covers compulsory and voluntary coverage, contributions and benefits. Compulsory coverage includes all employees under 60 and self-employed individuals. Benefits include monthly pension, dependent's pension, retirement benefits, death benefits, disability benefits, loans and more. The duties of employers and remedies for non-payment of contributions are also described. Disputes are settled by the Social Security Commission and courts.

![C. BY AGREEMENT [Sec. 8 (j)

(4)]

Any foreign government,

international organization, or their

wholly-owned instrumentality

employing workers in the

Philippines, may enter into an

agreement with the Philippine

government for the inclusion of

such employees in the SSS](https://image.slidesharecdn.com/sssgsispresentation-240220075850-2accd280/85/SSS-GSIS-PRESENTATION-Social-legislation-14-320.jpg)

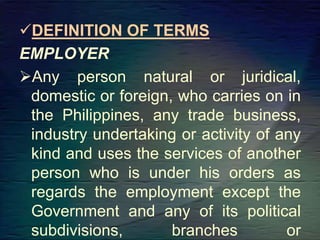

![BENEFITS

1. MONTHLY PENSION (Sec. 12)

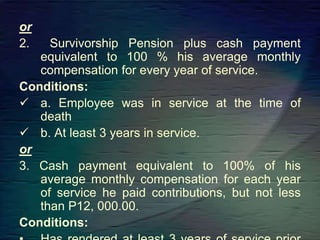

A.] Monthly pension shall be the highest of

the following:

P300.00 plus

20% of Ave. monthly salary credit plus

2% of Ave. monthly salary credit for

each credited year of service in

excess of 10 years.

40% of monthly salary credit

P1, 000.00, provided that the monthly](https://image.slidesharecdn.com/sssgsispresentation-240220075850-2accd280/85/SSS-GSIS-PRESENTATION-Social-legislation-18-320.jpg)

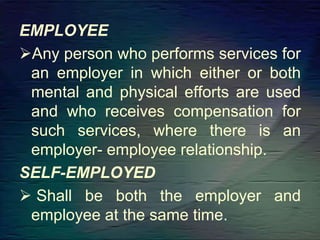

![B.]For members with at least 10 years

credited service, the minimum

pension shall be P1, 200.00.

C.]For members with at least 20 years

credited service, the minimum

pension shall be P2, 400.00.](https://image.slidesharecdn.com/sssgsispresentation-240220075850-2accd280/85/SSS-GSIS-PRESENTATION-Social-legislation-19-320.jpg)

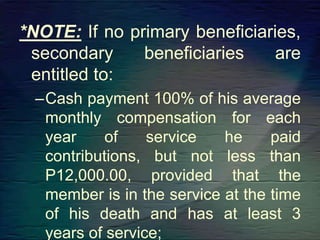

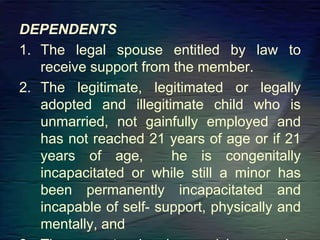

![UPON DEATH OF RETIRED MEMBER

[Sec. 12-B (d)]

1.] His primary beneficiaries as of the date

of his retirement shall be entitled to

receive the monthly pension.

2.] If he has no primary beneficiaries and he

dies within 60 months from the start of

his monthly pension secondary

beneficiaries shall be entitled to a lump

sum benefit equivalent to the total

monthly pensions corresponding to the

balance of the five-year guaranteed

period, excluding the dependents’

pension.](https://image.slidesharecdn.com/sssgsispresentation-240220075850-2accd280/85/SSS-GSIS-PRESENTATION-Social-legislation-23-320.jpg)

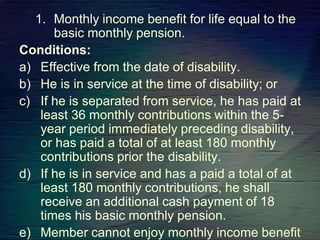

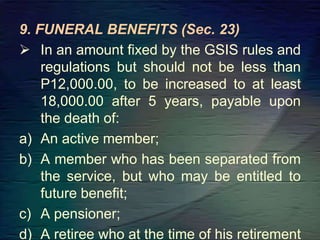

![DEATH OF PERMANENT TOTAL

DISABILITY

PENSIONER

1.] His primary beneficiaries shall be

entitled to the monthly pension; or

2.] If he has no primary beneficiaries

and he dies within sixty (60) months

from the start of his monthly

pension, his secondary beneficiaries

shall be entitled to a lump sum

benefit equivalent to the total](https://image.slidesharecdn.com/sssgsispresentation-240220075850-2accd280/85/SSS-GSIS-PRESENTATION-Social-legislation-25-320.jpg)